US futures are pointing to a higher open today after ending lower on Friday as traders shifted their focus from trade war concerns to upcoming Federal Reserve meeting. Investors are looking forward to the Fed meeting for clues for interest rate hikes.

The S&P futures rose 0.59% to 2,621, Dow futures gained 0.71% to 24,095, and Nasdaq advanced 0.74% to 6,502.25. Elsewhere, shares at Asian markets closed higher on Monday, and European stocks are trading higher.

On the European economic front, data from the Sentix showed that Eurozone investor sentiment index fell to 19.6 in April from 24 in March. Destatis data revealed that Germany’s exports fell 3.2% on month in February after declining 0.4% in January, and imports tumbled 1.3% on month after declining 0.2% in January. The State Secretariat for Economic Affairs data showed that Switzerland’s jobless rate remained stable at 2.9% in March. Statistics Norway data revealed that Norway’s industrial production expanded at a stable rate of 1.8% on year in February from January.

On the Asian economic front, data from the Australian Industry Group showed that performance of construction index in Australia rose to 57.2 in March from 56 in February. The Ministry of Finance data revealed that Japan’s current account surplus jumped to 2.076 trillion yen in February from 607.4 billion yen in January. The Cabinet Office data showed that Japan’s consumer confidence held steady at 44.3 in March from last month. The Ministry of Finance data revealed that Taiwan’s foreign trade surplus grew to $6 billion in March from $3.97 billion last year.

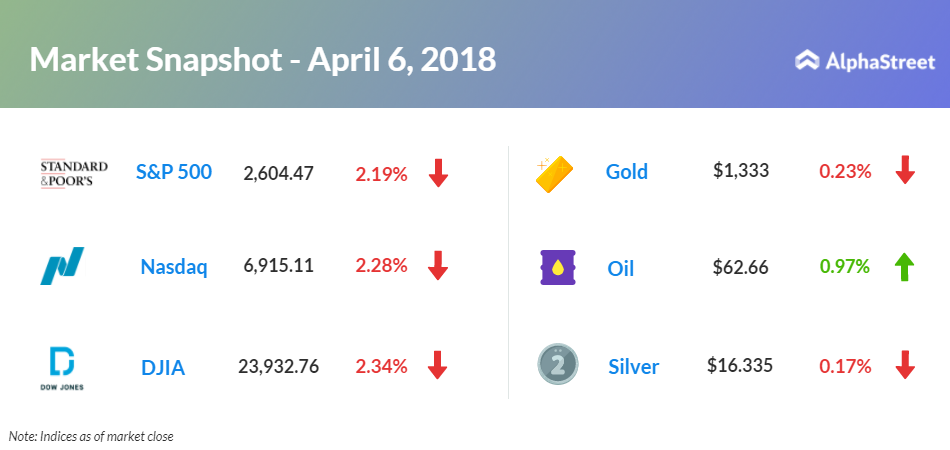

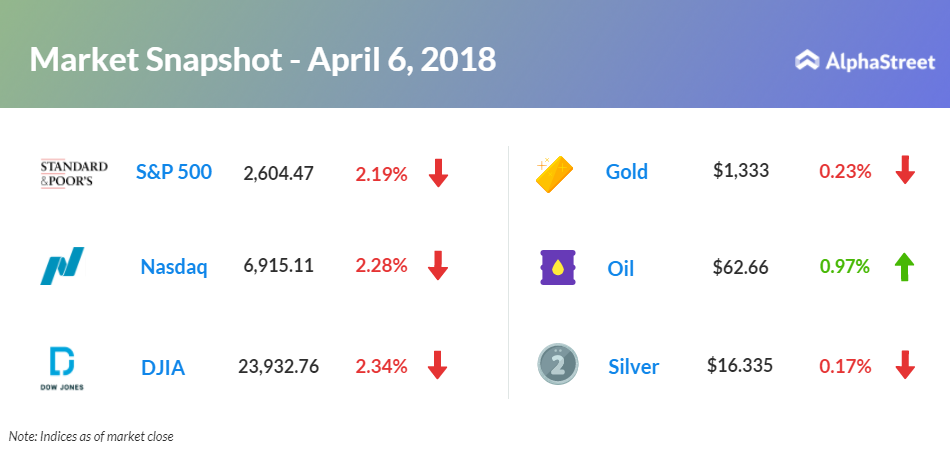

On April 6, US ended lower, with Dow down 2.34% to 23,932.76. Nasdaq tumbled 2.28% to 6,915.11, and S&P 500 fell 2.19% to 2,604.47. Traders remained concerned on the renewal of trade war after President Donald Trump intended to impose $100 billion of additional tariffs on Chinese imports.

A Labor Department report showed that non-farm payroll employment rose by 103,000 jobs in March after jumping by 326,000 jobs in February. The unemployment rate remained unchanged at 4.1% in March from the five previous months. Average hourly employee earnings growth expanded to 2.7% in March from 2.6% in February.

Meanwhile, key economic events scheduled for today include TD Ameritrade’s investor movement index and six-month treasury bill auction.

On the corporate front, AveXis (AVXS) stock jumped 82.60% in the premarket after Novartis (NVS) agreed to buy AveXis for $8.7 billion in cash, or $218 per share. Merck (MRK) stock rose 2.59% in premarket after its cancer drug Keytruda met the main study goal of helping earlier untreated lung cancer patients live longer. General Motors (GM) stock grew 2.71% in premarket after brokerage firm Morgan Stanley upgraded the shares to “overweight” from “equal-weight”.

AveXis (AVXS) stock jumped 82.60% in the premarket after Novartis (NVS) agreed to buy AveXis for $8.7 billion in cash, or $218 per share.

Deutsche Bank (DB) stock rose 3.39% in premarket after it named Christian Sewing as its new executive chief. Menlo Therapeutics (MNLO) stock plunged 57.69% in the premarket after its skin condition treatment failed to meet the primary or key secondary efficacy endpoints.

Crude oil futures are up 0.97% to $62.66. Gold is trading down 0.23% to $1,333, and silver is down 0.17% to $16.335. On the currency front, the US dollar is trading up 0.09% at 107.01 yen. Against the euro, the dollar is up 0.15% to $1.2301. Against the pound, the dollar is up 0.24% to $1.4123.