Wall Street’s favorite topic of discussion died down on August 2, when a few minutes ahead of noon, Apple (AAPL) breached the trillion-dollar mark. In fact, it could be said that the iPhone-maker managed to scrape past rival Amazon (AMZN) to the finish line, as the latter touched the mark only a month later. Notably, Apple has been trading since 1980, while Amazon became public 17 years later.

With the first two spots taken, market pundits now mull over who has the fuel to grab the bronze. There are two ideal candidates – Alphabet (GOOGL) and Microsoft (MSFT) –, and most analysts feel both have pretty good chances. However, analysts are of split opinion when it comes to predicting which tech giant will outstrip the other.

Arguably, Microsoft may have a slight edge. The company, which dodged past Alphabet in market cap earlier in May, has so far managed to keep a consistent lead. Over the past two years, CEO Satya Nadella has managed to keep the company on a growth trajectory by focusing on core businesses, following years of stagnation and a slew of flopped products under the reins of Steve Ballmer.

Market observers are particularly bullish about the prospects of Azure, the second largest cloud infrastructure service after Amazon Web Service concerning market share. With around 18% global market share and consistent growth in the 90% range, Azure could highly benefit from Microsoft’s traditional business model of subscription-based software licensing.

With sufficient support from growth in other units including data centers and Office 365, analysts feel there is enough momentum to lift the company to the 13-digit market cap. Morgan Stanley had in May predicted that it expects the company to hit $1 trillion market cap in 2019.

Roundup: How the cloud industry took shape in the second quarter

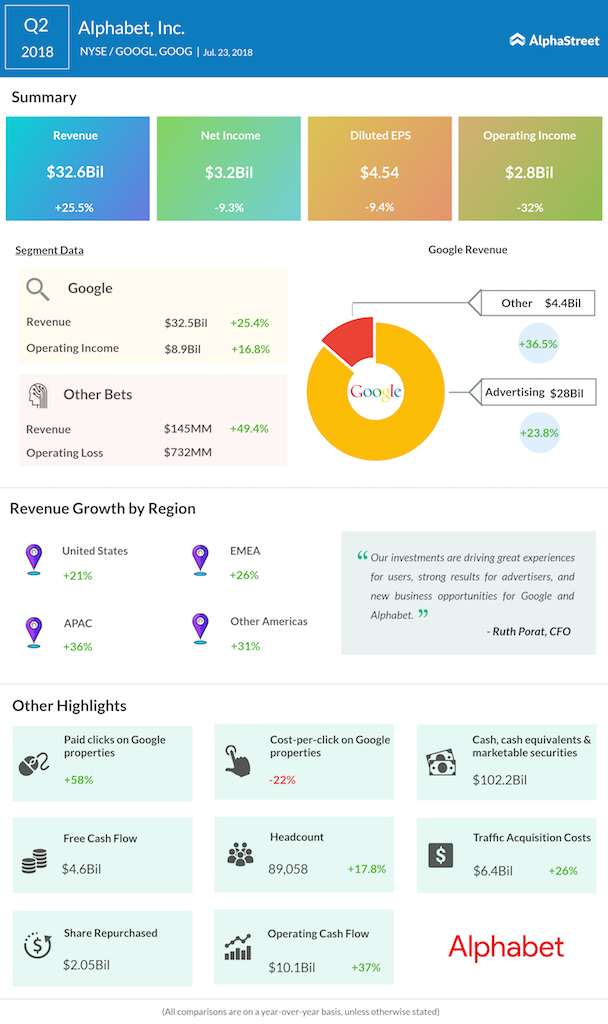

On the other hand, the Google-parent has recently been riding on ad-revenue growth, which accounts for more than 80% of its top line. During the recent second-quarter results, a 23.8% increase in advertising revenue had pushed total revenue up 26%, above street expectations.

Meanwhile, allegations of monopoly within and outside the US are likely to hinder a seamless growth of the stock.

A stock upgrade and a couple of solid results are all that requires for both the companies to reach the coveted figure. The trillion-dollar story doesn’t end in 2018.

Related IGs: