Market Position

Financial Results

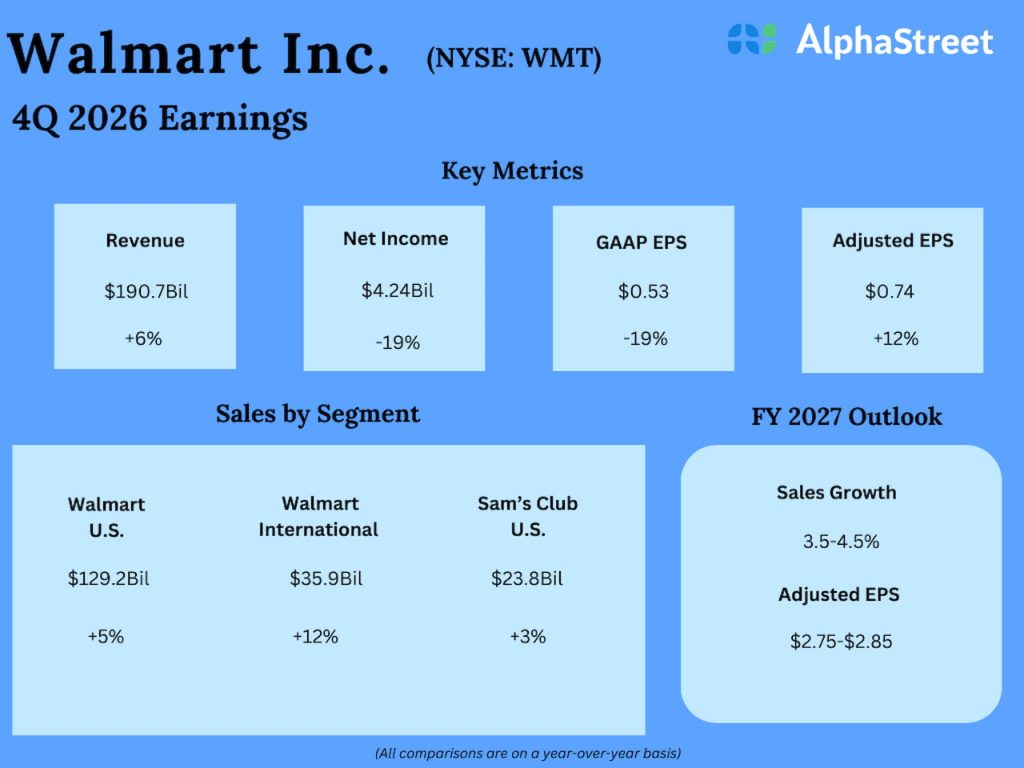

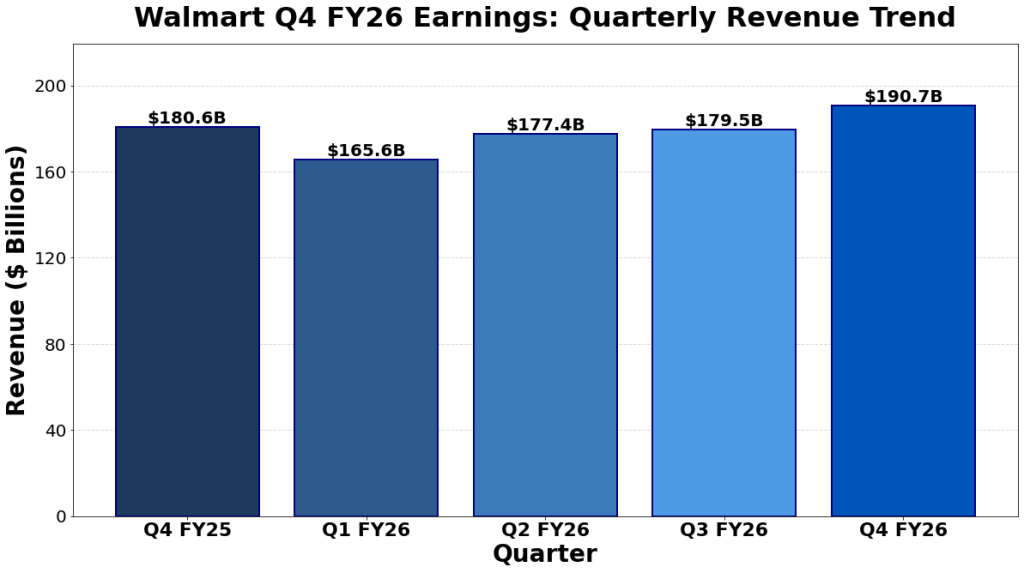

Q4 FY26 delivered robust performance. Revenue reached $190.7 billion, up 5.6%. Also, this outpaced the prior year. Operating income grew faster at 10.8%. So, gross margin expanded 13 basis points. The company achieved better expense leverage. In fact, adjusted operating income grew 10.5% in constant currency.

Full Year FY26 Results

Walmart’s full-year fiscal 2026 results show momentum. Net sales reached $713.2 billion, up 4.7%. Also, operating income grew 1.6% on a reported basis. Adjusted basis showed 5.4% growth in constant currency. Plus, operating cash flow jumped $5.1 billion to $41.6 billion. Free cash flow increased $2.3 billion to $14.9 billion.

Walmart Q4 FY26 earnings show increasing quarterly revenue momentum from Q4 FY25 through Q4 FY26.

eCommerce Growth

eCommerce growth continues to accelerate. Global eCommerce sales surged 24%. So, this represented 23% of total net sales. Store-fulfilled pickup and delivery channels grew over 50%. Also, marketplace sales expanded across all regions. Membership revenue grew 15.1% globally. Plus, advertising sales jumped 37%. Walmart Connect in the U.S. rose 41%.

Segment Performance in Q4 FY26

Walmart U.S. net sales grew 4.6% to $129.2 billion. Comp sales (excluding fuel) rose 4.6%. Also, eCommerce contribution to comp sales reached 520 basis points. Operating income increased 6.6% to $7.0 billion. Meanwhile, Walmart International net sales reached $35.9 billion, up 11.5%. Operating income jumped 36.0% to $1.9 billion. Plus, Sam’s Club U.S. net sales grew 2.9% to $23.8 billion. Operating income rose 3.8% to $596 million.

Forward Guidance

Management provided detailed guidance for FY27. Net sales are expected to grow 3.5%-4.5% in constant currency. Also, adjusted operating income will grow 6.0%-8.0% in constant currency. Interest expense will increase approximately $200 million-$300 million. So, the effective tax rate is expected to be 23.5%-24.5%. Capital expenditures will be approximately 3.5% of net sales. Plus, channel expansion continues to support long-term growth.

Key Takeaways from Walmart Q4 FY26 Earnings

Walmart continues to execute well in a competitive environment. Also, the company is leveraging omnichannel capabilities effectively. eCommerce remains a key growth driver at 24% growth. Plus, membership revenue and advertising sales demonstrate diversification. In fact, margin expansion reflects operational leverage. So, management shows confidence in continued growth. Overall, FY27 guidance reflects healthy market positioning.