Regions Financial Corporation (NYSE: RF) reported first quarter 2019 earnings that were in line with estimates while revenues fell short of expectations.

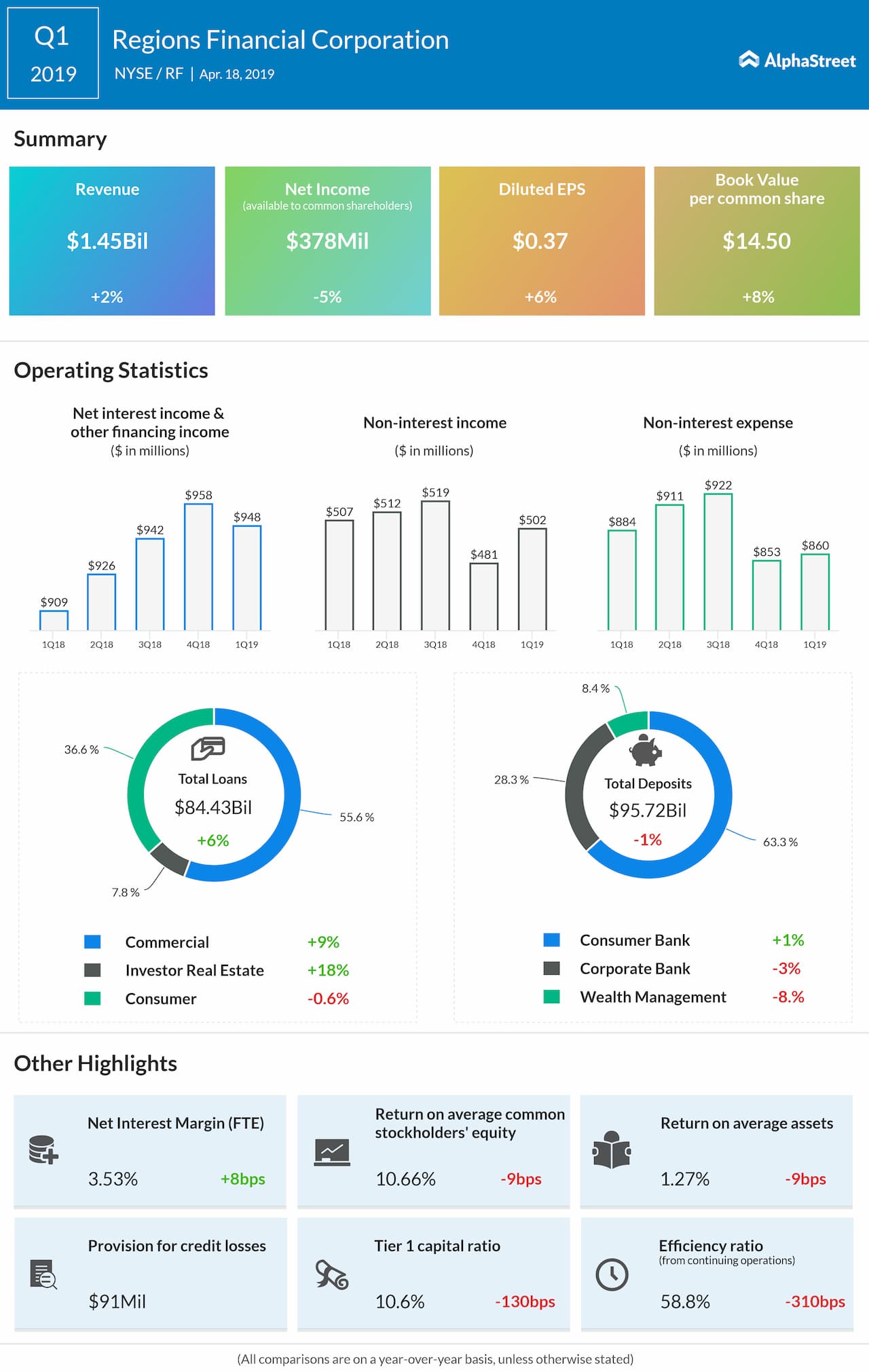

Total revenues grew 2.4% year-over-year to $1.45 billion. Net income available to common shareholders was $378 million, or $0.37 per share, compared to $398 million, or $0.35 per share in the year-ago period.

Net interest income and other financing income grew 4% while net interest margin increased 7 basis points, driven mainly by higher interest rates and favorable remixing within the consumer loan portfolio into higher yielding products.

Non-interest income decreased 1% and non-interest expense decreased 3% on a reported basis. Average loans and leases increased 5% while average deposits fell 1%.

Annualized net charge-offs improved 4 basis points on a reported basis while the allowance for loan and lease losses as a percent of total loans fell 4 basis points. Total non-performing loans, excluding loans held for sale, dropped 13 basis points to 0.62% of loans outstanding.

The company’s Basel III Common Equity Tier 1 ratio stood at 9.8% while its tangible common book value per share, on an adjusted basis, was $9.72. Regions reported an efficiency ratio of 58.8% during the quarter, an improvement of 310 basis points from last year.

Regions Financial’s shares have climbed 18% year to date.