Shares of Micron Technology (NASDAQ: MU) were up 3.3% in midday trade on Thursday after the company reported better-than-expected results and provided an optimistic outlook for its business a day earlier.

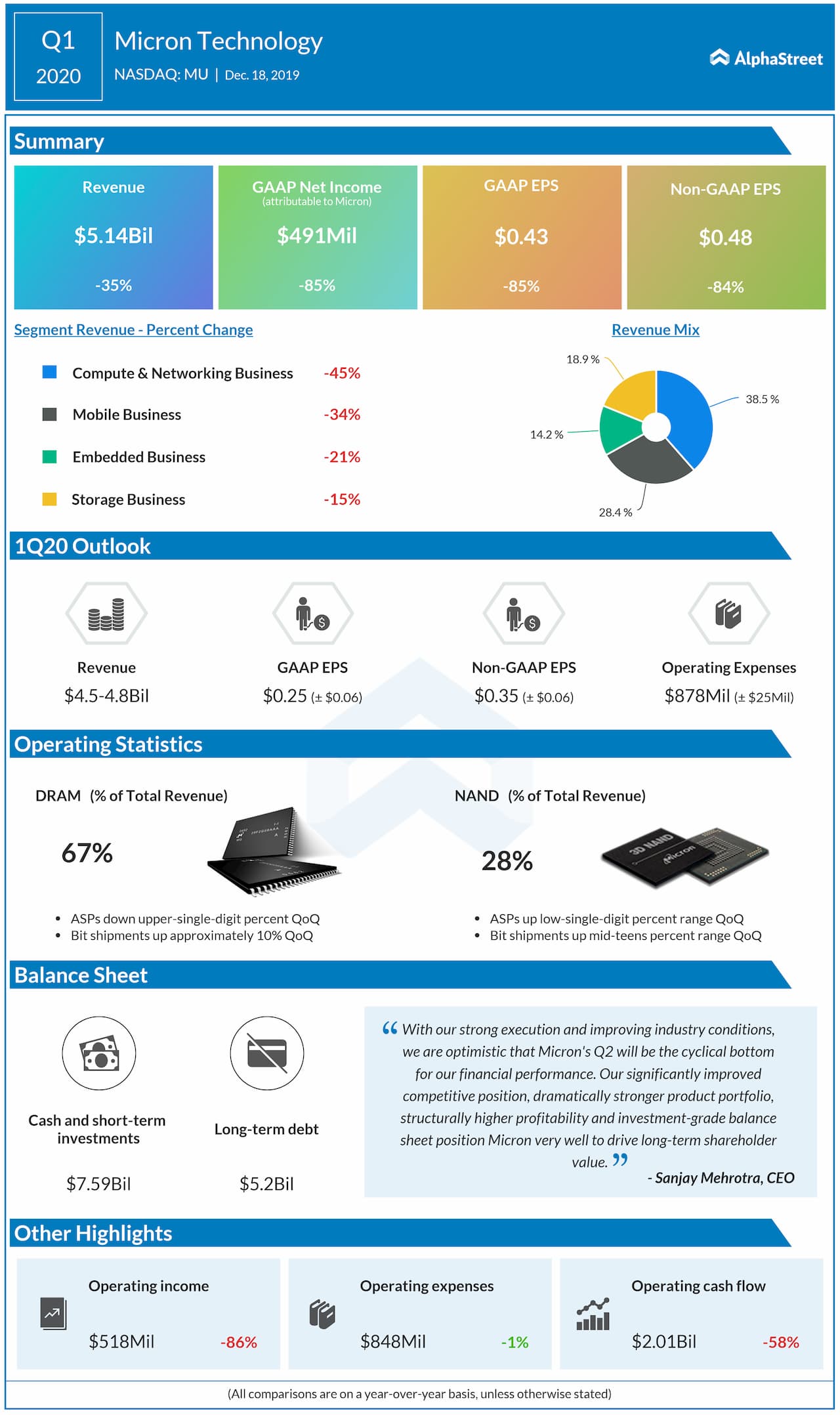

Micron reported a 35% drop in revenue to $5.14 billion while adjusted EPS fell by 84% to $0.48. The results, however, surpassed forecasts of EPS of $0.47 on revenue of $5.01 billion. The demand for microprocessors worldwide was impacted by near-term macroeconomic and trade-related uncertainties.

On its quarterly conference call, the company stated that

the industry supply demand balance continues to improve in DRAM and NAND. Micron

said the recent business trends have provided optimism that its second quarter

will mark the bottom for its financial performance after which an improvement is

anticipated in the third quarter followed by continued recovery in the second

half of calendar year 2020.

In fiscal 2019, high-value solutions accounted for approx. 50% of NAND bits. This figure is expected to grow to over two-thirds of Micron’s NAND bits sold for fiscal 2020 and the company is on track to drive 80% of its NAND bits into high-value solutions in fiscal 2021. This mix improvement is expected to improve profitability and reduce volatility in margins.

Also read: Accenture Q1 2020 Earnings Report

Although it will take time to scale up its 3D XPoint product

portfolio and achieve healthy margins, the company is excited about the

long-term potential of 3D XPoint for memory and storage applications. Micron

believes that as the only company in the world with a portfolio of DRAM, NAND

and 3D XPoint technologies, it is in a unique position to develop

differentiated products for customers.

For the second quarter, Micron expects revenue in the range of $4.5-4.8 billion and adjusted earnings in the range of $0.29-0.41 per share. A number of analyst firms have raised the price target on Micron’s stock following the results announcement.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions