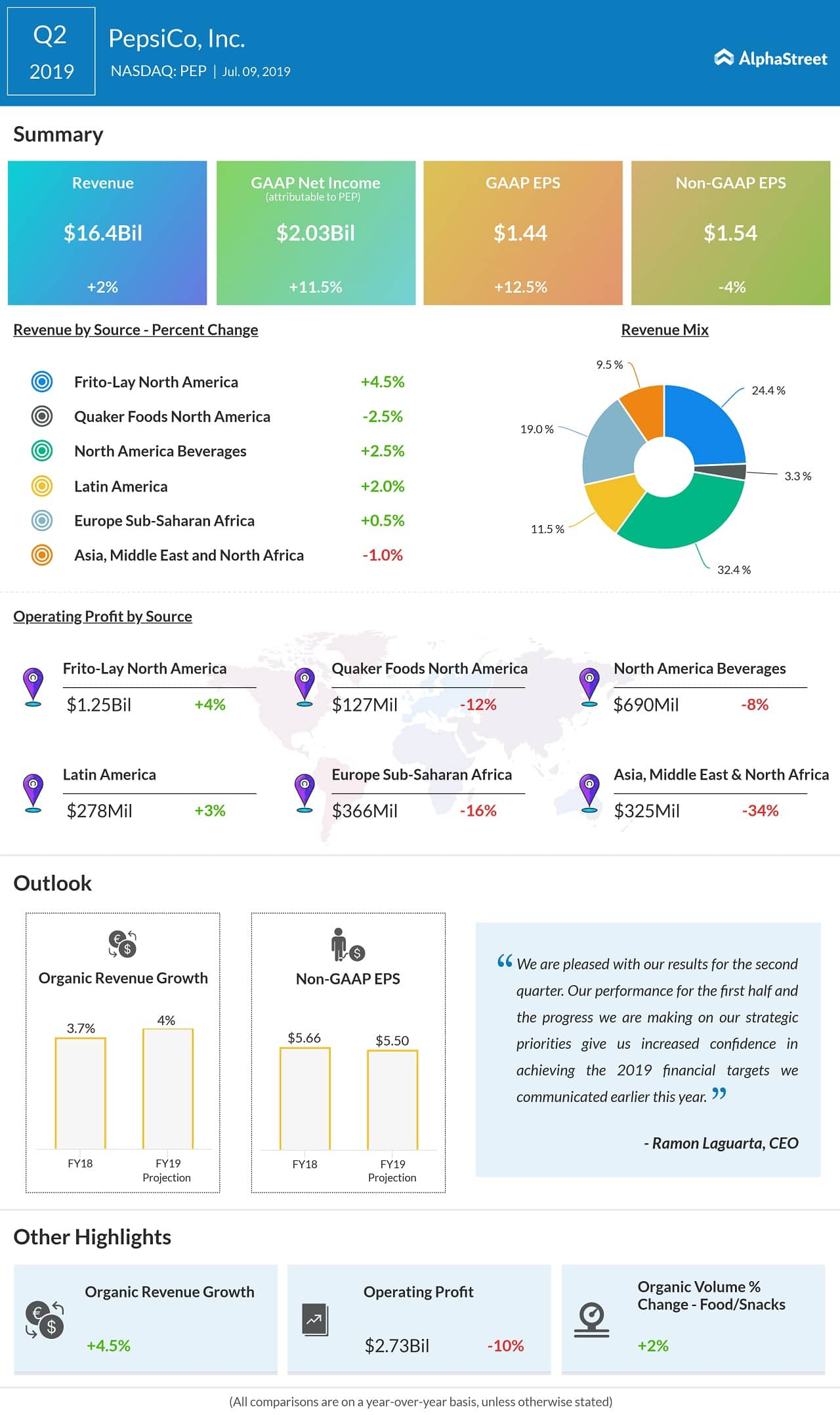

Beverage giant PepsiCo (NASDAQ: PEP) on Tuesday reported second-quarter earnings and revenues that topped earnings estimates. Revenues grew 2.2% to $16.45 billion, edging past analysts’ estimate for $16.42 billion. On an organic basis, revenue grew 4.5%.

The snack business continued to outperform in Q2, with organic revenue growth of 5%. The segment was also returned 4.5% higher adjusted constant currency profits. Meanwhile, the Quaker Foods North America, despite seeing a 3% organic revenue growth, saw its profits plunge double-digits.

Core earnings fell 4.3% year-over-year to $1.54 per share, beating the street estimate of $1.50 per share.

PEP shares were up 0.5% during pre-market trading on Tuesday. The stock has gained 22% so far this year.

Ramon Laguarta, who took charge as PepsiCo CEO in October last year, expressed confidence of meeting the full-year targets set by the beverage company.

READ: Why is it the right time to invest in beverage stocks?

PepsiCo reiterated its guidance of full-year organic revenue growth of 4%. For this period, core EPS is projected to fall 3% to $5.50 per share.

PepsiCo continues to boost its strong product portfolio through innovation and strategic partnerships. The company recently teamed up with Lavazza to launch iced coffee in the UK. PepsiCo’s diversification efforts through various acquisitions and partnerships are likely to pay off in driving growth going forward.

Pepsi’s primary competitor The Coca Cola Company (NYSE: KO) is slated to report financial results two weeks later.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions