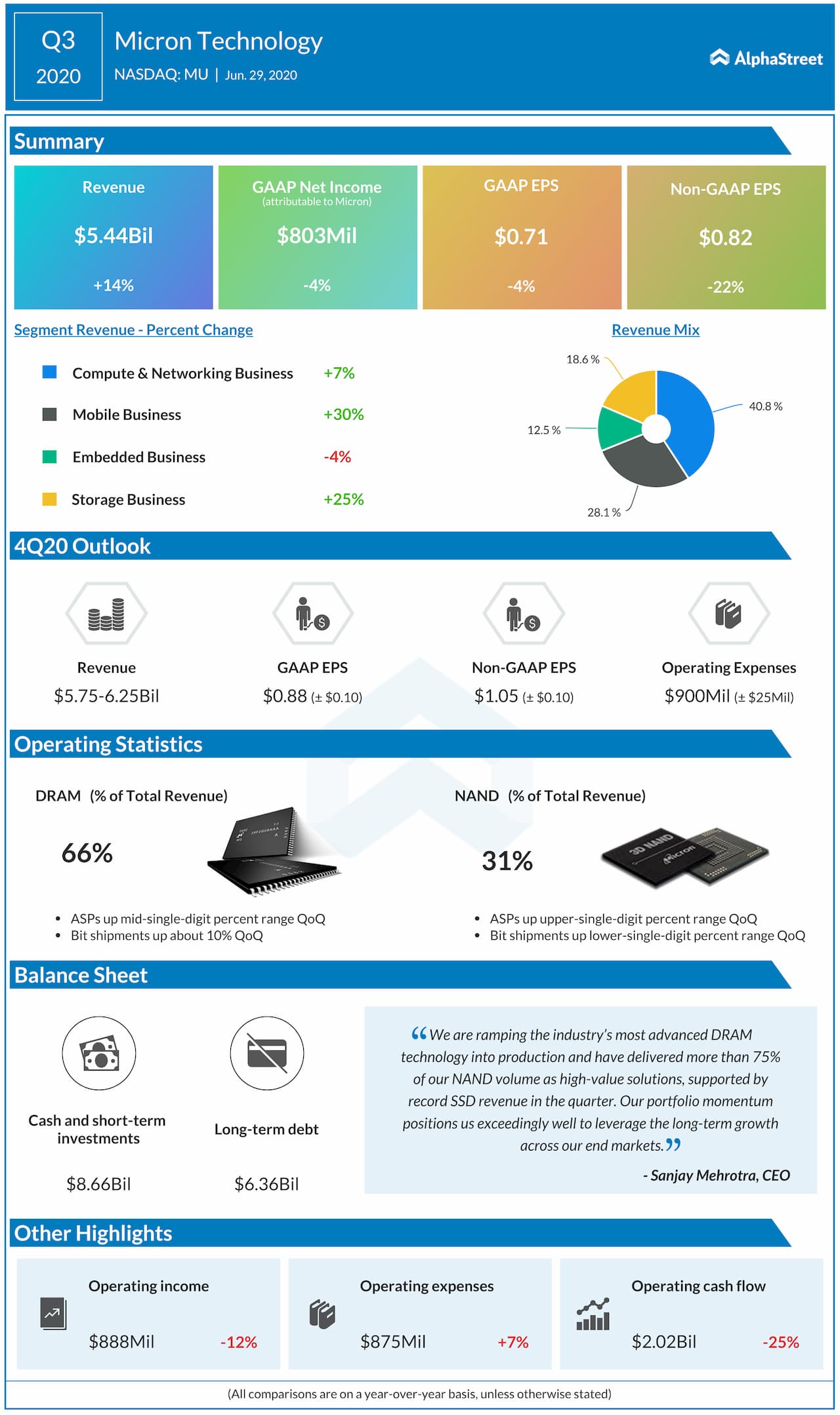

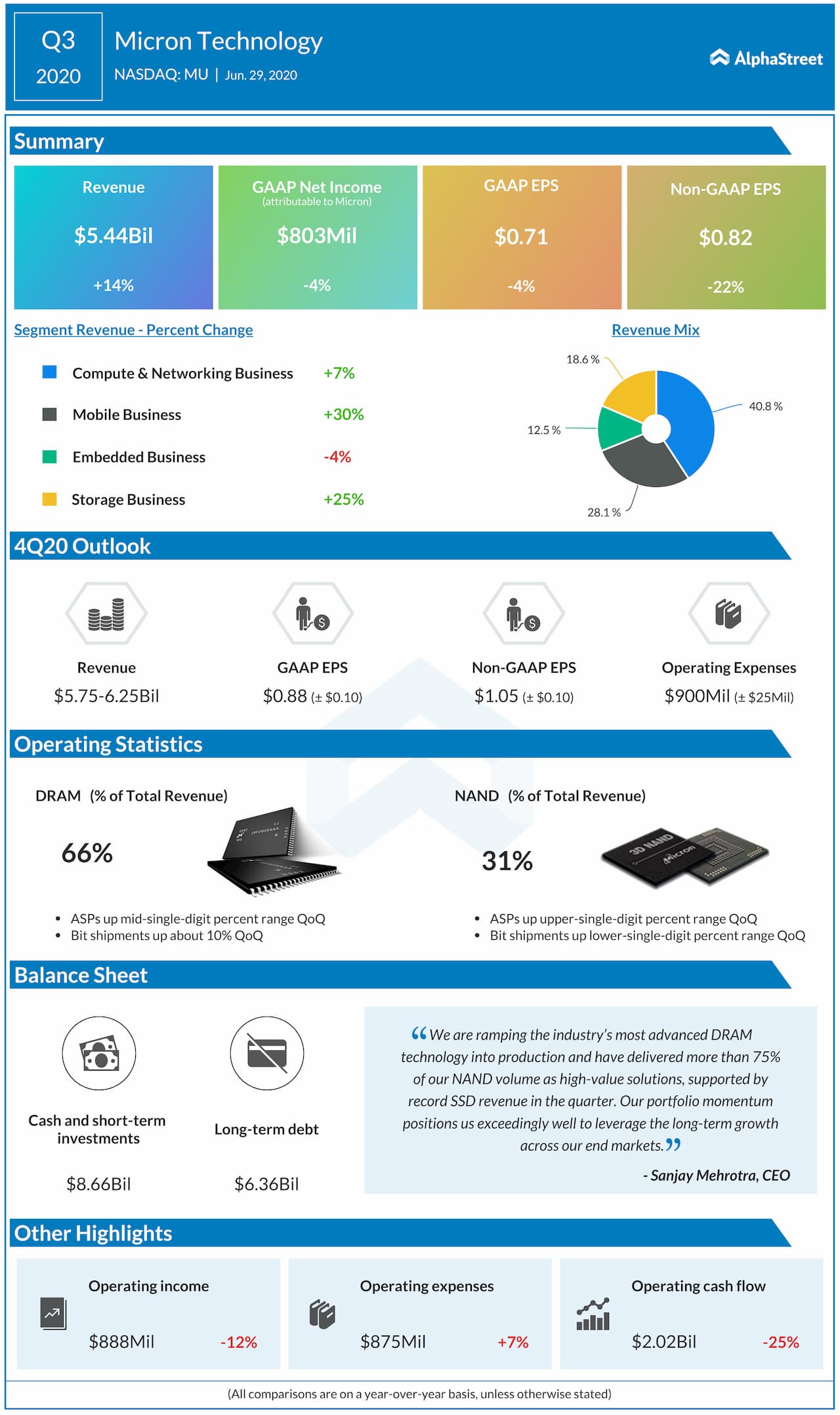

Micron Technology (NASDAQ: MU) reported revenue growth of 13% on a sequential basis and 14% on a year-over-year basis for the third quarter of 2020. The sequential growth in revenue was driven by data center and mobile markets.

Most of the company’s fab and assembly sites continued with

full production during the quarter with the Singapore and Taiwan facilities

reaching record production. The assembly and test sites in Malaysia were affected

by the health crisis but these impacts were offset by adjustments at other

facilities.

Looking ahead, the company has projected a healthy outlook for data centers and expects smartphone and consumer end-unit sales to improve in the second half of calendar year 2020.

Opportunities

As reiterated on several occasions earlier, the COVID-19 pandemic is driving a rapid shift in the way businesses and consumers operate. People are increasingly moving to online platforms for shopping and entertainment and this rise in ecommerce, gaming and video streaming activity will help drive data center capacity requirements.

As companies and educational institutions move towards

remote work and online learning, the demand for new technology solutions will

increase. There is also an acceleration in emerging technologies such as

robotics. This digital transformation and adoption of new technologies is expected

to continue going forward and it is expected to drive higher consumption of

memory and storage.

Micron’s diversified product portfolio has positioned it

well to benefit from the secular data growth that is driving the cloud,

enterprise and networking markets. In mobile, smartphone unit sales growth is

expected to pick up in 2021 driven by 5G along with higher memory and storage

content.

Micron believes memory and storage content growth will be

the strongest in the low to mid-range part of the smartphone market, which is

also the largest segment by units. In graphics, the company expects new gaming

consoles to drive DRAM and NAND demand.

Risks

The coronavirus outbreak has affected the cyclical recovery

in DRAM and NAND leading to strong demand in some segments and weak demand in

others. The segments driven mainly by consumer demand have been negatively

impacted.

The pandemic as well as macro and trade uncertainties have

limited Micron’s visibility across end-markets in the short-term. Its

opportunities are also being impacted by the restrictions on Huawei.

Looking at industry supply, the company expects supply

growth in the second half of 2020 to be somewhat muted compared to its

expectations before the outbreak. Delays in equipment deliveries could result

in slower node transitions and lower bit growth.

Outlook

In the long-term, Micron expects DRAM industry bit demand CAGR to be in the mid to high teens range while NAND industry bit demand CAGR is expected to be in the 30% range. This growth will be aided by technology trends such as artificial intelligence, machine learning, cloud computing and 5G.

Click here to read the full transcript of Micron Technology Q3 2020 earnings conference call