For any company that sells a product, two important factors driving the business are demand and profit margins. Thor Industries (NYSE: THO) is at the moment, struggling with both. Even though it has been pretty much an industry-wide weakness, Thor has been among the worst hit.

The rising pessimism is evident from the stock, which has been spiraling since January last year. In the past 12 months, THO shares have declined over 40%, primarily due to disappointing quarterly results. In the trailing four quarters, the manufacturer of recreational vehicles managed to surpass bottom-line estimates only once.

The company is next expected to report quarterly results on Monday, September 30, before the market opens. For the current fourth quarter, analysts expect earnings of just $1.43 per share, 24 cents lower than a year ago.

It may also be noted that the estimate was downsized five times during the past 90 days from the initial estimate of $1.62 per share, signifying rising skepticism in the market.

READ: Is Lululemon’s bull run coming to an end?

ADVERTISEMENT

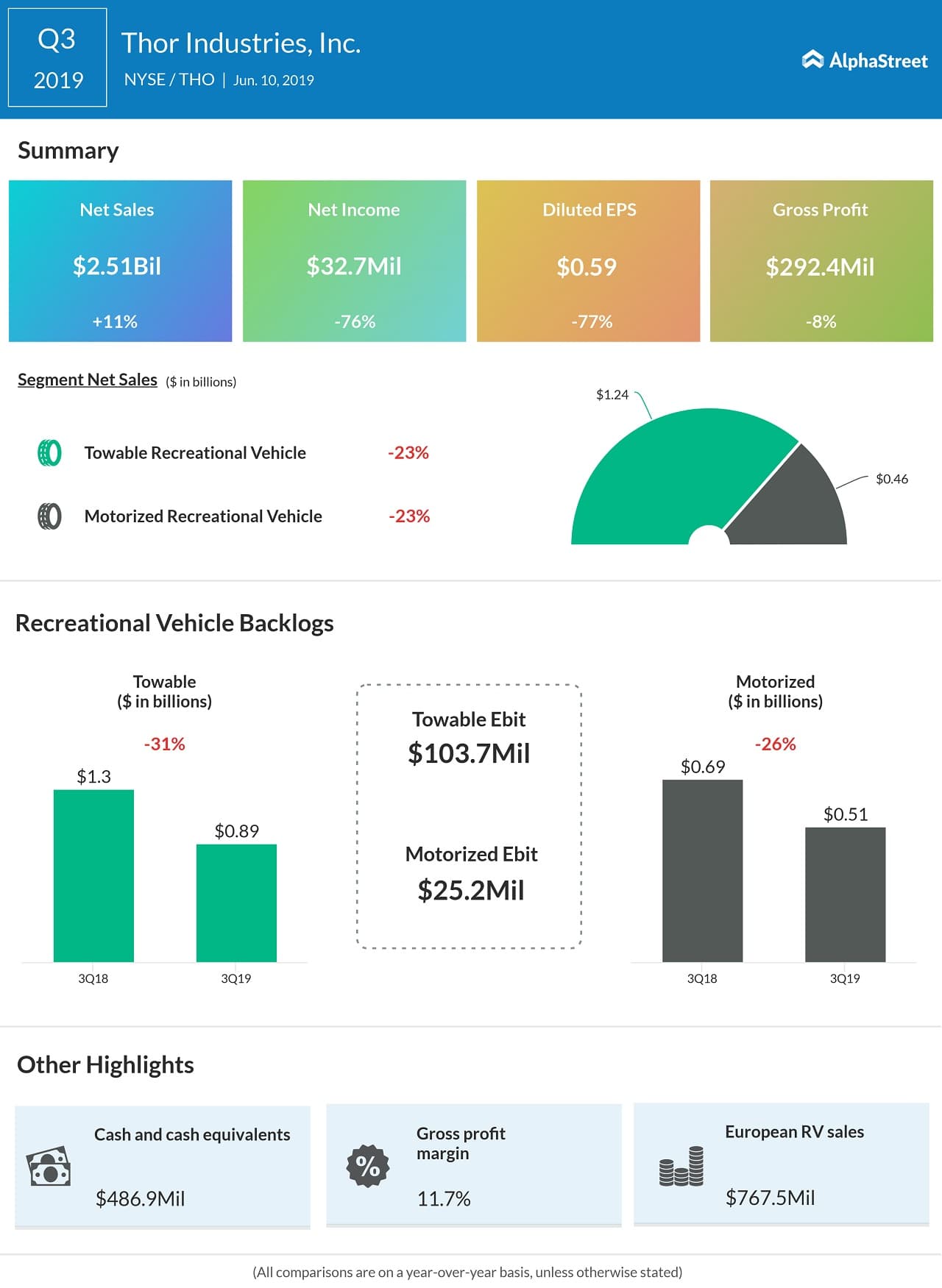

Meanwhile, the company is expected to see a 25% increase in revenues to $2.35 billion, as the recent acquisition of Germany-based rival Erwin Hymer Group comes into play. However, most of the gains on the bottom-line from this acquisition would be offset by weakness in North America sales, as well as higher freight and material costs.

THO stock has a 12-month average price target of $47, which is at a 7% downside from the last close. Despite the declines, the market feels the stock is overvalued and has an average rating of Moderate Sell.