US futures are pointing to a higher open in the stock market today after ending negative on Monday. Wall Street attempted to bounce back following the worst meltdown on the Christmas Eve trading session. Investors are cautious on lingering concerns about growth and the widening clash between President Donald Trump and the Federal Reserve on the rate hikes issue.

The S&P futures rose 0.69% to 2,358, Dow futures inched up 0.53% to 21,816 and Nasdaq advanced 0.95% to 5,948. Elsewhere, shares at Asian markets closed lower on Wednesday and the European stocks were trading mostly lower.

On the European economic front, data from the statistical office INE showed that Spain’s producer price index rose by 3% annually in November after increasing 4.6% in October. On the Asian economic front, data from the Economic Development Board Singapore showed that Singapore’s manufacturing output grew 7.6% year-on-year in November, following a 5.5% rise in October.

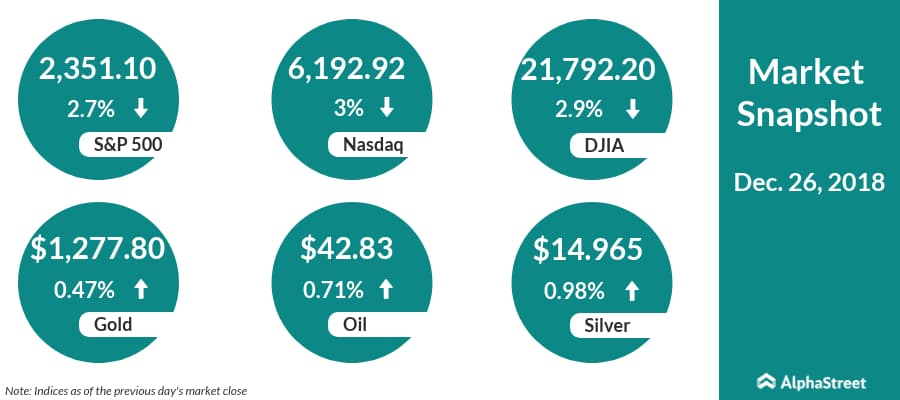

On December 24, US ended lower, with Dow down 2.9% to 21,792.20, the Nasdaq dropped 2.2% to 6,192.92 and the S&P 500 inched down 2.7% to 2,351.10. Traders remained concerned about the continued weakness arising the partial government shutdown. The partial shutdown would continue until Thursday as Trump and Democratic lawmakers remain distinct on the funding issue for the president’s controversial border wall.

Meanwhile, key economic data that will be released today include the S&P/Case-Shiller Composite-20 home prices for October and Richmond Fed manufacturing index for December.

On the corporate front, Mastercard (MA) stock inched up 0.66% in the premarket after it reported a 5.1% increase in US retail sales between November 1 and December 24. Jd.com (JD) stock rose 2.94% in the premarket after its board authorized a share buyback program of up to $1 billion to be executed over the next twelve months. Amazon.com (AMZN) stock gained 1.86% in the premarket after a strong year-over-year growth in holiday season Alexa sales.

Roku (ROKU) stock advanced 4.53% in the premarket following Needham naming the streaming video device maker as a top pick for 2019. Safe-T Group (SFET) stock jumped 33.22% in the premarket after it disclosed an order from a leading Israel-based food and beverage corporation for Safe-T’s Software Defined Access solution.

Crude oil futures are up 0.71% to $42.83. Gold is trading up 0.47% to $1,277.80 and silver is up 0.98% to $14.965. On the currency front, the US dollar is trading up 0.36% at 110.604 yen. Against the euro, the dollar is down 0.21% to $1.138. Against the pound, the dollar is up 0.01% to $1.2673.