Walt Disney (NYSE: DIS) topped

revenue and earnings expectations for the first quarter of 2020, allowing the

stock to gain 1.5% in aftermarket hours on Tuesday.

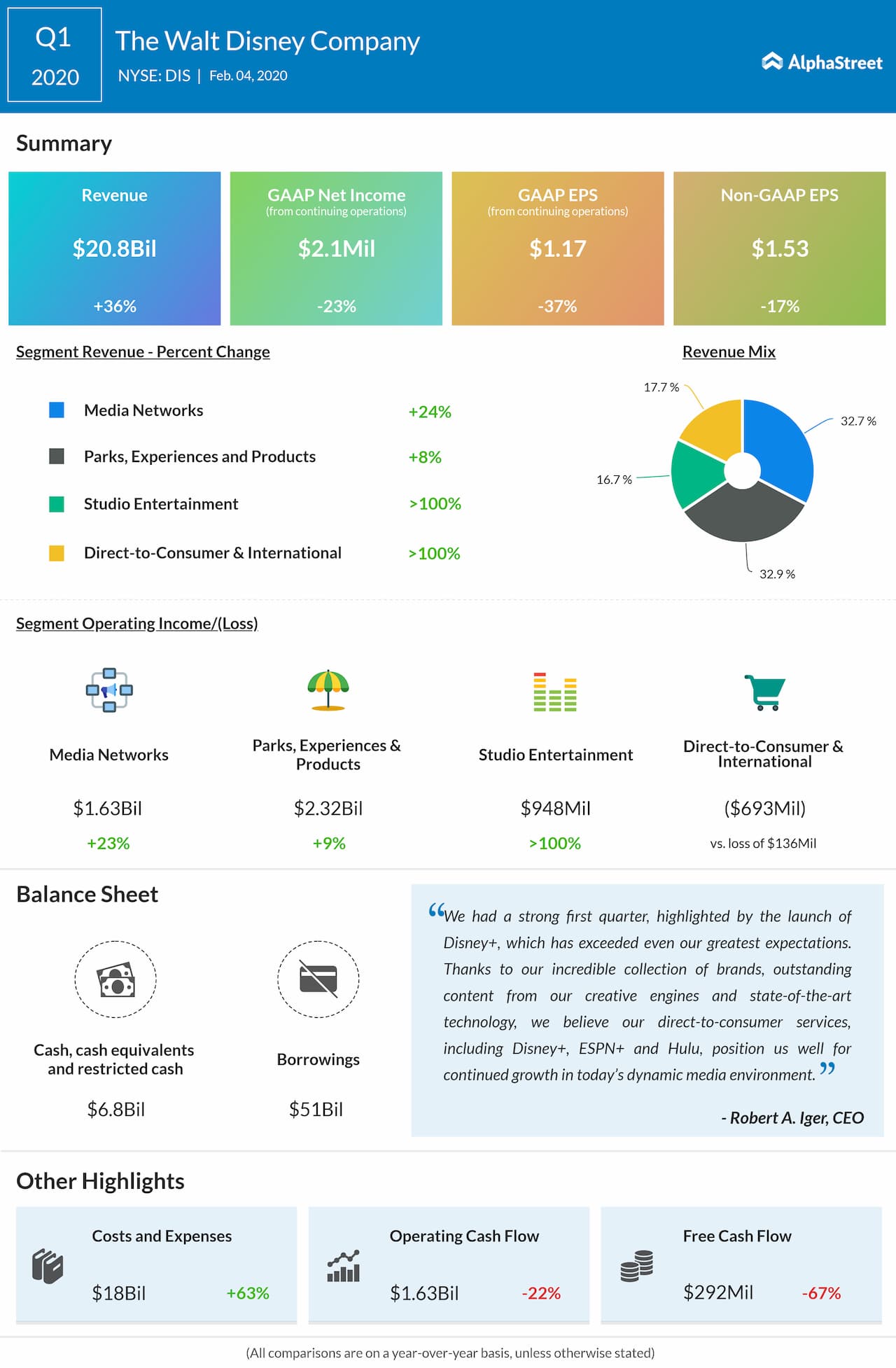

Total revenues increased 36% year-over-year to $20.8 billion,

beating estimates of $20.7 billion.

GAAP net income attributable to Disney fell 22% to $2.1 billion while EPS dropped 37% to $1.16. Adjusted EPS declined 17% to $1.53 but surpassed forecasts of $1.46.

In the Media Networks

segment, revenues rose 24% to $7.4 billion. Cable Networks revenues increased

20%. ESPN saw declines due to an increase in programming and production costs

as well as lower advertising revenue. Broadcasting revenues grew 34% to $2.6

billion.

Revenue in Parks, Experiences and Products rose 8% to $7.4

billion. Higher sales of Frozen, Star Wars and Toy Story merchandise helped

drive an increase in merchandise licensing results. Studio Entertainment

revenues totaled $3.8 billion in the quarter. Direct-to-Consumer &

International revenues rose from $0.9 billion to $4 billion.

As of quarter-end, Disney + had 26.5 million paid subscribers while ESPN+ had 6.6 million subscribers. Total Hulu subscribers amounted to 30.4 million, reflecting a 33% increase year-over-year.

In November, Disney began offering a bundled subscription package of Disney+, ESPN+ and Hulu. The bundled offering has a lower average retail price per service compared to the prices of each service on a standalone basis. The average monthly revenue per paid subscriber for ESPN+ decreased from $4.67 to $4.44 due to a shift in the mix of subscribers to the company’s bundled offering.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions