Salesforce raised its revenue guidance for FY19 to a range of $13.075 billion to $13.125 billion, while for Q2 2019, revenue is expected to come in the range of $3.22 billion to $3.23 billion. The current quarter GAAP earnings per share is expected to be in the negative territory of ($0.09) – ($0.08) and for the year it is expected to come in the range of $0.49 to $0.51. On an adjusted basis, the company expects earnings per share to be in the range of $0.46 to $0.47.

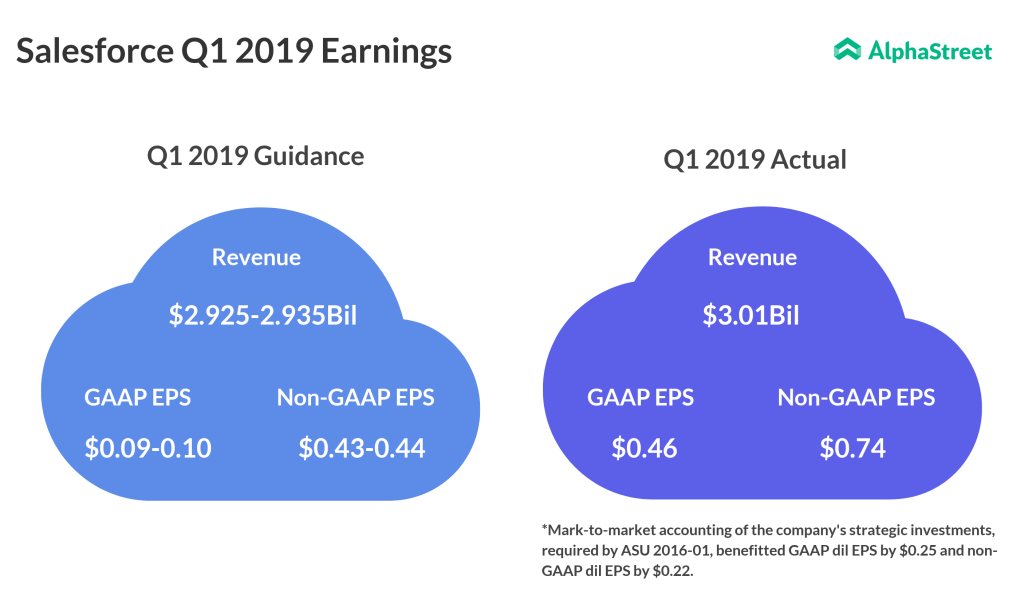

Salesforce delivered more than $3 billion in revenue in the first quarter, surpassing a $12 billion annual revenue run rate. “Our relentless focus on customer success is yielding incredible results, including delivering nearly two billion AI predictions per day with Einstein,” said Marc Benioff, CEO.

Recently, the company had acquired MuleSoft, its biggest acquisition ever, which bolstered to report revenue surpassing estimates. However, the San Francisco, California-based cloud giant saw its operating expenses jump 17.5% to $2 billion.

Salesforce’s all cloud service offerings contributed to its earnings, growing double digits, with Marketing and Commerce Cloud reporting the highest growth of 41%, followed by platform revenue and service cloud. Subscription and support revenue saw a jump of 27%, surpassing projections.

Geographically Americas, which contributes 70% to the company’s revenue, jumped 19%, with Europe posting the highest growth of 48% for the quarter.

Salesforce stock has seen a surge of 42% in the last one year, while it shot up 23.3% since the beginning of this year. After the earnings report, the stock gained a marginal 1%, while jumped about 4.5% after hours trading.