Shares of Take-Two Interactive Software (NASDAQ: TTWO) have gained 36% in the past 12 months and 14% in the past three months. The general sentiment around the stock is bullish after it ended its fiscal year 2021 on a strong note and announced some strategic acquisitions that give it vast expansion opportunities. Here are a few points that work in the company’s favor:

Solid portfolio

Take-Two has a solid portfolio that continues to drive user engagement and growth. These include the Grand Theft Auto, NBA 2K and Red Dead Redemption games, among others. Sales of Grand Theft Auto V surpassed expectations in fiscal 2021 and to-date, has sold-in over 145 million units worldwide. Grand Theft Auto Online also witnessed strong engagement trends during the fourth quarter of 2021.

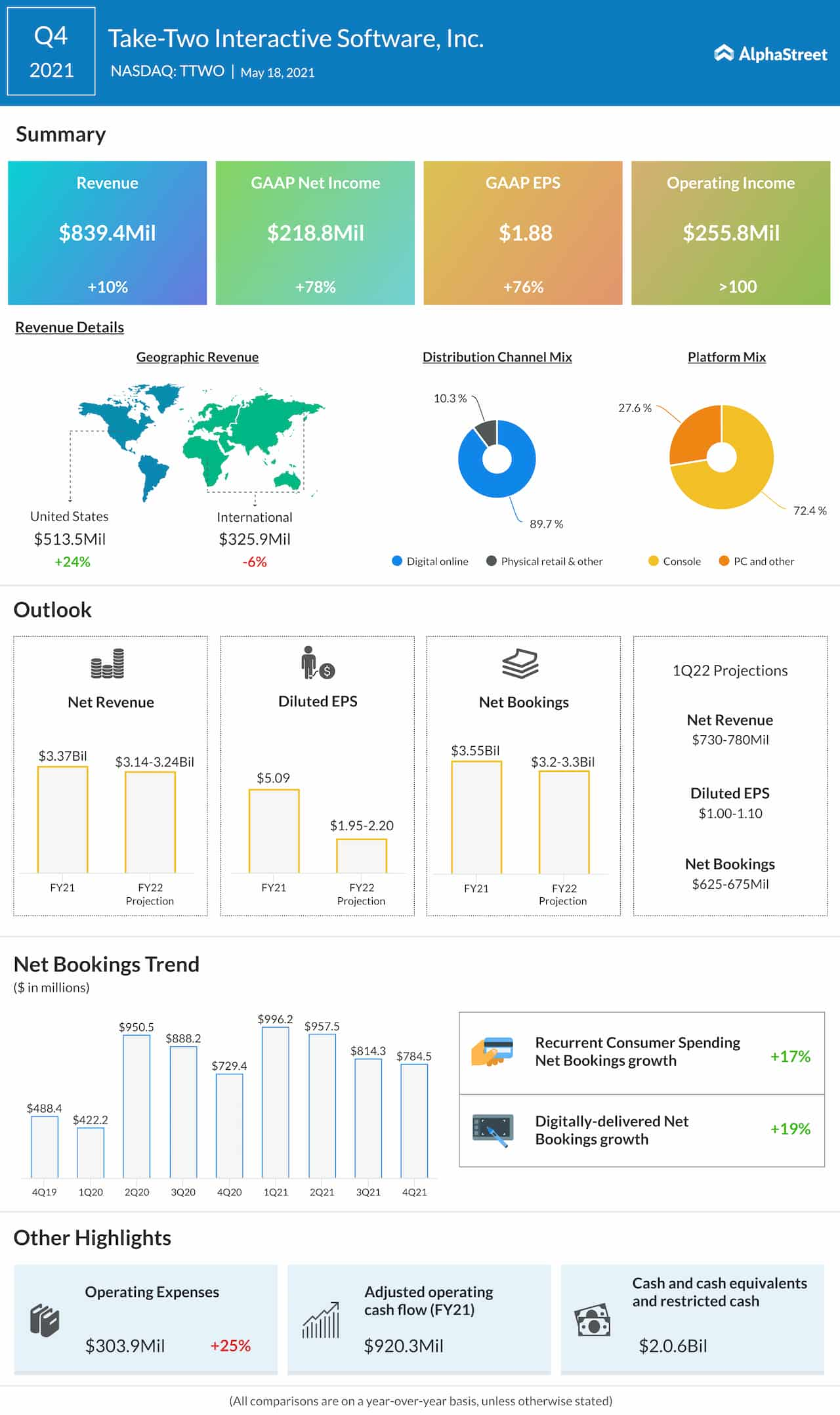

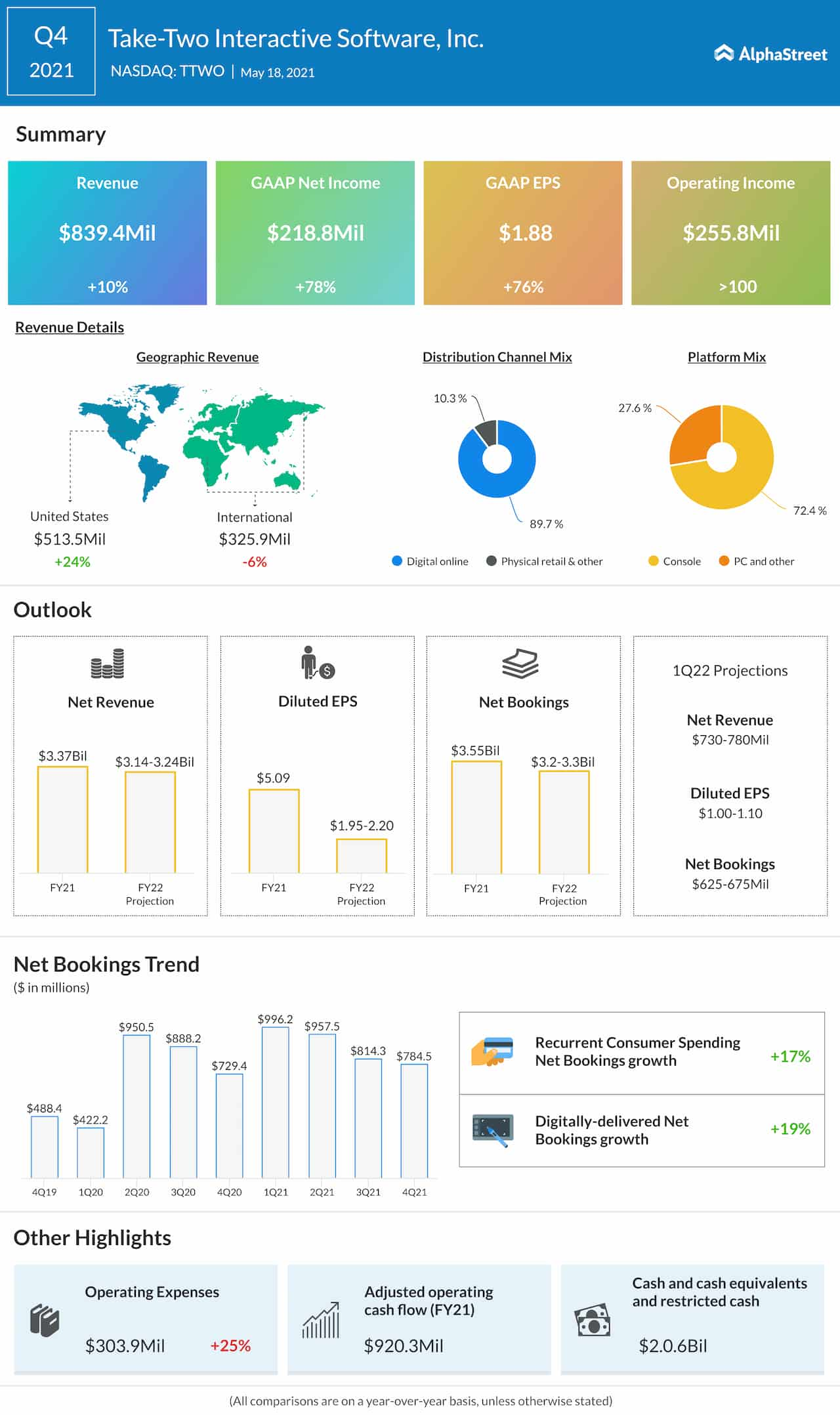

NBA 2K is seeing high levels of user engagement with over 2.3 million daily players. To-date, NBA 2K21 has sold-in over 10 million units. Red Dead Redemption 2 is also performing well and has sold-in over 37 million units worldwide to-date. These titles, along with others, helped drive a 9% year-over-year growth in revenues during FY2021.

New launches

Take-Two’s constant efforts to expand and improve its portfolio is another factor that will help drive user growth and engagement going forward. The company has a strong pipeline with several new releases lined up over the coming years.

