Microsoft Corp. (NASDAQ: MSFT), the company that pioneered some of the most innovative computing technologies, is on a drive to incorporate artificial intelligence into all areas of its business. After upgrading its Bing search engine with AI, the company is all set to integrate ChatGPT, the highly popular chatbot developed by OpenAI, into its cloud computing products.

Stock Rallies

This week, Microsoft’s stock made one of the sharpest gains in recent times after the company reported impressive third-quarter results. It is currently trading close to $300, which is well above the 52-week average. The market is quite bullish on the growth prospects of the stock, which looks poised to soon return to the record highs of 2021. Right now, MSFT is one of the most compelling investment opportunities in the tech sector, even at the relatively high valuation.

The company last year made a big leap toward its shift to an AI-based business model and is currently enjoying an edge in that area over rivals like Google’s parent Alphabet. Going forward, Microsoft’s aggressive AI push will be a key growth driver for the company, complementing the success of its cloud business.

AI Race

However, the scramble to catch on AI has spurred intense competition among tech companies, hence Microsoft will have to keep innovating and channelizing its resources to achieve its AI goals. Also, the top line with be under pressure from the persistent weakness in PC market as people tighten their purse strings due to fiscal uncertainties and high inflation.

“We have the most powerful AI infrastructure, and it’s being used by our partner OpenAI, as well as NVIDIA, and leading AI startups like Adept and Inflection to train large models. Our Azure OpenAI Service brings together advanced models, including ChatGPT and GPT-4, with the enterprise capabilities of Azure. From Coursera and Grammarly to Mercedes-Benz and Shell, we now have more than 2,500 Azure OpenAI Service customers, up 10X quarter-over-quarter. Just last week, Epic Systems shared that it was using Azure OpenAI Service to integrate the next generation of AI with its industry-leading EHR software,” said Microsoft’s CEO Satya Nadella in a recent statement.

Meanwhile, the tech firm suffered a setback this week after a European regulatory agency opposed its $69-billion acquisition of gaming company Activision Blizzard, citing anticompetition concerns. But the stock stayed intact, thanks to the positive third-quarter outcome and the management’s bullish guidance.

Financials

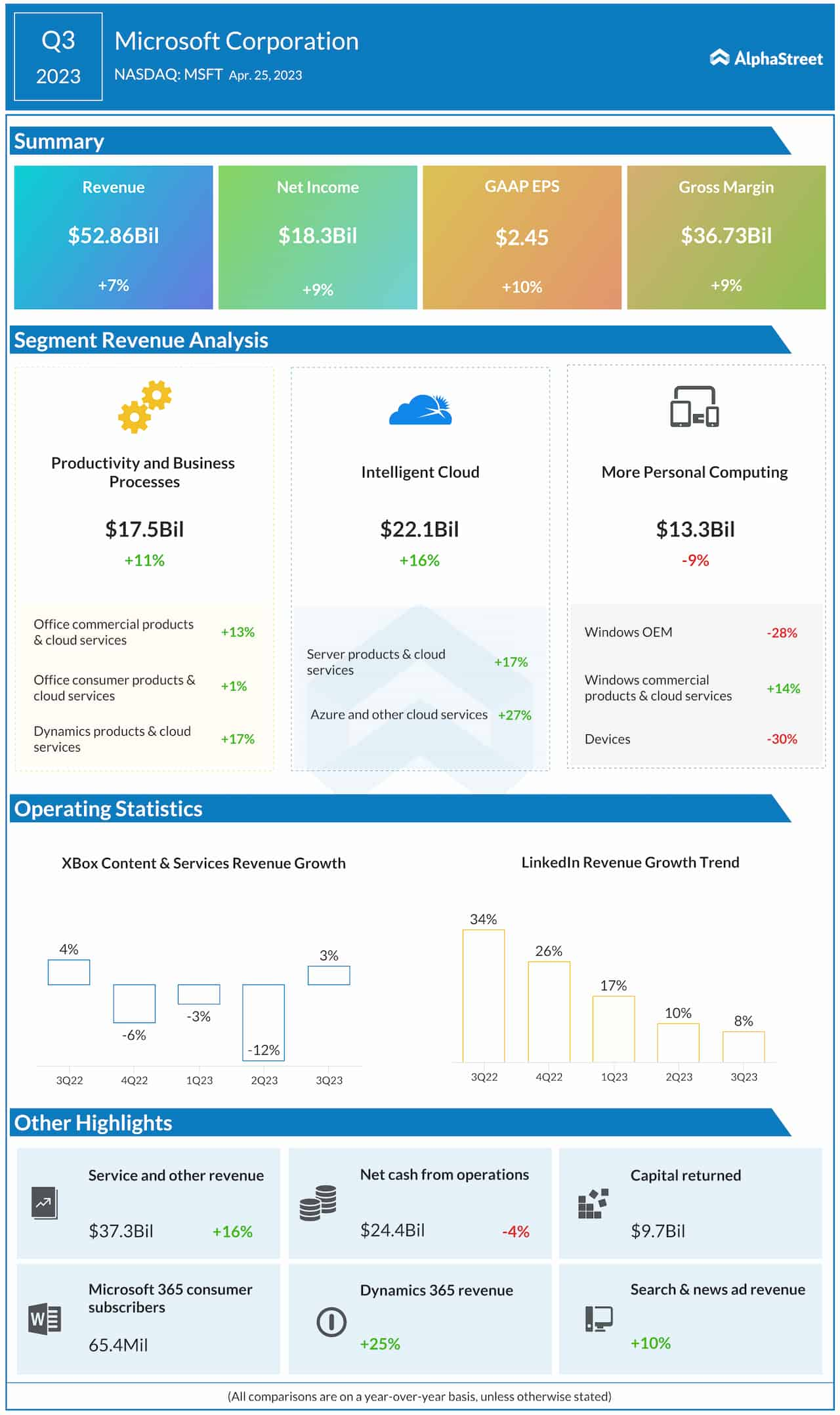

The company reported stronger-than-expected earnings for the March quarter, marking the third consecutive beat. Net income increased by about 10% year-over-year to $18.3 billion or $2.45 per share. The cloud segment and the business division that includes the MS Office portfolio expanded by double digits, outweighing the weakness in the Windows business.

The revenue contribution of Intelligent Cloud rose to $22 billion, which is up 16%. As a result, total revenues moved up 7% annually to $52.86 billion. Meanwhile, LinkedIn revenue growth decelerated, extending the recent trend. Microsoft 365 added more users during the quarter, taking the total subscriber number to 65.4 million.

Shares of Microsoft were trading up 8% on Wednesday afternoon, after opening the session sharply higher. The stock is up 24% since the beginning of the year.