Defense company

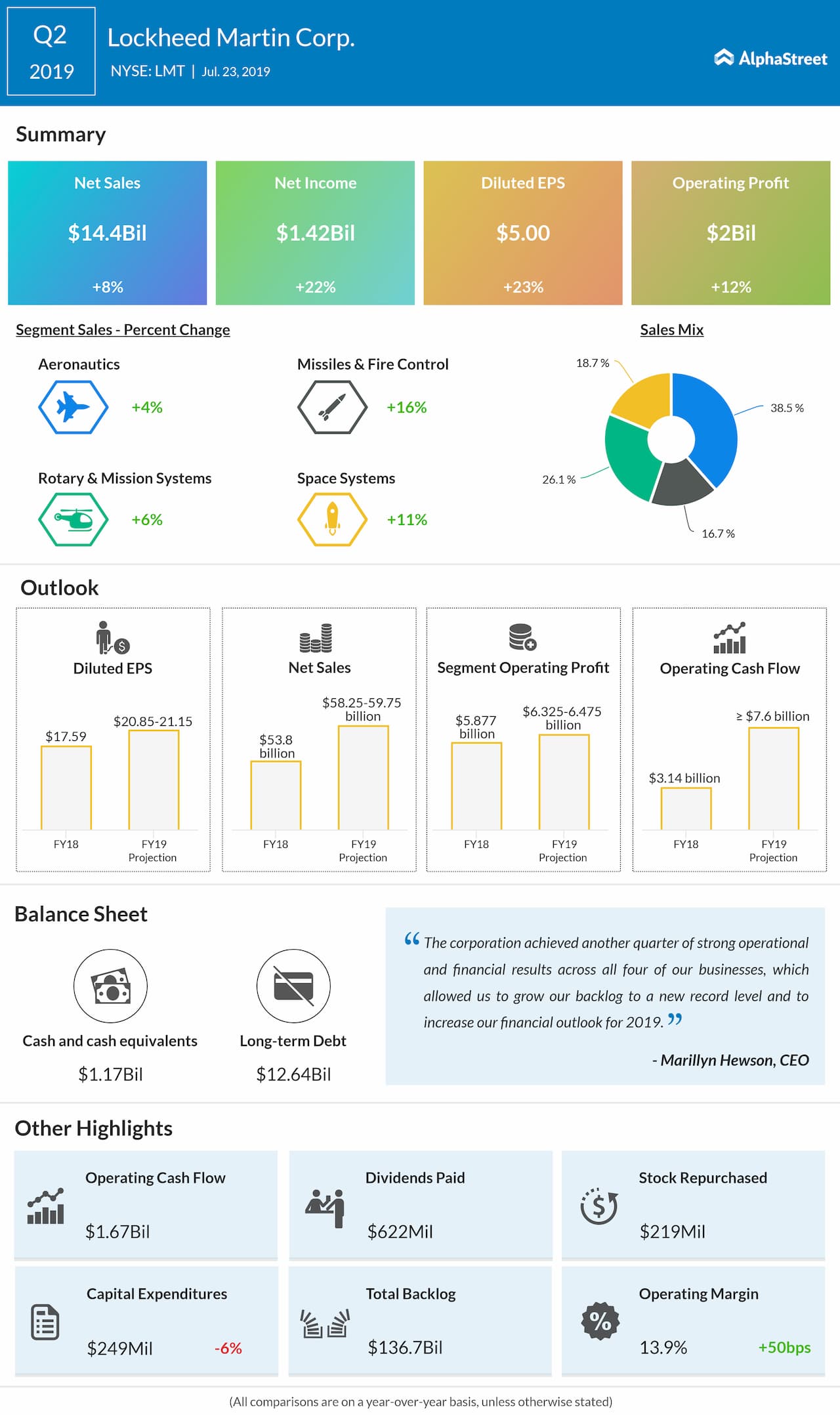

Lockheed Martin (NYSE: LMT) on Tuesday

reported second-quarter earnings that surpassed Wall Street expectations. The

company reported Q2 earnings of $5 per share including certain severance

charges of $96 million, which was way ahead of the street projection of $4.77 per

share.

Revenue grew 7% to $14.4 billion, surpassing the target of $14.2 billion set by analysts. The company reported revenue growth in all four business units.

The biggest segment,

Aeronautics grew 4.3%, while Missiles and Fire Control delivered the highest growth

rate of 15%. Rotary and Mission Systems revenues improved 5.6% and Space

operations saw revenues jump 11%.

LMT shares gained 1.6% following the announcement. The stock has gained 35% in the year-to-date period.

CEO Lockheed Martin said, “The corporation achieved another quarter of strong operational and financial results across all four of our businesses, which allowed us to grow our backlog to a new record level and to increase our financial outlook for 2019.”

READ: Virgin Galactic vs. Blue Origin: The race to suborbital space tourism

Guidance raised

Buoyed by the better-than-expected results, Biogen raised its full-year revenue guidance to $58,250 billion – $59,750 billion, compared to the earlier guidance range of $56,750 billion – $58,250 billion.

EPS is expected to be between $20.85 and $21.15, an increase from the prior guidance range of $20.05 – $20.35.