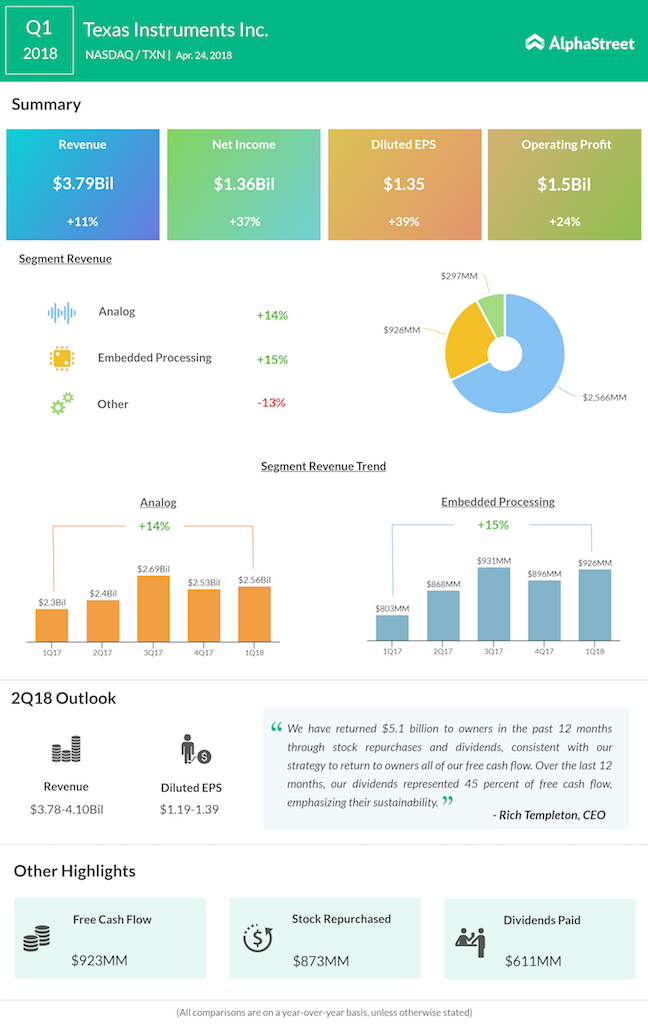

Semiconductor company Texas Instruments (TXN) reported top and bottom line results that topped consensus estimates for the first quarter of 2018, with revenue increasing 11.3% to $3.79 billion, aided by continued demand for the company’s Analog and Embedded Processing products in the industrial and automotive markets. Earnings spiked 37% to $1.36 billion with EPS jumping 39% to $1.35. The higher profit was aided by higher sales and operating income.

The company’s Analog business has been seeing growth throughout the year, displaying double-digit growth for the first quarter, while Embedded Processing business also showed significant improvement in sales, increasing 15% year-over-year. The growth of 14% in Analog is expected to bode well for the future given TXN’s ambitious product line and manufacturing efficiencies.

“We now expect our ongoing annual operating tax rate to be about 16 percent starting in 2019 and 20 percent in 2018, lower than our previous expectations of 18 percent and 23 percent, respectively,” said Rich Templeton, President and CEO.

Going forward, Texas Instruments is seeing second quarter 2018 revenue to be in the range of $3.78 billion to $4.10 billion, and earnings per share to be between $1.19 and $1.39, which includes an estimated $10 million discrete tax benefit.

Post the earnings release, the company’s stock jumped almost 5% in after-market trading.