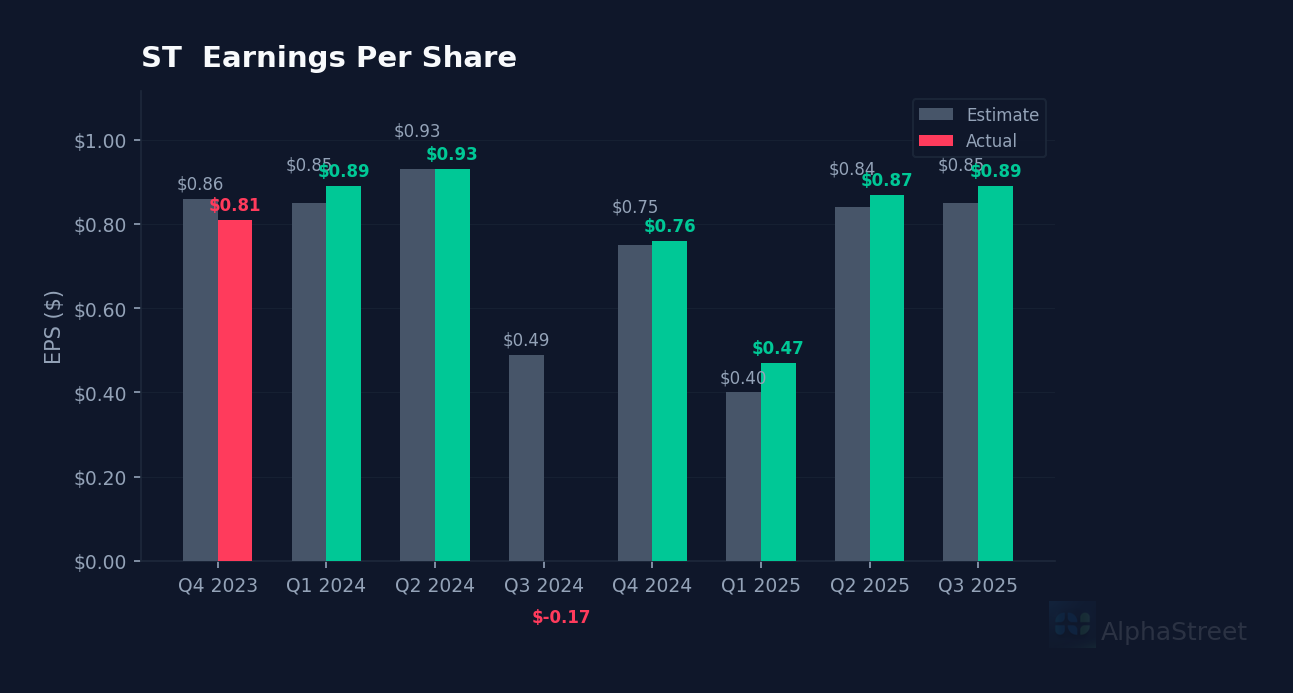

Sensata extends its earnings beat streak. Sensata Technologies (ST) delivered Q4 EPS of $0.89, topping consensus of $0.85 by 4.6% — marking the company’s third consecutive quarter of earnings surprises. Revenue hit $3.69B for the full year, though the quarter came in at $908M against Q4 2024’s $908M baseline. Shares climbed 1.0% in after-hours trading to $37.25, extending a rally that’s seen the stock gain 29.5% since mid-November.

Leadership transition accompanies solid execution. The quarter marked CEO Stephan von Schuckmann’s first earnings call at the helm, following Martha Sullivan’s transition to advisor. CFO Brian Roberts emphasized that Q4 revenue “exceeded the top end of our $870 million to $900 million guidance range,” pointing to better-than-expected performance despite headwinds in the automotive sensor market. The company’s 10.2x forward P/E ratio sits well below sector averages, suggesting the market hasn’t fully priced in the turnaround potential.

China drag weighs on growth trajectory. Management acknowledged ongoing challenges in China, where local manufacturers continue to pressure multinational competitors. Von Schuckmann noted the company expects “more normal outgrowth patterns return in China” once it laps difficult comparisons in the second half of 2025. For the full year, Sensata expects outgrowth “somewhere kind of in our normal range, maybe a little bit on the lower end, given where IHS is” — a cautious stance that reflects conservative automotive production forecasts rather than company-specific weakness.

ICE portfolio proves resilient. Contrary to concerns about exposure to internal combustion engines, management expressed confidence in the durability of its traditional automotive business. “If anything, it should give confidence that our ICE portfolio is very strong,” von Schuckmann said, pushing back against fears that electrification would rapidly erode legacy revenue streams. The company’s operating margin of 11.0% demonstrates profitability even as revenue declined 5.2% year-over-year, indicating pricing power and cost discipline.

Capital allocation signals confidence. The board approved a $0.12 per share quarterly dividend for Q1 2026, payable February 25 — a 33% yield at current prices that underscores management’s confidence in cash generation. With analyst price targets averaging $39.80, the stock trades at a modest 6.8% discount to Street expectations despite consistent execution on earnings.

This article was generated using AlphaStreet’s proprietary financial analysis technology and reviewed by our editorial team.