Monster Beverage Corp. (MNST) has reported double-digit growth in fourth-quarter earnings and revenues, aided by the solid demand for its popular soft drink brands and newly launched products. The results also exceeded Wall Street estimates, triggering a stock rally after the announcement.

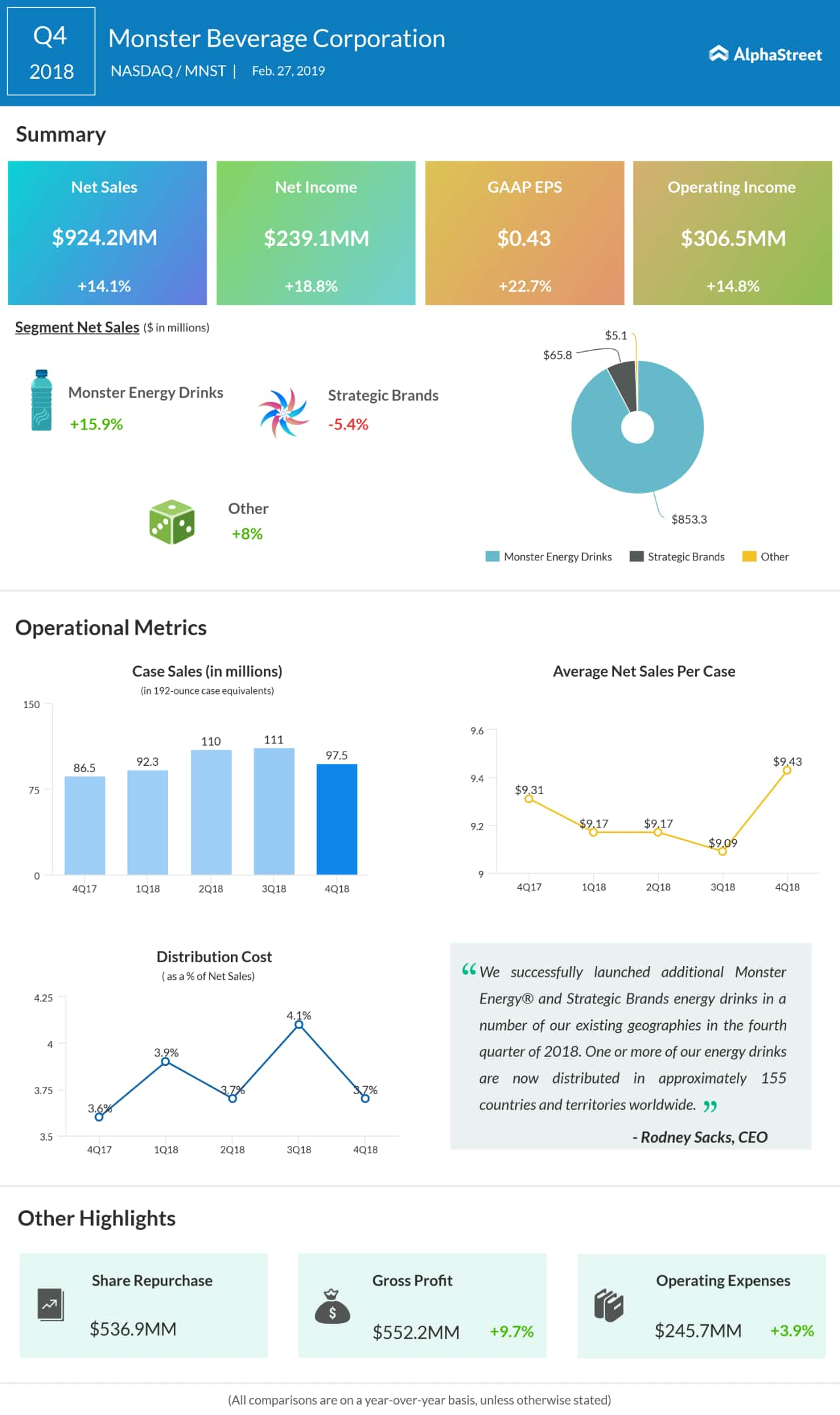

Net sales of the Corona, California-based energy drink maker advanced 14.1% annually to $924.2 million in the fourth quarter, exceeding expectations. A 16% growth in the Monster Energy Drinks brand more than offset a 5.4% decline in the sales of Strategic Brands. There was a notable increase in demand in the overseas markets.

The top-line growth was restricted, to some extent, by the commissions paid to Coca-Cola Company (KO) and advance purchases made by customers in the preceding quarter, in the wake of the price increase announced on certain products.

A 16% growth in the Monster Energy Drinks brand more than offset a 5.4% decline in the sales of Strategic Brands

Reflecting the strong sales growth, net profit climbed to $239.1 million or $0.43 per share in the December quarter from $201.3 million or $0.35 per share in the same period a year earlier. Market watchers had forecast slower earnings growth.

“During 2019, we will continue to launch our Monster Energy brand of energy drinks in new geographical markets, and plan to launch Predator, our strategically preferred affordable energy brand, in additional markets internationally,” said CEO Rodney Sacks.

During the quarter, the company launched several new products under the Monster Energy Drinks and Strategic Brands segments across the key markets, which will be expanded to the other markets in the coming months. It also repurchased about 9.4 million shares for $536.9 million and authorized a new share buyback program valued at $500 million.

Also read: PepsiCo reports in-line results for Q4

Monster Beverage’s deteriorating relationship with Coca-Cola, which holds a significant stake in the company, continues to be a cause for concern for shareholders. Coca-Cola recently launched new energy drink brands, which according to Monster Beverage violated the partnership agreement between the companies.

Shares of Monster Beverage surged about 9% during the extended trading session Wednesday after the earnings report. After slipping to a multi-year low in December last year, the stock gained about 12% so far this year.