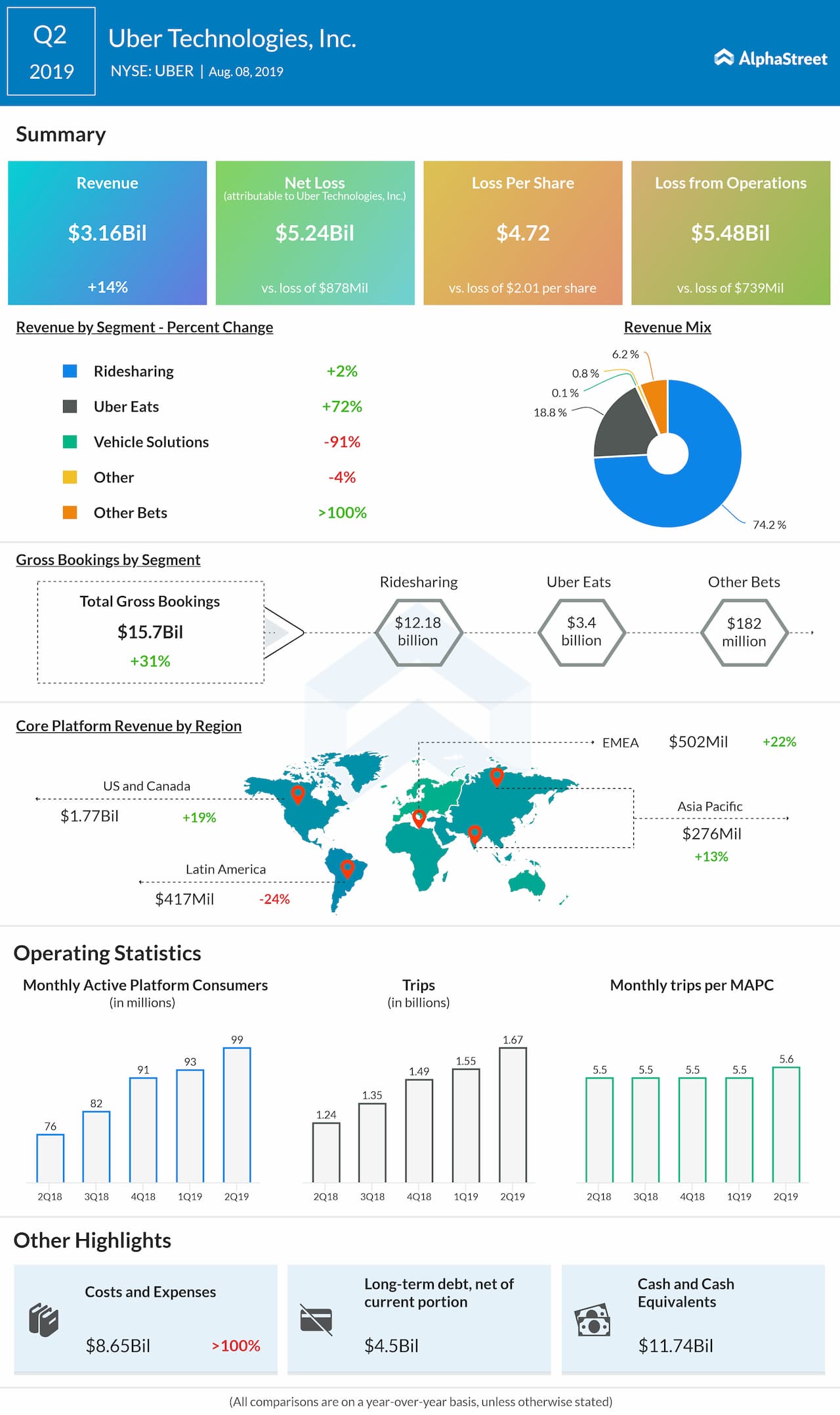

Gross bookings surged 31% to $15.76 billion in the second quarter, while Core Platform gross bookings soared 30% to $15.57 billion. Monthly active platform consumers (MAPCs) increased 30% to 99 million, while trips in the quarter jumped 36% to 1.68 billion.

Total costs and expenses in 2Q increased to $8.65 billion from $3.51 billion in the prior-year quarter. As expected, the excess driver incentives increased year-over-year in the second quarter. The company had spent $263 million for excess driver incentives versus $163 million in the second quarter of 2018.

“Our platform strategy continues to deliver strong results, with Trips up 35% and Gross Bookings up 37% in constant currency, compared to the second quarter of last year,” said CEO Dara Khosrowshahi.

“In July, the Uber platform reached over 100 million Monthly Active Platform Consumers for the first time, as we become a more and more integral part of everyday life in cities around the world,” he added.

Since becoming a public company in May, Uber had closed above its IPO price of $45 in just two trading days. Shares of Uber ended up 8.24% at $42.97 today as the company got a lift from the stronger-than-expected Q2 results announced by its rival Lyft yesterday evening.