Information technology firm Infosys Limited (NYSE: INFY) is slated to report second-quarter 2020 earnings results on Friday, October 11, before the opening bell. Despite the concerns relating to the slowing economy in different parts of the world, Wall Street expects the company to report a 9% jump in revenues to $3.19 billion during the quarter.

The Bengaluru-headquartered firm is projected to report second-quarter earnings of $0.14 per share, a cent higher than what it reported last year.

Analysts have hit bulls-eye in predicting the bottom-line results of Infosys in three of the past four quarters. In just one quarter, Infosys missed the average market estimate by a cent.

Stagnation in economic growth in China and Europe, as well as the lack of clarity relating to Brexit are expected to dent the second-quarter results. In fact, Infosys recently acquired Irish contact center Eishtec for an undisclosed amount, in a move that could be seen as setting up of an operating hub outside UK.

Infosys had also earlier this year bought a 75% stake in ABN AMRO unit Stater to add fillip to its US mortgage business.

READ: NYU professor who predicted Amazon-Whole Foods deal forecasts death of Tesla, 4 others

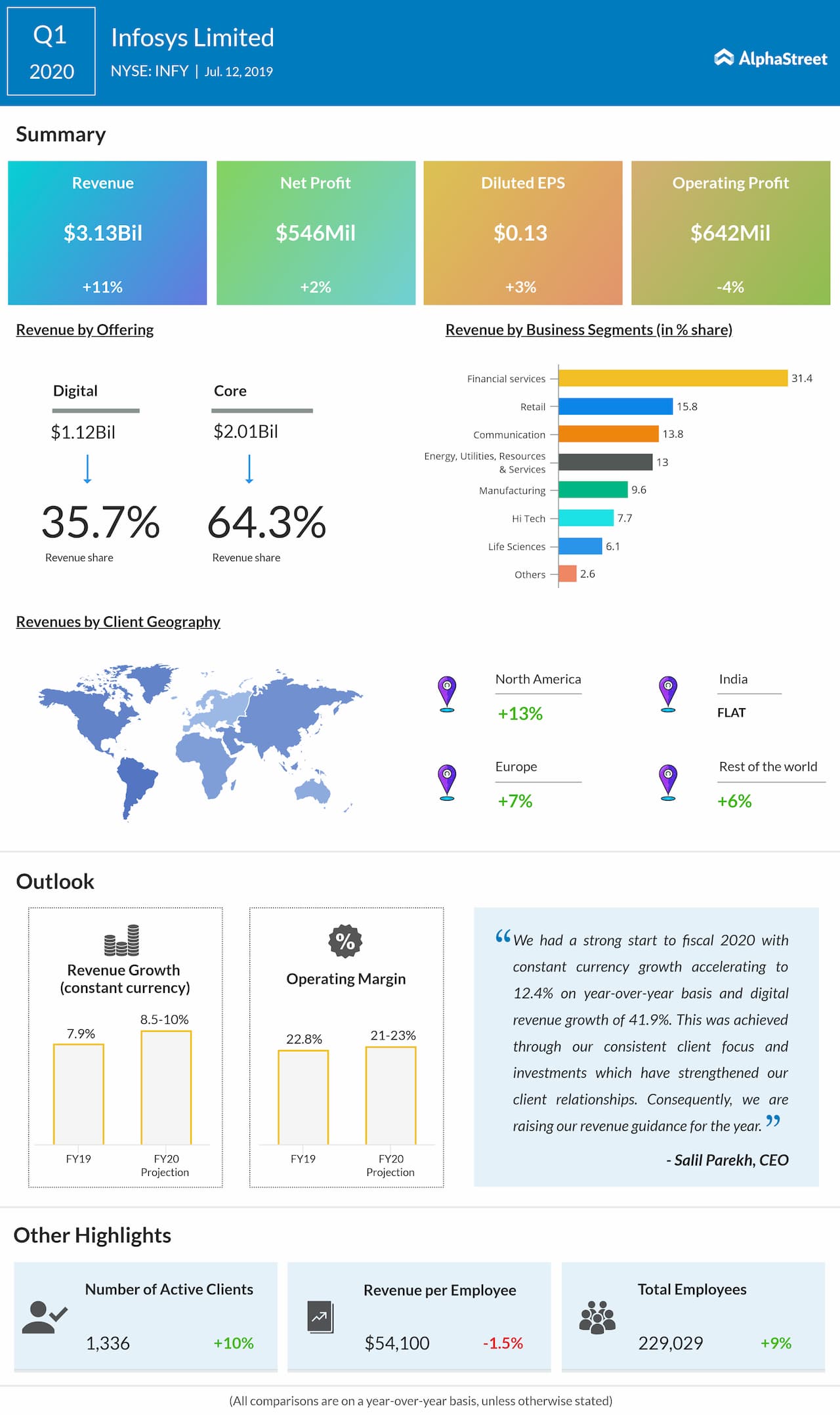

During the first quarter of 2020, Infosys reported a 2% increase in earnings helped by higher revenues as well as lower income tax expenses. The company also lifted revenue growth outlook for fiscal 2020 that is above the Street view.

Segment growth was robust with all large regions and most verticals growing at double digits year-over-year in constant currency.

INFY stock has gained 18% in the year-to-date period. The stock has a 12-month average price target of $12.75, which is at a 14% upside from Wednesday’s trading price.

Listen to on-demand

earnings calls and hear how management responds to analysts’ questions