Spin-off

Smith & Wesson Brands, Inc. (NASDAQ: SWBI), formerly American Outdoor Brands Corporation, is a manufacturer of firearms and a provider of accessory products for the shooting, hunting and outdoor enthusiasts. The company operates through two segments; Firearms and Outdoor Products & Accessories (OP&A).

Last November, AOBC said that it would spin-off the outdoor products and accessories business as a tax-free stock dividend to the stockholders. On June 1, 2020, American Outdoor Brands’ name was changed as Smith & Wesson Brands, Inc. (firearm business) and ticker symbol as SWBI. The spin-off company is planned to be named as American Outdoor Brands, Inc. (outdoor products and accessories business) and it will trade under the ticker symbol AOUT.

This spin-off is expected to be completed early in the

second fiscal quarter, probably in August barring any unforeseen delays. When

the spin-off is completed, AOUT will own all assets relating to the existing

OP&A segment. The new company will have no outstanding debt.

Q4 results

Smith & Wesson reported its fourth quarter 2020 results last Thursday. The gunmaker’s revenue jumped 32.9% to $233.6 million in the fourth quarter of 2020 beating the market’s view of $217.6 million. Adjusted earnings of $0.57 per share surpassed the analysts’ estimates of 40 cents a share.

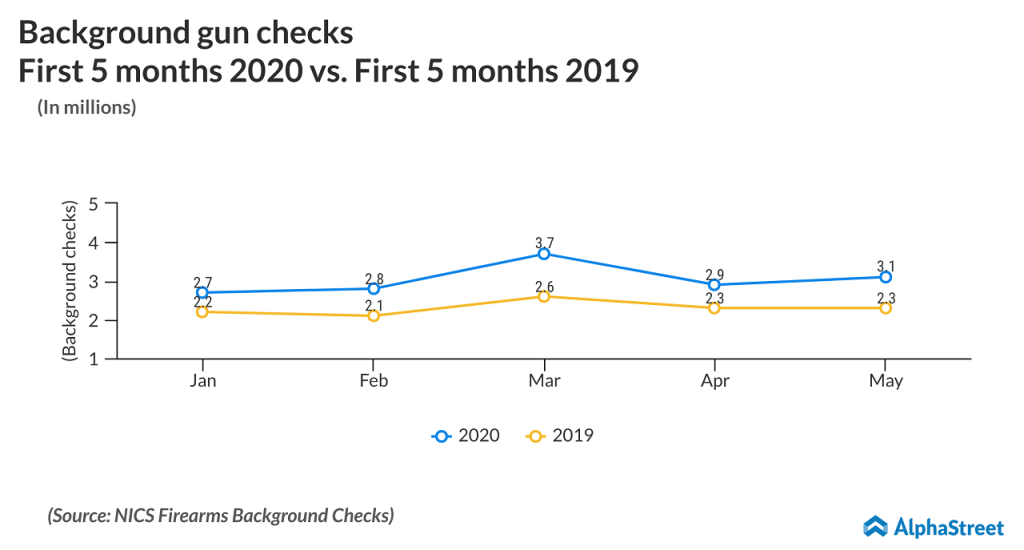

Firearms segment revenue soared 37% annually due to strong orders from retailers and distributors, which was driven by sudden and heightened consumer demand for the firearms. In the fourth quarter, e-commerce channel grew 103% compared to the prior year and included a significant increase in direct-to-consumer sales.

As of fourth quarter end, Smith & Wesson had cash of

$125.4 million and total bank debt of $160 million. When the spin-off is

completed, AOUT will own all assets relating to the existing OP&A segment.

The new company will be well capitalized and will have no outstanding debt.

When discussing the recent surge in the Q4 earnings call, co-CEO Mark Smith said:

“There’s really two types of surges, right, one is fear of gun control regulation and one is fear of personal protection. And when we get into personal protection, I’m sorry, when we get into gun control, it tends to be a lot of firearms owners and enthusiasts going out purchasing more firearms. In one of these type of what’s happening right now is really driven by, in large part we believe is driven by the fear of personal protection and that brings new shooters into the marketplace.”

ADVERTISEMENT

The company declined to comment on the percentage of sales from e-commerce and Amazon and added that more details will be available when it files the Form 10-K for fiscal 2020.

Outlook

A vast majority of OP&A segment products are sourced from China or rely upon components coming from China. The impacts of China-related tariffs and the COVID-19 pandemic (if China is affected by the second wave of COVID-19) are expected to affect the OP&A segment. The company stated that suppliers in China are all operational now.

SWBI stock, which reached its 52-week high ($19.75) last Tuesday, dropped 5.45% and closed at $17.70 on Friday. Shares of Smith & Wesson have jumped 91% since the beginning of 2020. Rival Sturm, Ruger & Company’s (NYSE: RGR) stock also reached its 52-week high early this month. The present social unrest and the possible government change after the November election in the US are expected to benefit Smith & Wesson this year.