Tiffany & Co. (TIF), a leading manufacturer and retailer of designer jewelry, is scheduled to report the fourth-quarter 2018 results Friday before the market opens. The progressive slowdown in comparable store sales is expected to continue this time too, impacting the bottom-line performance. Wall Street analysts predict a 3.6% decline in earnings to $1.61 per share, while revenues are forecast to remain broadly unchanged at $1.34 billion.

In the previous earnings report, the management had cautioned that high operating expenses might impact margins in the final months of fiscal 2018. It needs to be seen whether the positive earnings surprises of the previous quarters would be repeated this time.

It is expected that recent innovations in pricing and new jewelry designs, with an option for personalization, would increase store traffic, thereby helping the company achieve its goal of 6-7% sales growth in fiscal 2018. Meanwhile, the pressure on operating margin from higher selling, general & administrative expense needs to be tackled even as Tiffany continues to invest heavily in technology and visual merchandising.

Earlier, the management had cautioned that high operating expenses might impact margins in the final months of fiscal 2018

The management currently expects full-year earnings to come at the lower end of its $4.65-$4.80 per share guidance range, reflecting the squeeze on margins. Like most American retailers, Tiffany had a lackluster holiday season that affected store performance in the fourth quarter, which was partially offset by an improvement in online sales. Both net sales and comparable store sales took a beating in major markets, except in Japan and China.

Meanwhile, the long-term outlook on the company’s top-line performance remains upbeat as it stands to benefit from strategic investments in production and distribution. The ongoing efforts to expand the store network, with focus on new markets, and augment the distribution network will support growth in the coming quarters.

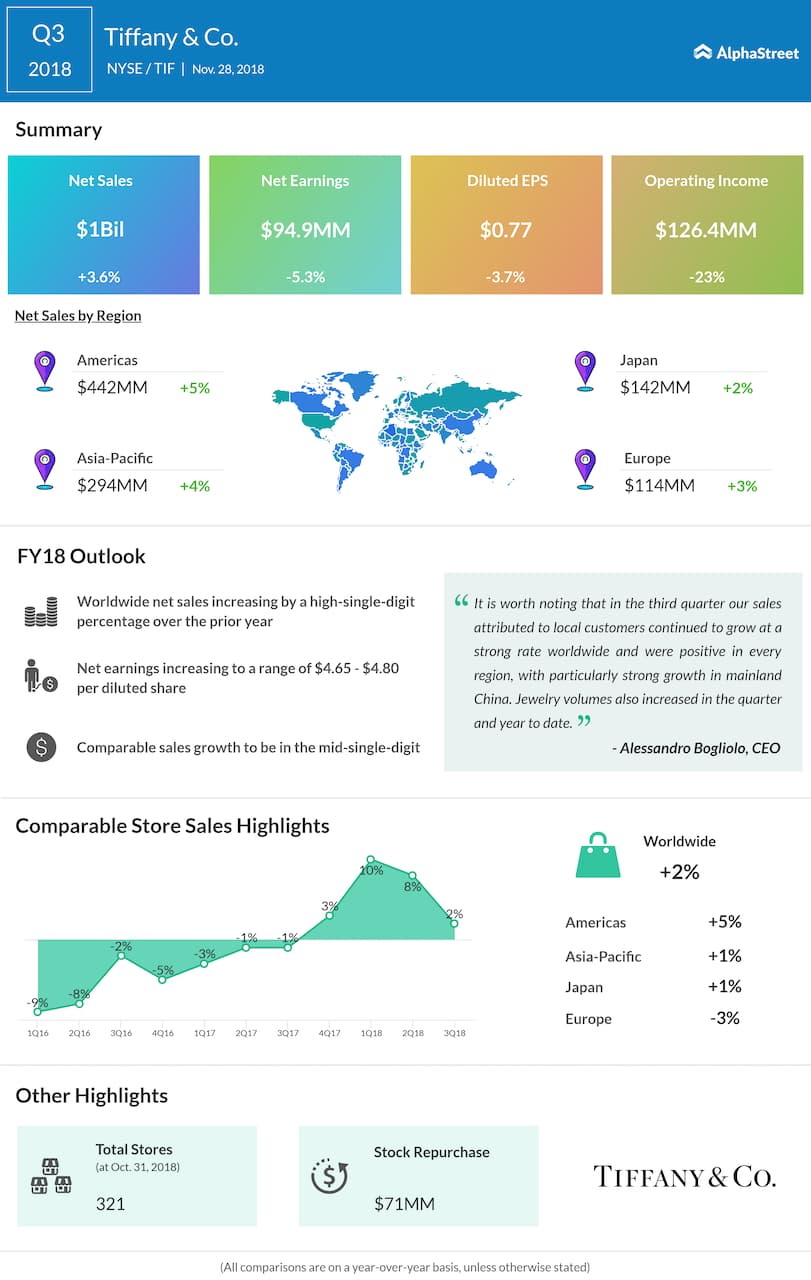

In the third quarter, worldwide sales grew 4% to $1.01 billion but missed analysts’ forecast, as comparable store sales growth eased to 2%. Earnings dropped 3.7% annually to $0.77 per share but came in slightly above the estimates.

Recovering steadily from the recent lows, Tiffany shares gained about 19% so far this year, outperforming the S&P 500 index. However, the stock trades about 1.5% lower compared to the levels seen a year earlier.