Mixed results

Business performance

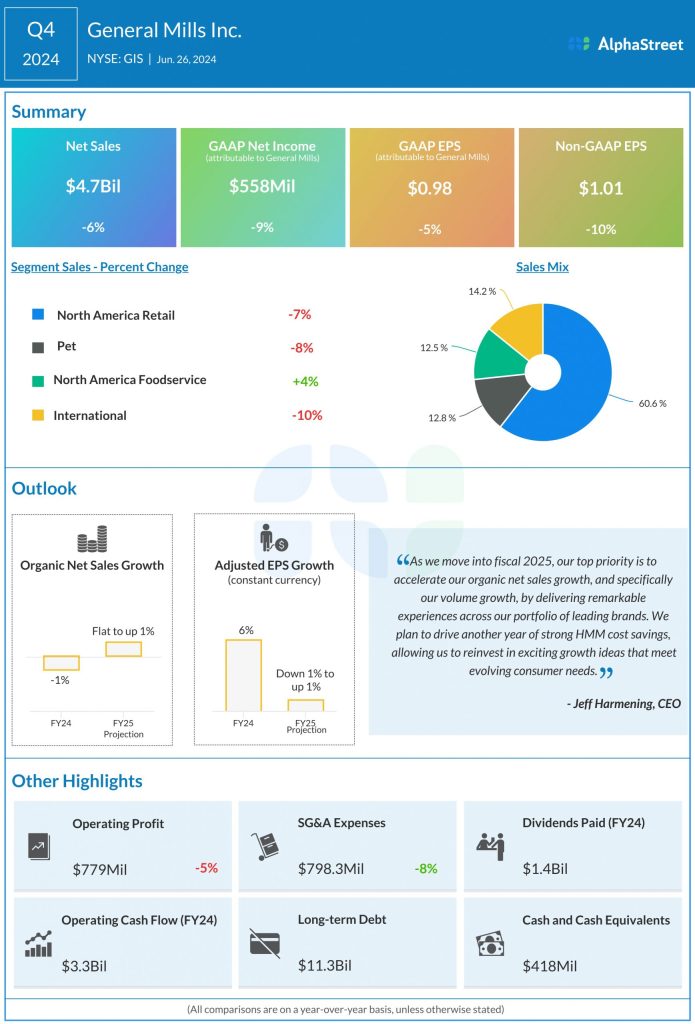

In the fourth quarter, General Mills saw sales decline across all its segments, except Foodservice. Sales in the North America Retail, Pet, and International segments were negatively impacted by unfavorable price and mix. The North America Foodservice segment saw sales increase by 4%, helped by growth in breads, cereal, and frozen biscuits.

GIS continues to invest in its brands and it is working on improving taste and bringing new flavors into some of its biggest brands and products. It is also focusing on providing healthy as well as convenient options for customers through product innovation. This will continue to be a priority for the company in fiscal year 2025 as well.

As mentioned in its report, returning the Pet segment to growth is another priority for GIS. In Q4, sales in the Pet segment fell 8%. The company believes the trend of pet humanization will drive growth in this category over the long term. It continues to invest in product innovation and packaging as well as providing offerings at optimal prices within this segment.

Outlook

Looking ahead to fiscal year 2025, General Mills anticipates an uncertain macroeconomic environment across its core markets. Even so, the company expects to see a gradual improvement in category volumes during the year. It also plans to fuel organic sales growth through investments in its leading brands that will help drive household penetration and market share.

For FY2025, General Mills expects organic sales growth to range between flat to up 1%. Adjusted EPS is expected to range between down 1% and up 1% in constant currency from the base of $4.52 earned in FY2024.