This year, the company will roll out new updates for Red Dead Online and Grand Theft Auto Online and it has two sports releases, NBA 2K22 and WWE 2K22, lined up. For fiscal year 2022, Take-Two has 21 titles planned for release, which include four immersive core releases and 10 free mobile games.

The pipeline for FY2023 and FY2024 includes 19 immersive core releases, which include sports simulation games, five independent titles and 10 free mobile games, among others. These titles are expected to help drive engagement and recurrent consumer spending.

Acquisitions and market opportunity

On its fourth quarter earnings conference call, Take-Two said the pandemic gave the interactive entertainment sector a huge boost and that it expected its overall addressable market to significantly increase going forward even beyond pre-pandemic levels.

The company is also strengthening its foothold in the mobile gaming market through its various acquisitions which presents another major growth opportunity. Based on data from Statista, mobile game revenues in the US reached $10.7 billion in 2020 and it is on track to surpass the $100-billion mark by 2023.

Take-Two has already acquired companies like Socialpoint and Playdots over the past years and now it is adding Nordeus to its kitty for $378 million. Through this acquisition, Take-Two will add the leading mobile soccer management game Top Eleven, which has 240 million users, to its portfolio. These acquisitions are expected to help drive significant growth in this space for Take-Two.

Click here to read Take-Two’s Q4 2021 earnings call transcript