The merger, announced in April, is expected to complete later this year, and the combined entity will be listed on the NYSE under the new ticker symbol, SHPW. According to the company, not even 10% of the 100 million global manufacturers have gone digital, offering plenty of headspace for growth.

In an interview with AlphaStreet, Shapeways CEO Gregory Kress elaborated on the firm’s optimistic outlook and operational strategies going forward. Excerpts:

AlphaStreet: The 3D printing space has become highly competitive industry. How do you expect to turn the market sentiments in your favor?

Greg: Shapeways is very complimentary to the basic hardware providers as well as material providers out there because we become a strong down-sell solution for those partners when customers aren’t able to make large capex investments to bring on those levels of technology. And so they use services like Shapeways to go do that.

Ultimately, within our space, there is competition. But I think what differentiates us is that we were able to achieve very competitive pricing models based on the fact that we have digitized our end-to-end processes and allows us a more differentiated cost structure to meet the needs of our customer base. We also allow for high-quality, flexible manufacturing, which you don’t necessarily see consistently across the industry.

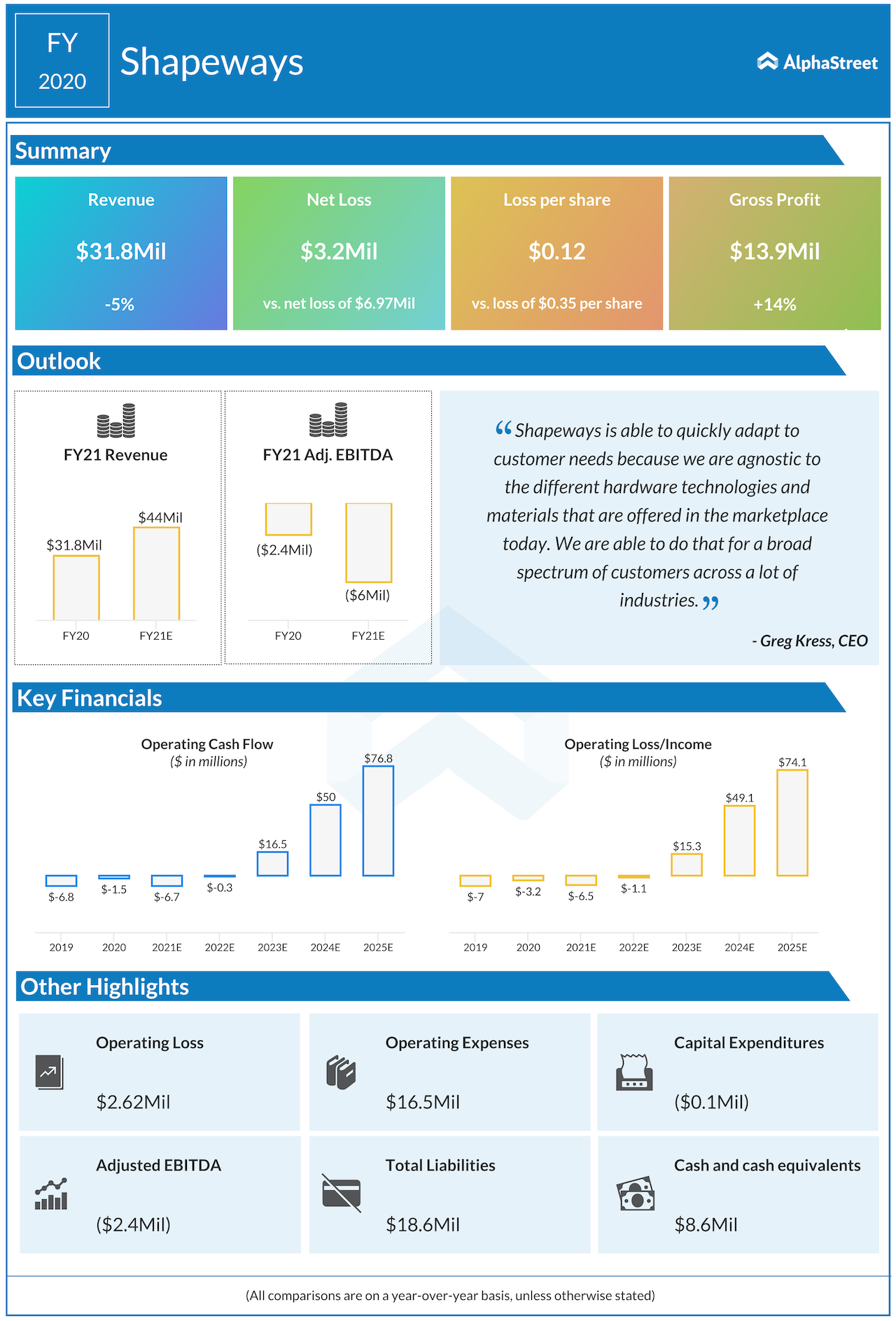

AlphaStreet: Your revenues fell 5% in FY20, but you are projecting a growth of 95% in fiscal 2022. What gives you confidence in such a drastic rise in revenues?

