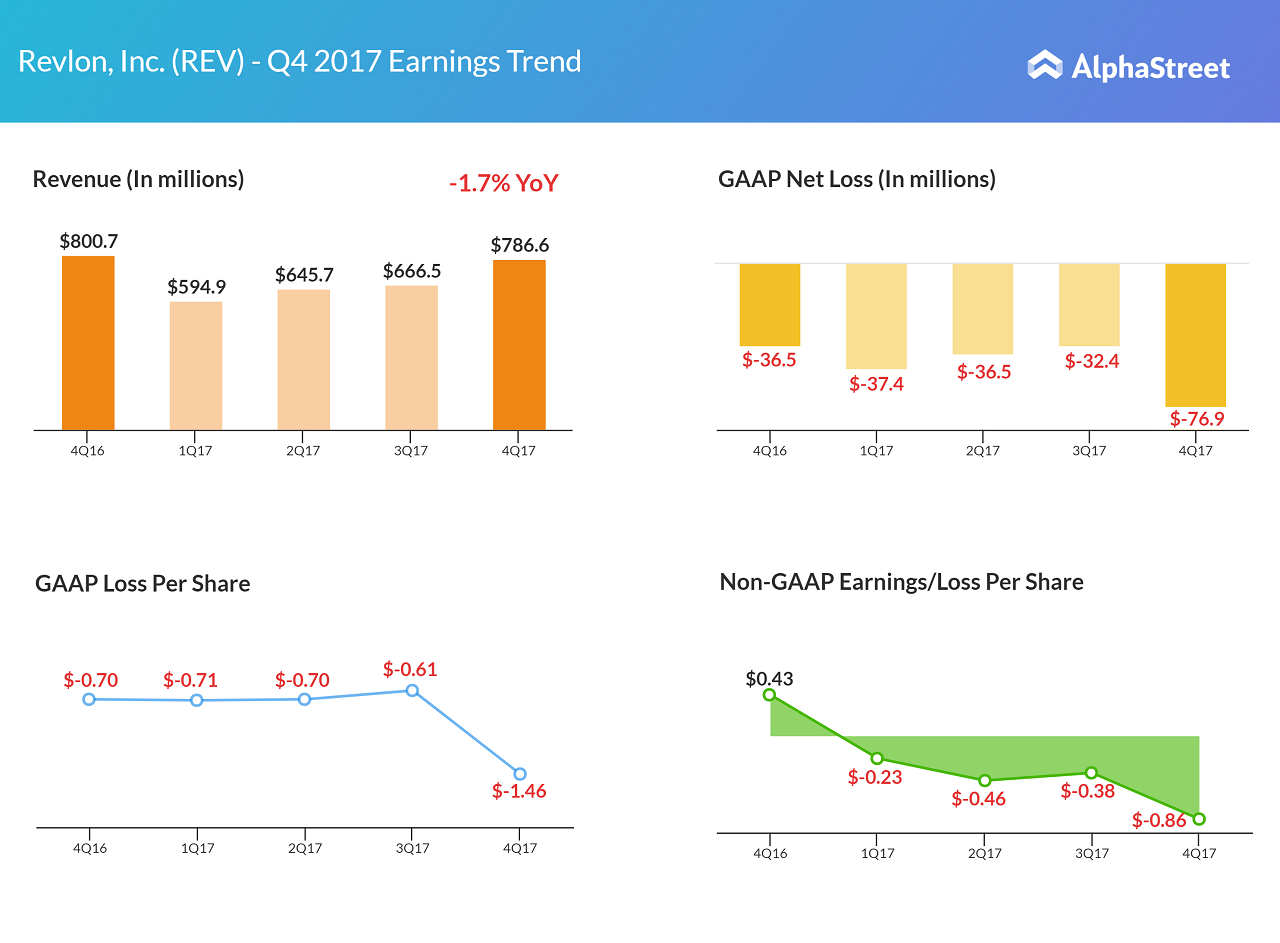

Cosmetics company Revlon (REV) reported declines in top and bottom line results, primarily hurt by steep fall in sales in North America. However, international growth was a big positive for the Elizabeth Arden segment compared to other segments, gaining 2.3% year-over-year. Net loss more than doubled to $76.9 million or $1.46 per share from the year ago loss of $36.5 million or $0.70 per share, impacted by the US corporate tax cuts. Excluding special items, the company lost $0.86 per share compared to a gain of $0.43 per share a year ago.

Across all geographical segments, international was a bright spot for Professional and Elizabeth Arden segments, which gained 8.5% and 20.7% respectively in sales, while Consumer and Other segments declined 1.5% and 23.4% respectively.

Elizabeth Arden Integration

Revlon said it is continuing to speed up the realization of synergies and cost cuts on the restructuring and consolidation of Elizabeth Arden, delivering $69 million of synergies and cost reductions for 2017 vs. the expected amount of $55 million to $60 million.