Pearl Diver Credit Company Inc. (NYSE: PDCC) released Q4 2025 earnings today. Pearl Diver Q4 2025 reported mixed results but showed rising cash flow momentum. In fact, recurring cash flows surged to $9.8 million in the quarter.

Pearl Diver Q4 2025 Earnings: Quarterly Performance

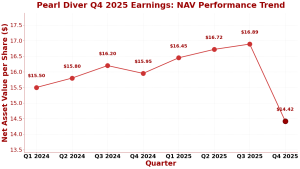

Q4 2025 delivered key insights into Pearl Diver’s CLO equity strategy. Net asset value declined to $14.42 as of December 31, 2025. In particular, this compares to $16.89 in the prior quarter. So the NAV fell 14.6% sequentially. As a result, market conditions and loan spread tightening drove the decline.

The company reported a net loss of $12.4 million for the quarter. Investment income reached $5.7 million, up from $5.4 million previously. Yet expenses of $2.5 million rose slightly. Overall, net investment income improved to $3.4 million. Therefore, this marks a 13.3% increase from the prior quarter’s $3.0 million.

Click here to read the press release.

Pearl Diver Q4 2025 Earnings: Cash Flow Performance

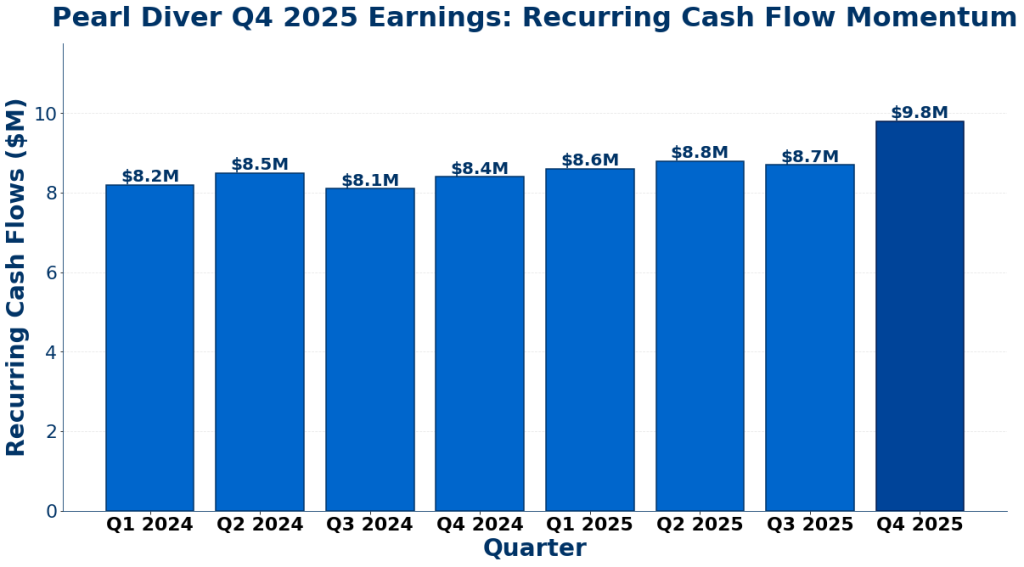

Cash flow performance improved in the quarter. Recurring cash flows from CLO investments surged to $9.8 million. Also, this rose 12.6% from $8.7 million in Q3. On a per-unit basis, cash flows hit $1.44. Therefore, this exceeded the prior quarter’s $1.28 per unit.

Cash flows exceeded distributions and expenses again. Also, management noted this as a key achievement. In fact, quarterly distributions totaled $0.22 per unit. Coverage improved thanks to rising cash generation. So this sustainability supports Pearl Diver’s dividend strategy.

Figure 1: Pearl Diver Q4 2025 earnings show rising recurring cash flows. Meanwhile, momentum built through 2024 and 2025, with Q4 hitting $9.8M.

Pearl Diver Q4 2025 Earnings: CLO Portfolio Metrics

The company manages a diversified CLO equity portfolio. As of December 31, Pearl Diver held about 1,279 unique corporate obligors. Also, these companies represent over 1,600 underlying loans. Plus, the total loan portfolio value reached $27.3 billion. Therefore, diversification reduces risk from any single obligor.

The largest obligor represented just 0.7% of loans. Also, the top 10 obligors accounted for 4.5% combined. This shows solid portfolio discipline. Meanwhile, the weighted average CLO yield was 12.99%. This compared to 13.07% in the prior quarter.

Capital Structure

Leverage rose modestly during the quarter. Total debt was $40.5 million. This represented 28.7% of total assets. Now, in the prior quarter, leverage was 25.7%. Plus, leverage increased 300 basis points.

Pearl Diver sold shares via its at-the-market offering. The company issued 30,680 shares in Q4 2025. Net proceeds were approximately $0.5 million. Meanwhile, in early Q1 2026, the company continued selling shares. Also, through February 13, 2026, it raised $0.4 million from 31,655 shares.

Figure 2: Pearl Diver Q4 2025 earnings show NAV pressure. Meanwhile, the December decline to $14.42 reflects market tightening and loan spread compression.

Forward Strategy

CEO Indranil Basu noted challenges in the macro environment. Loan spreads tightened, pressuring NAV. Yet management remained optimistic about CLO opportunities. Also, the company used its machine learning approach to find value. So management added positions offering solid risk-adjusted returns.

Pearl Diver’s reinvestment calendar extends into 2030. 99.9% of CLOs have reinvestment dates from 2026-2030. This creates opportunities to reinvest at favorable prices. Therefore, management plans to continue its CLO equity strategy. Now, the goal is to create shareholder value over time.

Key Takeaways

Pearl Diver Q4 2025 earnings show a mixed but constructive picture. Also, cash flow momentum continues to build. Recurring cash flows surged 12.6% to $9.8 million. Plus, net investment income improved 13.3%. Yet NAV fell due to market tightening and spread compression. Meanwhile, the portfolio remains well-diversified across 1,279 obligors. So management maintains a strategic focus on value creation. For investors, the rising cash flows support the current dividend. In short, the long reinvestment calendar offers future upside potential.

Click Here to visit the AlphaStreet website.