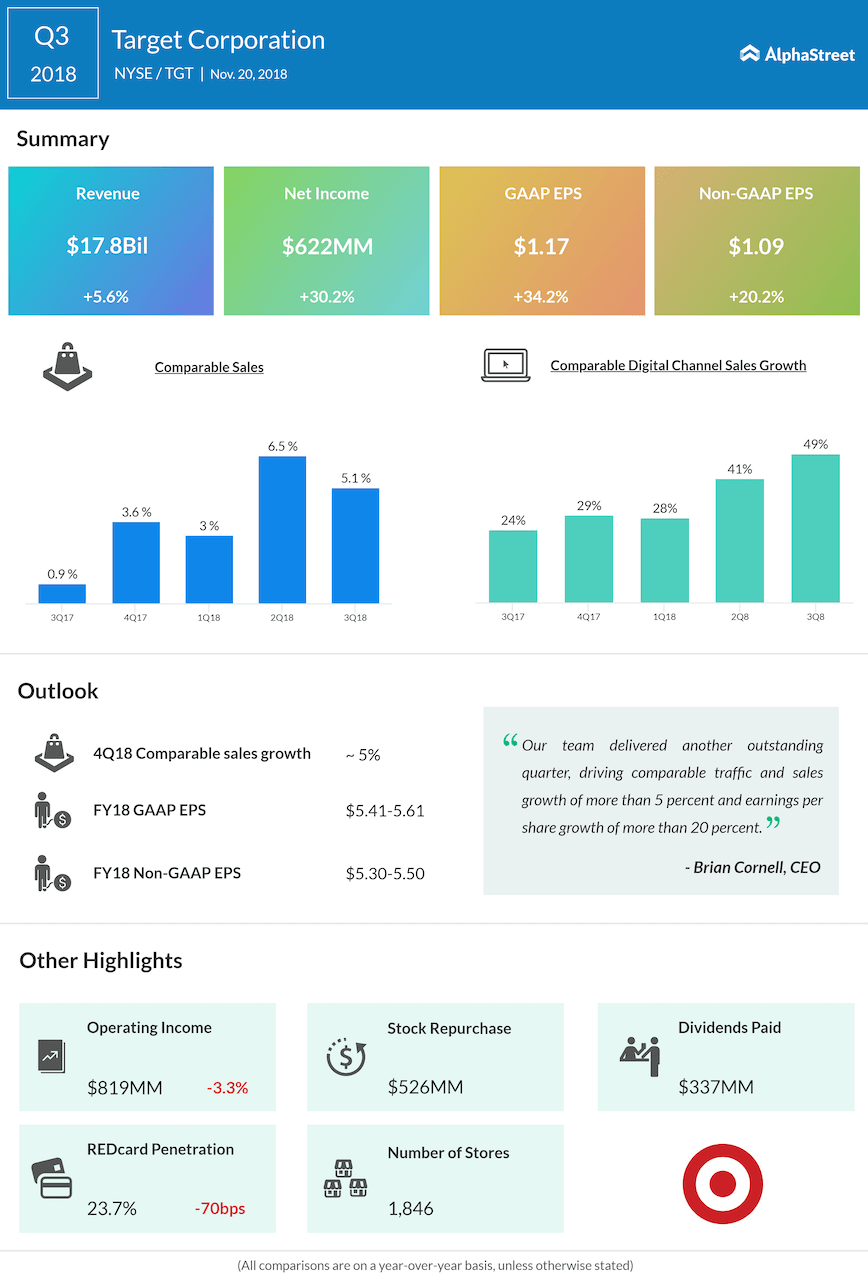

Target Corp (TGT) stock plunged 7% after missing earnings estimate in the third quarter. Net income rose 20% to $1.09 cents per share, lower than the average analysts’ estimate of $1.11 per share. Higher investments to improve supply chain efficiency hurt Target’s margins during the quarter.

On a GAAP basis, net income rose to $1.17 per share, compared to $0.87 per share during the same period last year.

The company reported 5.1% growth in comp sales driven by healthy increases in both store and digital channels. However, this came slightly below the Street consensus of 5.2%. Thanks to the increasing investments in the digital platform, comparable online sales jumped 49% in Q3.

Revenue of the department store chain rose 5.6% to $17.8 billion. Analysts had expected revenue of $17.75 billion during the quarter.

Target CEO Brian Cornell said, “We’ve made significant investments in our team heading into the holidays and they are ready to serve our guests with a comprehensive suite of convenient delivery and pickup options, a wide range of new products and unique gift ideas and a strong emphasis on low prices and great value.”

Why Target is a better investment than Walmart this holiday season

Despite the earnings miss, Target remains optimistic about the holiday quarter, when it anticipates comp sales growth of about 5%. The company also reiterated its guidance for full-year adjusted EPS between $5.30 and $5.50.

Target shares have increased 15% so far this year.

During the prior-sequential quarter (Q2), a 6.4% jump in store traffic had driven Target’s top line higher by 7%. Earnings grew 19% riding on the sales growth and lower income taxes. The results had also benefited from various merchandising strategies including cost-savings initiatives and efforts to improve pricing and promotions.