Soft drink giant PepsiCo (PEP) is scheduled to publish its fourth-quarter financial results Friday before the market opens. Analysts’ consensus estimate for adjusted earnings is $1.49 per share, up 14% from the year-ago period. Revenues are expected to be broadly flat at $19.51 billion.

Both the beverage and food divisions will likely register strong growth in the December quarter, with the only exception being the Quaker Food segment that witnessed weakness in the preceding quarter. The company’s earnings have exceeded Wall Street’s predictions consistently for nearly three years now, and the trend is expected to continue this time.

PepsiCo’s recent shift to healthier beverages and snacks, to cater to the changing consumer preferences, was well received in the key markets. As part of the efforts to serve the health conscious customers, the New York-based company made multiple acquisitions recently, including the $3.2-billion buyout of sparkling water maker SodaStream, and rolled out new products like Bubly and KeVita.

Also see: Pepsico Q3 2018 Earnings Conference Call Transcript

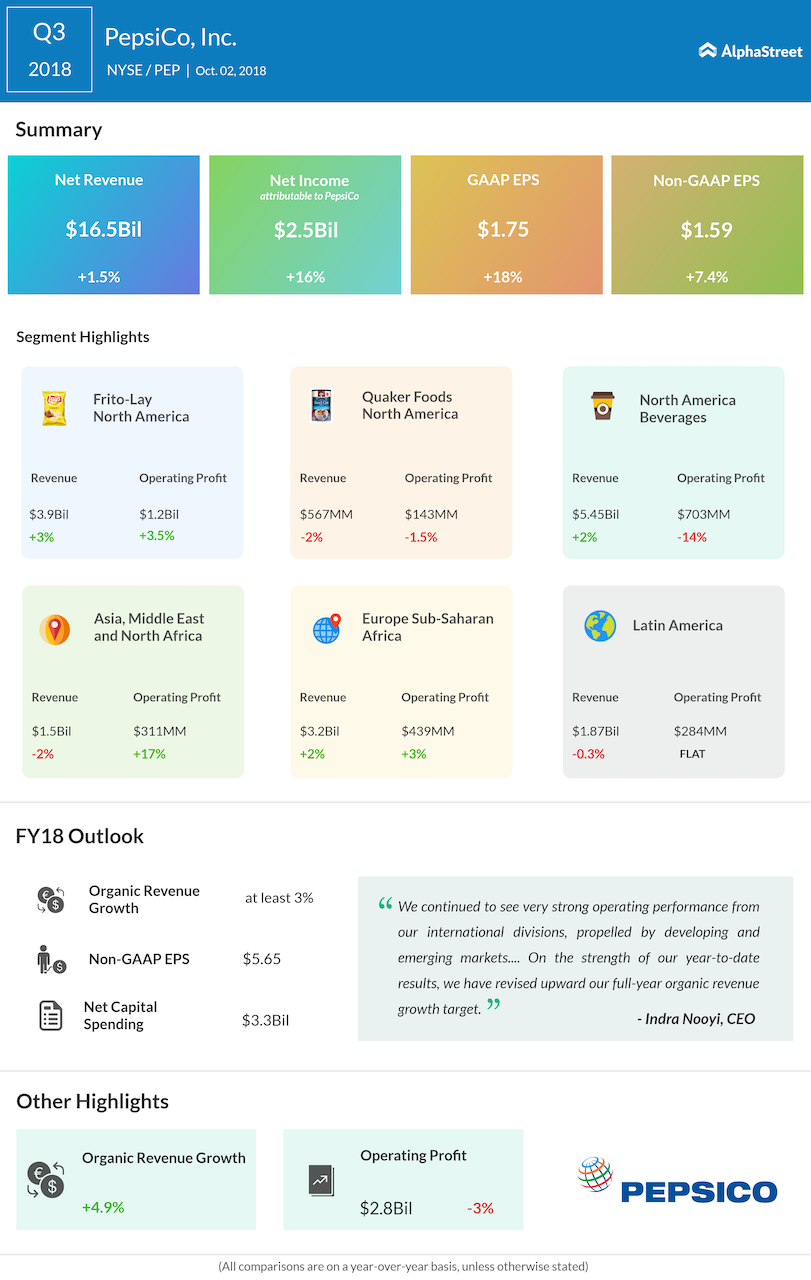

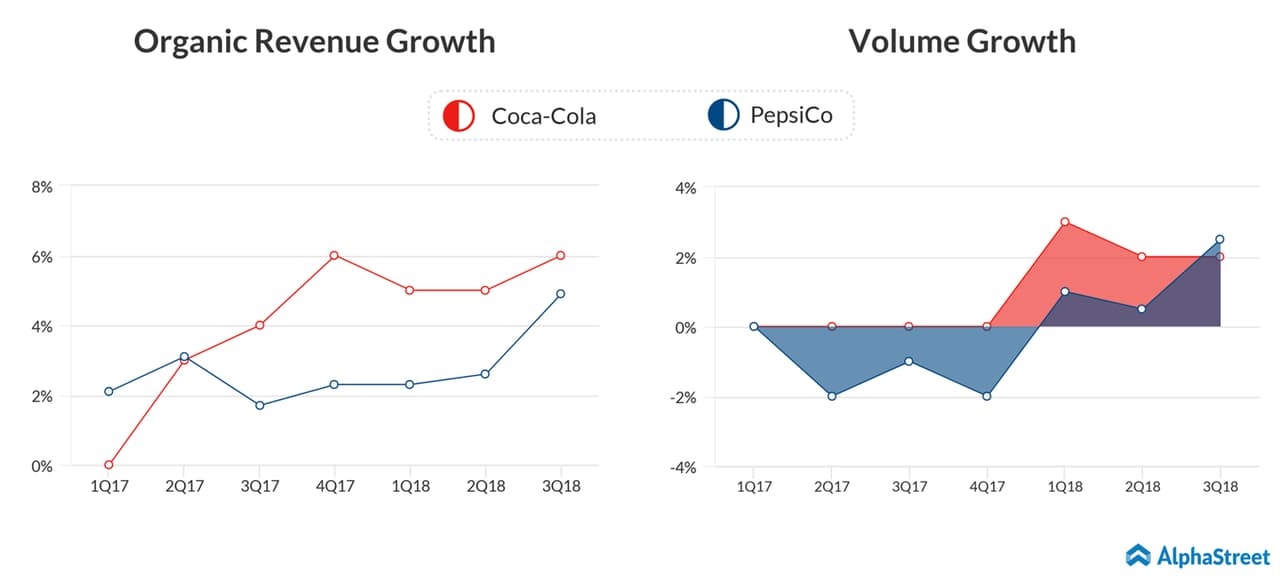

Such moves, combined with the aggressive e-commerce push, will ease the potential impact of the growing aversion to carbonated drinks. In the September-quarter, adjusted earnings surged to $1.59 per share on revenues of $16.4 billion, up 1.5%. The results topped market expectations amid record organic revenue growth. The management predicted that the bullish trend will continue in fiscal 2019.

Meanwhile, high transportation cost and commodity prices will continue to squeeze margins, partially offsetting benefits of the ongoing growth initiatives and favorable pricing. The stable overseas growth, especially in the developing and emerging markets, along with the strong snack profile and extensive delivery network, will help the company overcome the short-term headwinds.

Last year was particularly challenging for PepsiCo due to cost escalation and the changes in people’s consumption pattern. Rival soft-drink maker Coca-Cola (KO) will be reporting the results for its most recent quarter Thursday before the opening bell.

Last year was particularly challenging for PepsiCo due to cost escalation and the changes in people’s consumption pattern. Rival soft-drink maker Coca-Cola (KO) will be reporting the results for its most recent quarter Thursday before the opening bell.

Shares of PepsiCo hit a record high in November 2018, before retreating to the pre-peak levels in the following weeks. The stock has gained about 5% since the beginning this year.