US futures are pointing to a higher open today after ending higher on Tuesday, as earnings from major US companies outperformed the market consensus. Traders will be looking at the geopolitical front as well after Syria missile strikes last week, besides speeches from the Federal Reserve.

The S&P futures advanced 0.33% to 2,715.50, Dow futures rose 0.29% to 24,779, and Nasdaq gained 0.29% to 6,848.25. Elsewhere, shares at Asian markets closed mostly higher on Wednesday, and European stocks are trading higher.

On the European economic front, data from Statistics Portugal showed that Portugal’s producer price inflation slowed to 0.8% in March from 1.5% in February. Eurostat data revealed that Eurozone construction output declined 0.5% on month in February after falling 0.8% in January. Statistics Austria data showed that Austria’s consumer price inflation rose to 1.9% in March from 1.8% in February.

Istat data revealed that Italy’s industrial orders declined 0.6% on month in February after falling 4.6% in January. Eurostat data showed that Eurozone inflation accelerated to 1.3% in March from 1.1% in February. The Office for National Statistics data revealed that consumer prices in the UK rose 2.5% on year in March after increasing 2.7% in February.

On the Asian economic front, data from the Department of Statistics showed that Malaysia’s consumer prices rose 1.3% on year in March after increasing 1.4% in February. The Ministry of Finance data revealed that merchandise trade surplus in Japan jumped to 797.3 billion yen in March from 3.4 billion yen in February.

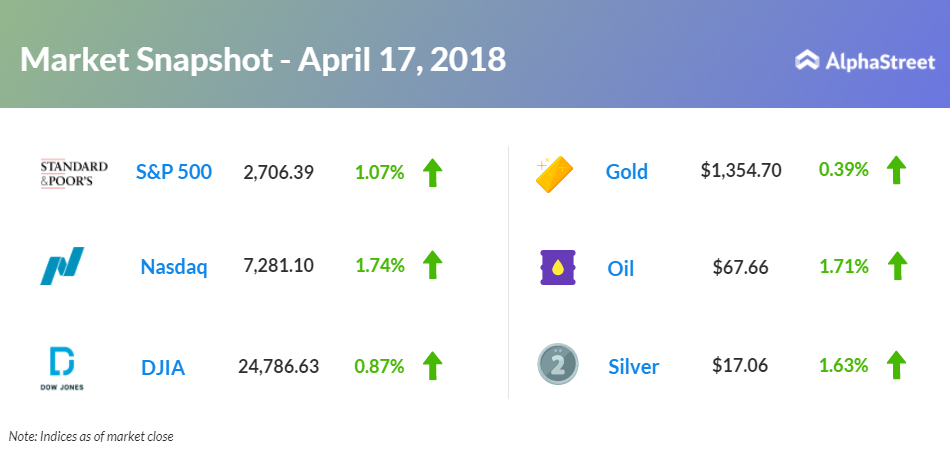

On April 17, US ended higher, with Dow up 0.87% to 24,786.63. Nasdaq advanced 1.74% to 7,281.10, and the S&P 500 gained 1.07% to 2,706.39. Traders reacted positively to better-than-expected earnings news from Johnson & Johnson (JNJ) and Goldman Sachs (GS). A Commerce Department report showed that housing starts grew by 1.9% to an annual rate of 1.319 million in March after falling 3.3% in February. A Federal Reserve report showed that industrial production rose 0.5% in March after increasing 1% in February.

Meanwhile, key economic events scheduled for today include Beige Book and Energy Information Administration’s petroleum status report. New York Federal Reserve Bank President William Dudley and Federal Reserve Vice Chairman for Supervision Governor Randal Quarles will be giving speeches today.

On the earnings front, key companies reporting earnings today include MGIC Investment (MTG), Kinder Morgan (KMI), Torchmark (TMK), Cathay General Bancorp (CATY), Pier 1 Imports (PIR), United Rental (URI), Steel Dynamics (STLD), Crown Holdings (CCK), Werner Enterprises (WERN), Boston Private Financial (BPFH), Umpqua Holdings (UMPQ), Alcoa (AA), American Express (AXP), Abbott Laboratories (ABT), Canadian Pacific Railway (CP), and Badger Meter (BMI).

Morgan Stanley (MS) stock rose 1.43% in the premarket after better-than-expected first-quarter results.

On the corporate front, Morgan Stanley (MS) stock rose 1.43% in the premarket after better-than-expected first-quarter results. eBay (EBAY) stock grew 5.89% in the premarket after brokerage firm Morgan Stanley upgraded the shares to “overweight” from “underweight”. Intuitive Surgical (ISRG) stock advanced 5.41% before the opening bell after better-than-expected first quarter results.

Textron (TXT) stock jumped 5.94% in premarket trading after stronger-than-expected first quarter earnings. US Bancorp (USB) moved up 0.37% in premarket after better-than-expected first quarter results. IBM (IBM) stock dropped 5.54% in before the opening bell after disappointing full-year earnings guidance.

Crude oil futures are up 1.71% to $67.66. Gold is trading up 0.39% to $1,354.70, and silver is up 1.63% to $17.06. On the currency front, the US dollar is trading up 0.17% at 107.199 yen. Against the euro, the dollar is up 0.17% to $1.2393. Against the pound, the dollar is down 0.42% to $1.4227.