Greg: Our revenue is really broken down into a couple of different buckets. First, we have our core installed business. These are customers that have been with Shapeways for a very long period of time. We understand these customers very well. And they represent a strong base of business. We have a cohort model that looks at that customer base and the retention model, the average order value, and the purchasing frequency of those customers. It gives us strong conviction on where that revenue will go and moving forward.

The second piece of our growth trajectory really is focused on investing in new additive technologies and materials. Over the next five years, we are forecasted to invest over $100 million in capex to support these additional technologies and materials. That will move us from the 90 materials and finishes that we offer today to over 250 materials and finishes by 2025. And this is our bread and butter.

We know how to go and deploy assets, bring them to market, fill the equipment and get high levels of asset utilization. Obviously, the biggest limiting factor here is capex investment. And so as part of this transaction, we have the opportunity to leverage that capex investment to go and roll out these new technologies and materials to go and support that customer growth.

There is also a strong M&A opportunity here. It’s a very fragmented market with small niche-added manufacturers that could become part of the Shapeways family and help accelerate the rollout of these types of hardware and materials.

The last piece of our growth is something we take a very conservative approach. One is monetizing our software. The software we have is what is truly differentiating our business over the last 10 years. We are now making that available to other manufacturers to enable them to get the same levels of productivity that Shapeways has, providing us with another revenue and growth lever for the business. Again, we are taking a very conservative approach to this, we think that this could be a disproportionate amount of our revenue in the future. But this won’t be rolling out to the public until later in the year.

The last piece is offering our customers more traditional manufacturing solutions. We won’t be creating manufacturing goods internally but leveraging the supply chain partners that already exist to be able to support our customer needs.

As we look at our revenue projections over the next several years, growing to $400 million by 2025 represents less than 1% of the total market. So Shapeways still has a tremendous amount of opportunity in front of us even beyond this plan.

Banxa founder Domenic Carosa: Crypto industry seeing huge HNI interest

AlphaStreet: What would you say is more important to you at this juncture – scale or profitability?

Greg: We are relatively close to EBITDA to positive. Right now we are slightly negative. But in reality, a big function of that is growth. Driving more growth to the business and great gross margin allows for a disproportionate amount of margin coming in. And that allows us to see much higher levels of profitability. Right now we feel comfortable with where we are from a profitability standpoint and we are shifting our focus to growth. We are able to achieve a significantly higher gross margin than others in the industry because of the software platform that we have invested in over the last 10 years.

AlphaStreet: Can you tell us a bit about your client mix?

Greg: Shapeways historically has been a self-service business. We grow by word of mouth organically, and we support a wide range of customers as they come in and use our services for manufacturing. That being said, it’s hard to know exactly what parts go to what industry.

Our top 250 customers represent roughly around 60% of our revenue today. About 40% of that revenue we see going to consumer businesses. Typically Shapeways is delivering it directly to the end-consumer on their behalf. The other 60% of our revenue breaks up pretty evenly across four verticals — medical, automotive, aerospace, and industrial.

If we look at the Medical space, we have customized knee braces, splints, orthotics, hearing aids, eyewear, all with the intent to offer our customers great products for that industry. The second is aerospace. And this really covers all the major players in aerospace. They use us for a lot of services as they bring new products to market, but also drones and unmanned aircraft.

The third group is automotive. We have seen a significant lift from tier one automotive suppliers for the low volume high mix production needs, where they are using Shapeways to fulfill a lot of those orders. And then lastly, we have industrial customers that really cover the gamut, but a very key niche of that is our robotics customers. These are typically low volume, highly complex designs, and very customized to the customer’s need.

Economic recovery gives 360 DigiTech further room for growth: CFO Alex Xu

AlphaStreet: Can you elaborate a bit on how you plan to use the proceeds from the Galileo merger?

Greg: There’s four primary use of proceeds associated with this transaction. The first is an investment in the expansion of our hardware material capabilities. This basically is focused on spending about $100 billion in capex over the next five years to accelerate and roll out more manufacturing services to the customers. This includes expansion of polymers, moving into industrial metals, launching certifications for specific industries, and then also expanding our footprint from a geographical standpoint.

The second use of proceeds is focused on our go-to-market. This basically aligns our go-to-market strategy directly with the hardware of material OEMs that are out there. The third use is expanding beyond just additive manufacturing to be able to support a broader share of wallet for our customer needs.

And then the last use of proceeds is further modernization and commercialization of our software platform. We have rolled out our platform to several different design groups over the last year.

__________

(Written by Arjun Vijay)