Micron Technology (NASDAQ: MU) made strong gains early Wednesday and traded higher throughout the session. The stock’s recovery, after the selloff that followed the company’s dismal fourth-quarter report a few months ago, has been sluggish. It closed the session up 3%.

Though it has relatively high debt, Micron’s recent investments have been attractive. The prospects of an uptick in shareholder value make the stock an investment option worth considering.

The value should increase further ahead of the next earnings announcement, which is expected on December 18 after the closing bell. Currently, the average 12-month price target is about $55, which represents an 18% upside from the last closing price. Analysts’ consensus rating on the stock is buy.

Back on Track

It is estimated that Micron would dominate the DRAM market in 2020, outpacing rivals with the help of its advanced technology, after a dull year that was marked by low shipments and unfavorable inventories.

Related: Micron Technology jumps to yearly high

ADVERTISEMENT

The primary factor that can work in favor of Micron is the steady improvement in memory prices, which indicates that the industry would return to the growth path by next year. The recovery would be complemented by the growing demand from the 5G market.

Cyclical Trend

However, considering the cyclical nature of the sector Micron represents, there is a looming risk of demand fluctuations, especially from a short-term perspective. It needs to be noted that Micron was the worst-affected company when DRAM prices fell sharply earlier this year, due to oversupply in the market. Also, the overall weakness in smartphone market and the shortage of Intel CPUs might persist in the near future.

Guidance Cut

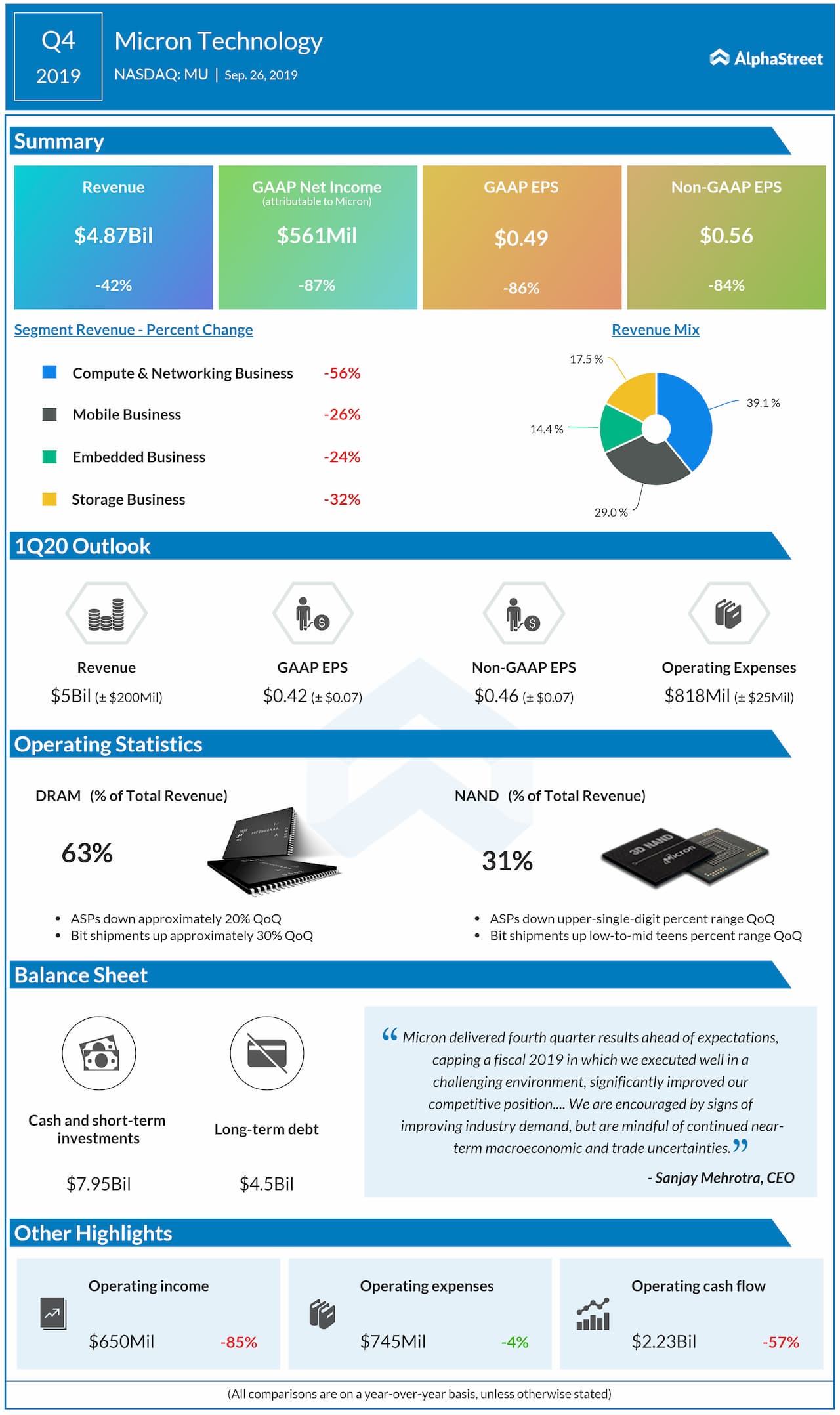

The management lowered its full-year guidance after fourth-quarter revenues and earnings dropped in double digits to $4.87 billion and $0.56 per share respectively. All the business segments registered negative growth, reflecting the pricing headwinds, weighing on the market’s sentiment.

Also see: Micron Q4 2019 Earnings Conference Call Transcript

Micron shares

have moved up 41% so far this year and 24% in the past twelve months. Currently

hovering slightly below the $50-mark, the stock consistently outperformed the

sector and the market this year.