It seems there is no let-up for the US travel industry from the geopolitical headwinds it’s been facing for some time; and the unimpressive operating performance by the leading players is reflective of the bleak scenario. Latest data from TripAdvisor, Inc. showed the travel giant’s pre-tax income slipped in the fourth quarter, both sequentially and on an annual basis.

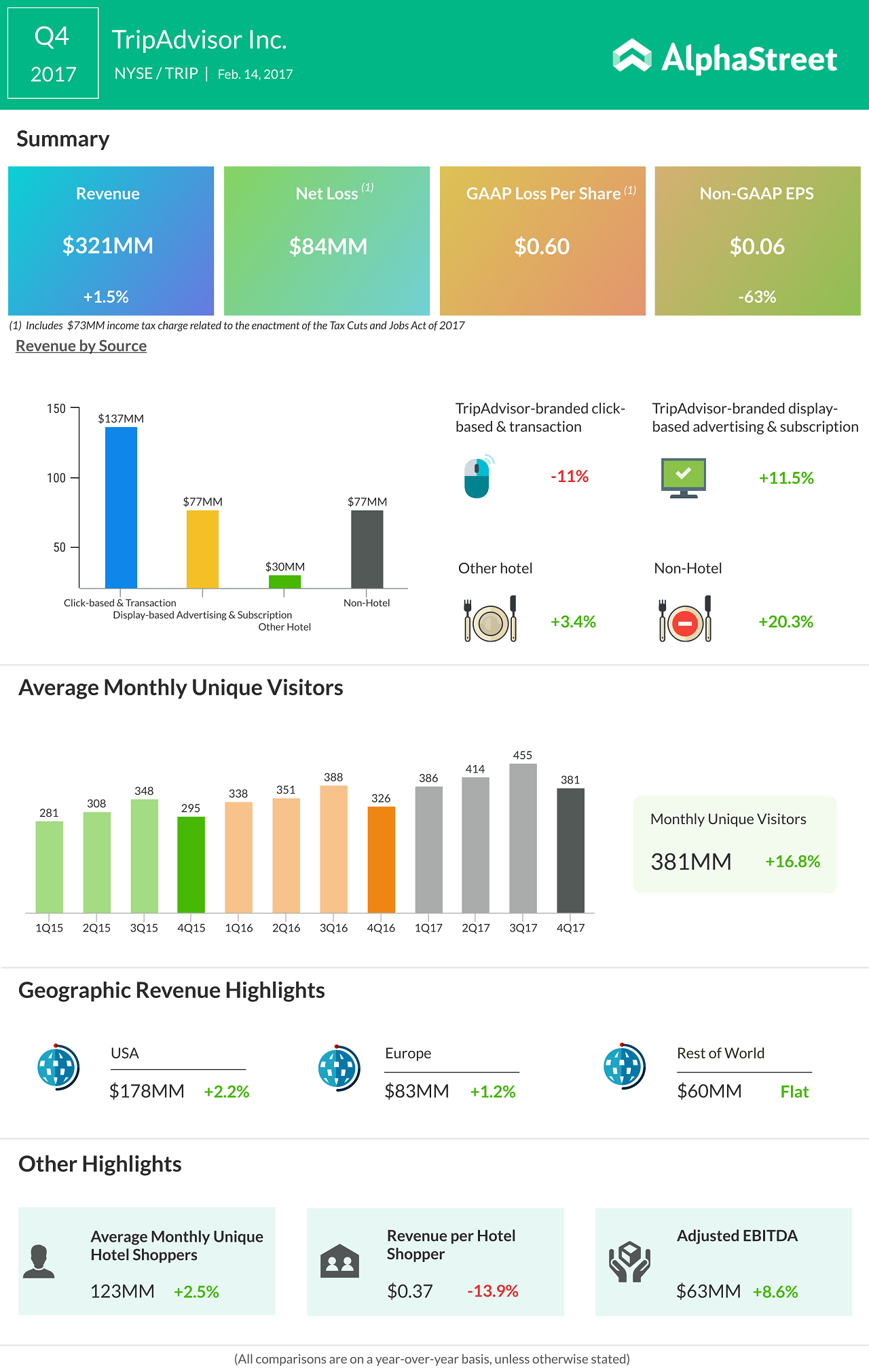

Earnings before tax declined and nearly flattened to $0.06 per share from $0.16 per share last year, while revenues gained 2% to reach $321 million. The bottom-line suffered a further blow from charges related to the recent income tax reform – mainly linked to repatriation of cash from international operations – dragging the company into a loss of $0.60 per share in the final three months of 2017. This compares to a $0.18 per share profit in the fourth quarter of 2016.

The bottom-line suffered a further blow from charges related to the recent income tax reform.

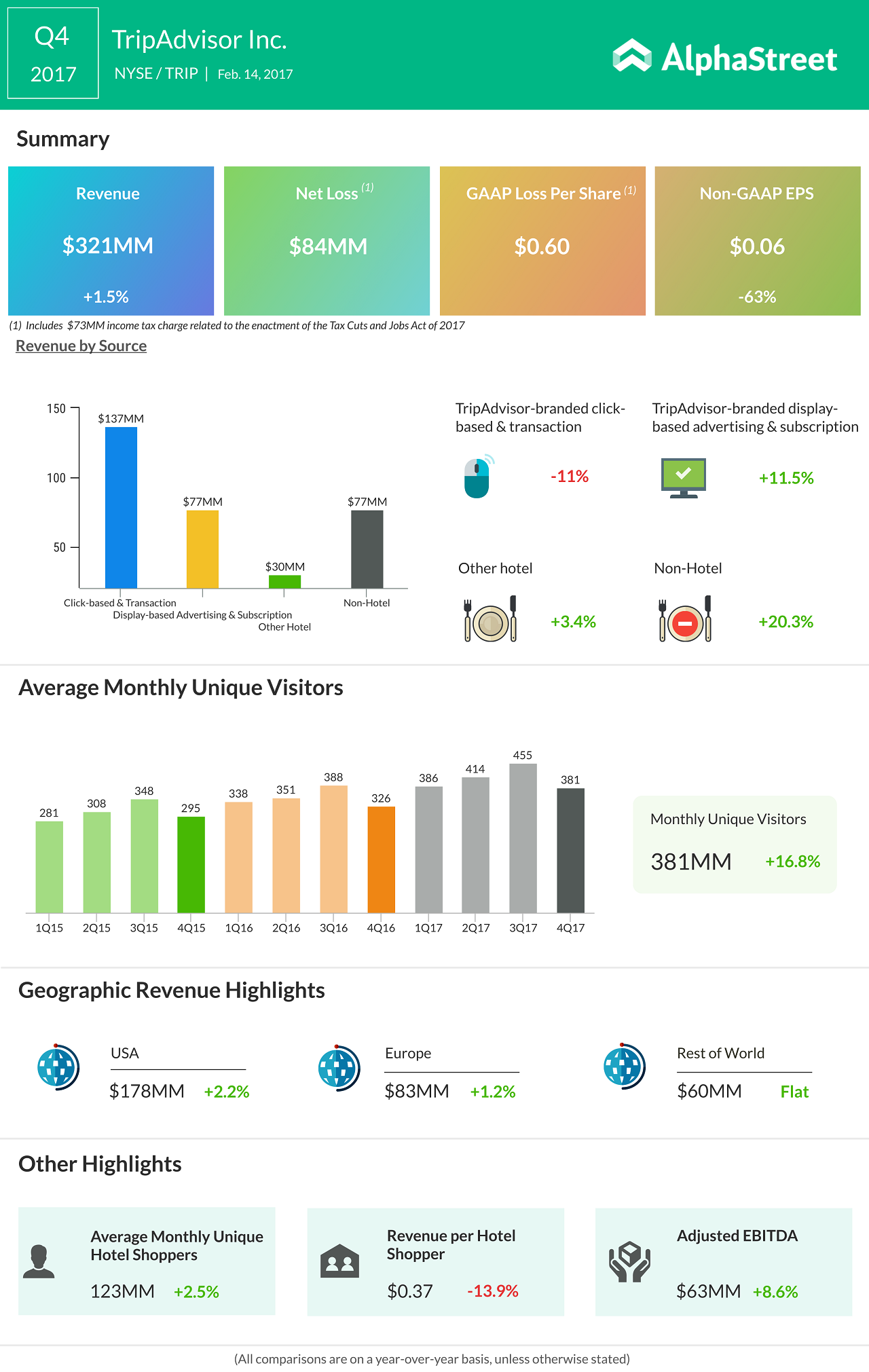

The result came in way below analysts’ expectations. Meanwhile, in what could be seen as a sign of recovery, TripAdvisor came out with some encouraging predictions, forecasting a stable topline as well as initiatives to reduce cost in the coming quarters. The market was quick to respond, and the stock gained about 20% on Wednesday after the news came out. The unexpected uptick in revenue also contributed to the stock rally. Interestingly, most of the revenue growth came from the company’s non-hotel business, rather than its core operations.

A confident Steve Kaufer, the CEO of TripAdvisor, commented, “We will find new ways to help travel partners get more visibility in front of our massive global travel audience. We are taking essential steps to unlock long-term growth.”

In what could be seen as a sign of recovery, TripAdvisor came out with some encouraging predictions, forecasting a stable topline as well as initiatives to reduce cost in the coming quarters.

The latest financial results published by Expedia, Inc. also indicate the travel industry is under severe stress. Expedia’s earnings plunged nearly 40% in the fourth quarter, both excluding tax-related charges and after including them. The worse-than-expected results triggered a sell-off and the stock lost significantly, reversing much of the recent gains.

Market watchers are expecting a similar outcome when online tour company The Priceline Group reports its most recent financial numbers later this month.