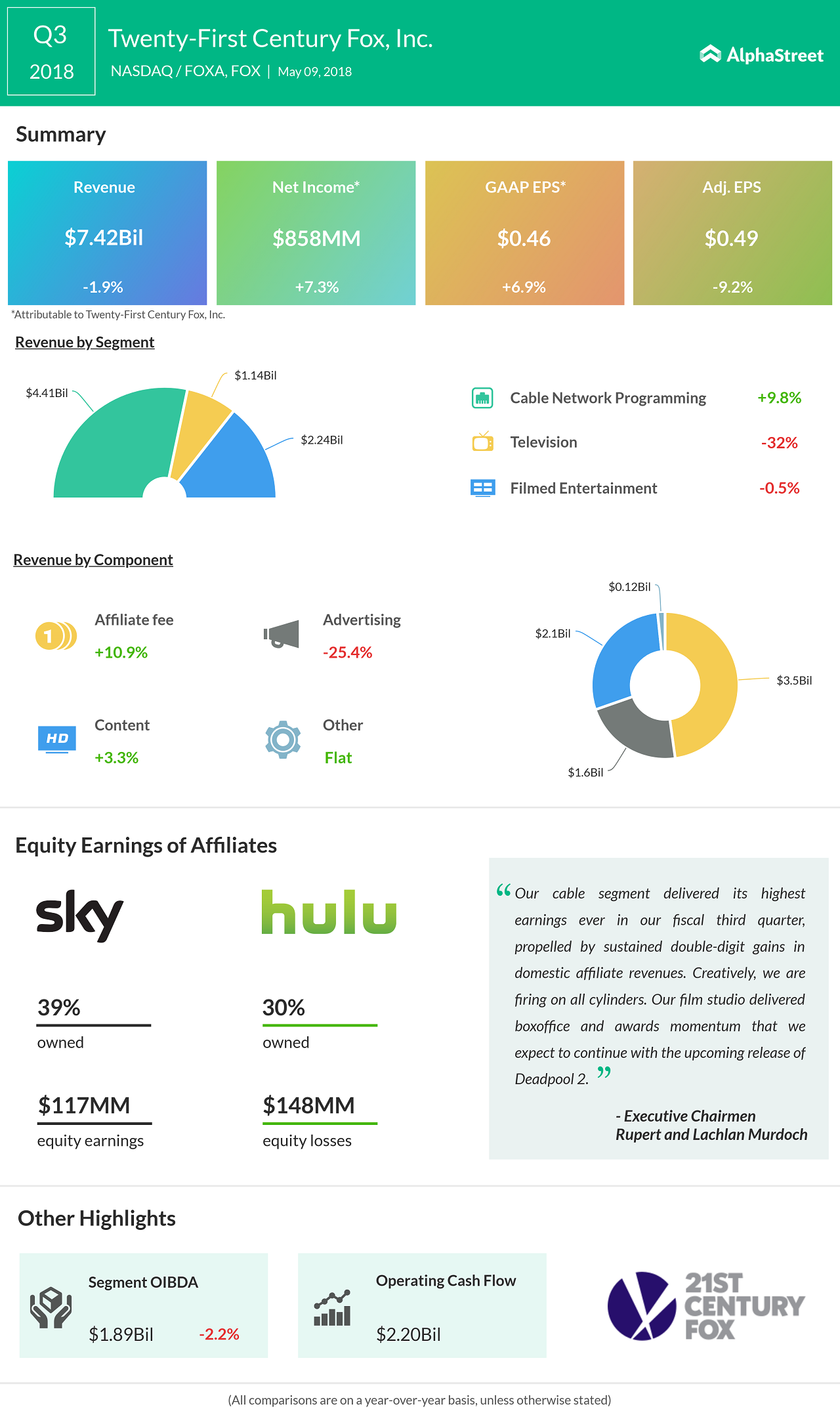

Twenty-First Century Fox (FOXA) reported a 7.4% rise in earnings for the third quarter, helped by sustained double-digit gains in domestic affiliate revenues. Lower operating expenses too boosted the company’s bottom line, despite lower revenue. Adjusted earnings and revenue missed Street’s expectations.

Despite revenue declining 2% to $7.42 billion, the company’s earnings increased 7.4% to $858 million or $0.46 per share. Higher contributions from the Cable Network Programming segment more than offset lower contributions from Television and Filmed Entertainment segments as well as the higher compensation expense related to the Walt Disney (DIS) and New Fox transactions.

However, adjusted EPS decreased 9.3% to $0.49, hurt by about $60 million charges from higher compensation expenses.

Revenues were hurt by the absence of advertising revenues generated by Super Bowl LI in the prior-year at the Television segment, which was partially offset by higher affiliate, syndication and advertising revenues at the Cable Network Programming segment.

Domestic affiliate revenue grew 10% on contractual rate increases across all of its domestic brands and 3% improvement in domestic advertising due to higher pricing at Fox News.

At Television, results reflect revenue declines from lower National Football League (NFL) postseason ratings and three fewer NFL broadcasts in the current quarter. Filmed Entertainment was hurt by higher deficits related to more new drama series delivered during the quarter and absence of revenue from the prior-year subscription-video-on-demand licensing of “The People v. O.J. Simpson: American Crime Story”.

“We continue to make operational and financial progress against near-term objectives as we also work to close our strategic transactions. Our film studio delivered box-office and awards momentum that we expect to continue with the upcoming release of Deadpool 2,” Executive Chairmen Rupert and Lachlan Murdoch said.

In December, the board of Fox approved Disney’s (DIS) stock bid to buy Fox assets including television and film studios, cable channels including FX and National Geographic, and 22 regional sports networks. In addition, Comcast (CMCSA) is likely to make a counteroffer for these same assets if the AT&T (T) and Time Warner (TWX) acquisition clear regulatory approvals.

Shares of the company’s Class A ended Wednesday’s regular trading session down 0.76% at $37.70 on the Nasdaq global market. The stock had been trading between $24.81 and $39.35 for the past 52 weeks.