Payment solutions firm Square (SQ) posted its third-quarter results earlier this month, but weak guidance for the upcoming period pushed the stock down despite upbeat results. Here’s a quick roundup.

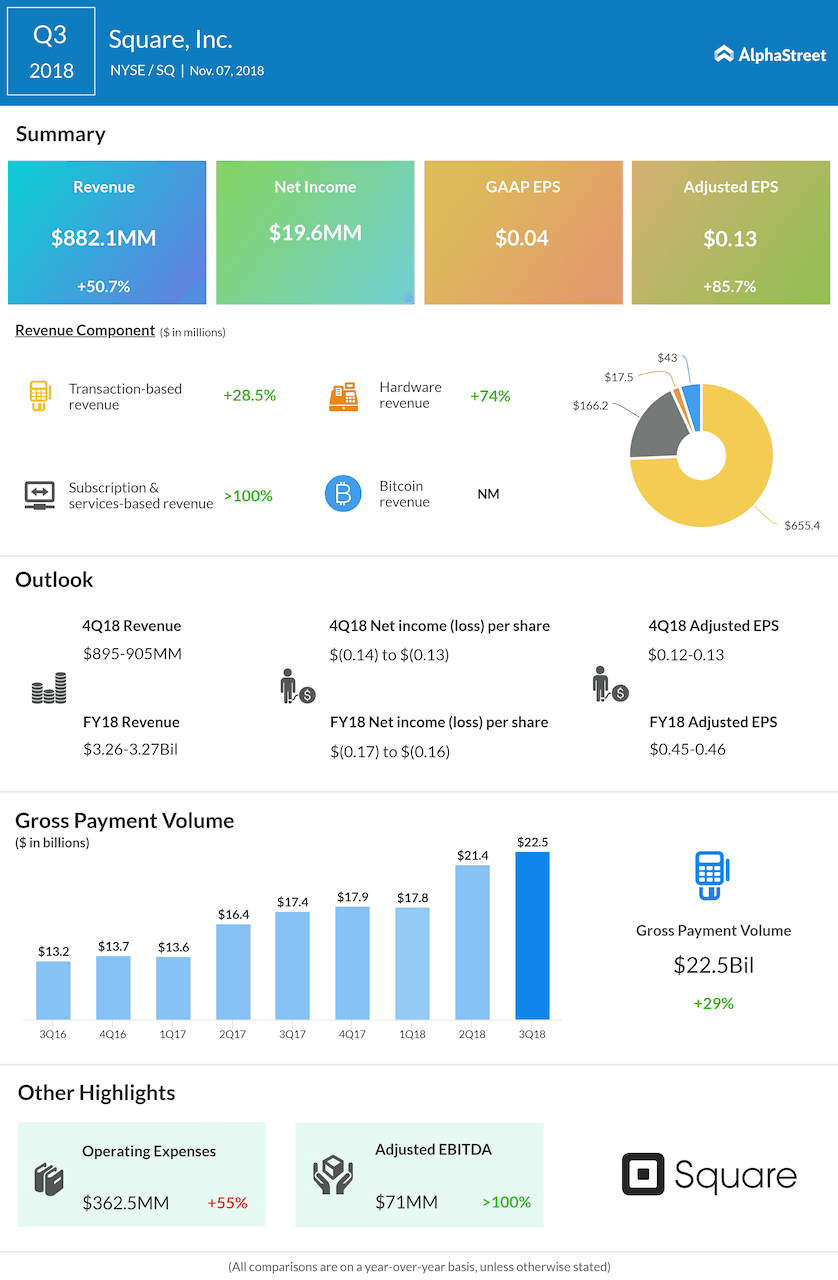

Square turned to a net income of $0.04 per share from last year’s $0.04-a-share loss, and it even gained from its investment in Eventbrite when the latter got a value bump after the IPO. Revenue also surged 51% in the quarter to hit $882 million.

Square was the answer for street vendors and small business orders to accept credit cards using the phone’s 3.5mm audio port. It soon took off and quickly ventured into microfinancing and even Bitcoin trading.

Square garnered about $43 million from Bitcoin trading, up 26% vs. the $34 million raked in the first quarter of 2018. In January, bitcoin trading was launched in its Cash app, available throughout the US excluding few states. The company expects to garner more revenues from bitcoin trading in the future.

On Tuesday this week, Square had closed 1.83% below its previous day. The stock which hit $61.82 was also below the S&P 500 dip of 1.82% loss.

By Wednesday, the payments solutions firm fell 16.8% from last month, while the tech sector only shed 5.96% and the S&P 500 slipped just 2.57%.

While it looks really bad for Square, we can expect to see a resurrection if we hear some good news by the time it posts its next earnings on Feb. 26, 2019.

Analysts are expecting a quarterly revenue of $910.57 million for the upcoming period, up 47.81% from a year ago. All eyes would be on Square would keep itself relevant and how it would perform this time around.