Lockheed Martin (NYSE: LMT) reported a 42% jump in earnings for the first quarter of 2019 helped by the significant contracts wins from the US Department of Defense and its allies. The results, which benefited from its differentiated portfolio and record backlog, exceeded analysts’ expectations. Also, the company lifted its earnings and sales guidance for the full year 2019.

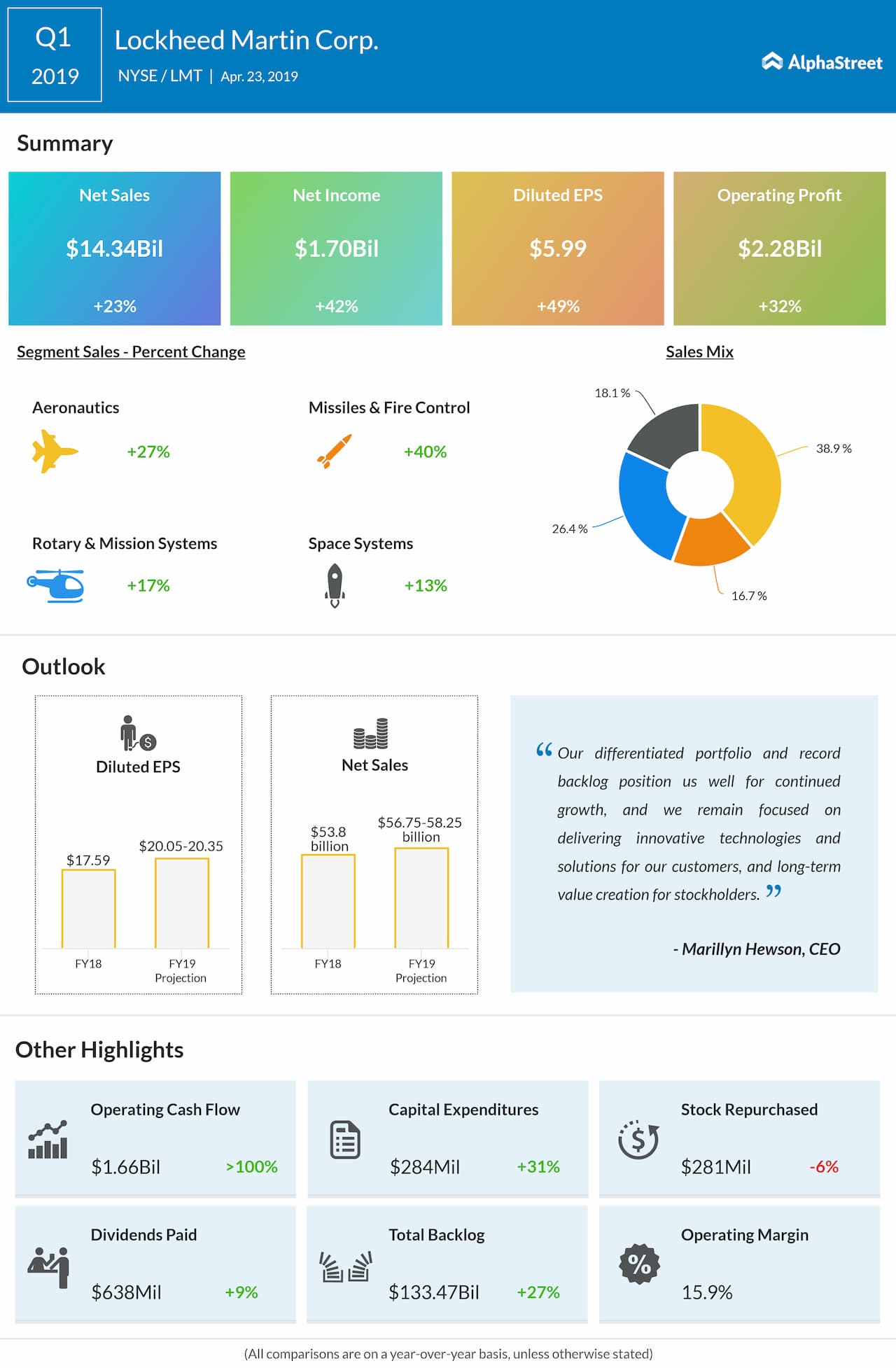

Net income climbed by 42% to $1.7 billion and earnings soared 49% to $5.99 per share. Net sales increased 23% to $14.3 billion. The company posted year-over-year sales increases in all of its business segments.

Looking ahead into the full year 2019, the company lifted its net sales outlook to the range of $56.75 billion to $58.25 billion from the prior range of $55.75 billion to $57.25 billion. Earnings guidance is lifted to the range of $20.05 to $20.35 per share from the previous estimate range of $19.15 to $19.45 per share.

The company now expects the 2019 net FAS/CAS pension benefit to be about $1.475 billion. Business segment operating profit outlook was raised to the range of $6.10 billion to $6.25 billion from the prior range of $6 billion to $6.15 billion. Cash from operations outlook is lifted to more than or equal to $7.50 billion from the prior estimate of more than or equal to $7.40 billion.

Also read: Lockheed Martin fourth-quarter earnings results

In the Aeronautics segment, sales grew 27% primarily attributable to higher net sales for the F-35 and the F-22 programs backed by increased volume. In Missiles and Fire Control, net sales improved 40%, primarily due to higher sales for tactical and strike missiles programs as well as integrated air and missile defense programs, and for sensors and global sustainment programs.

Rotary and Mission Systems segment sales increased 17% in the quarter, due to higher sales for integrated warfare systems and sensors programs and Sikorsky helicopter programs. In Space, segment sales rose 13%, driven primarily by higher sales in the Orion program, and government satellite programs.

Shares of Lockheed Martin ended Monday’s regular session up 0.32% at $315.26 on the NYSE. Following the earnings release, the stock inched up over 5% in the premarket session.