The Walt Disney Company’s (NYSE: DIS) stock rallied after it released fourth-quarter results last week, reporting stronger-than-expected earnings. The momentum is likely to continue in the new fiscal year, and it is estimated that the stock might go beyond the $ 100 mark in the next twelve months.

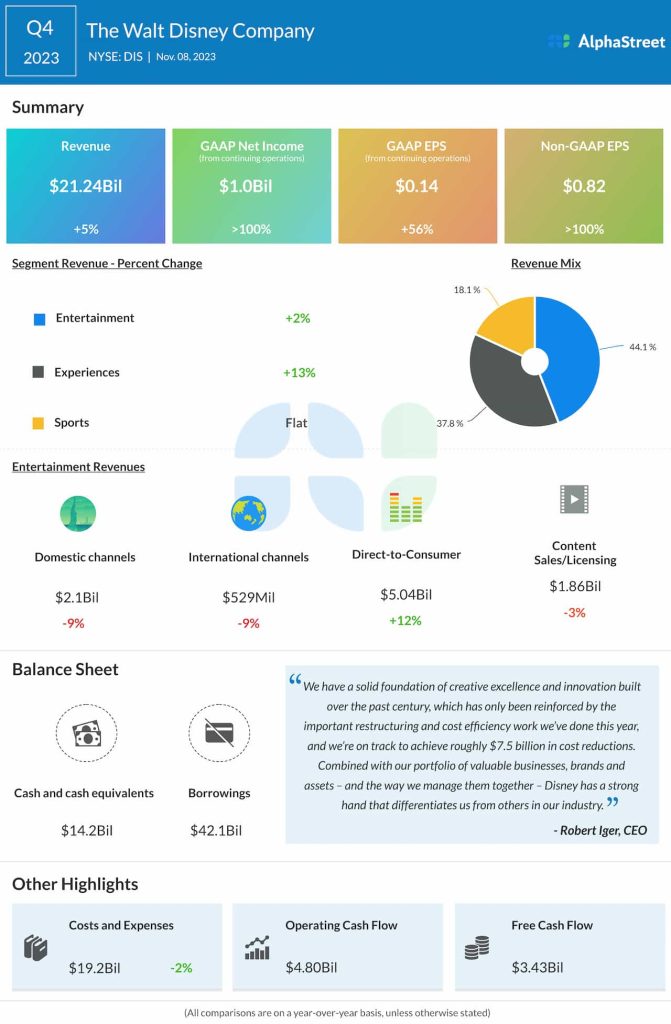

The Burbank-headquartered entertainment behemoth did a broad restructuring this year, with focus on achieving cost efficiency and profitable growth. Reflecting the aggressive cost-cutting efforts, operating expenses declined in the September quarter, adding to margin growth. The cost-reduction target has been raised by $2 billion. The company ended the quarter with $4.80 billion operating cash flow and $3.43 billion free cash flow.

Restructuring

As part of the reorganization, Walt Disney named PepsiCo veteran Hugh Johnston as the senior executive vice president and chief financial officer. The appointment comes a year after CEO Bob Iger returned to the company to take the helm after retiring in late 2021. The latest initiatives are significant because the management is working to return to the high-growth path and restore Wall Street’s confidence after the company suffered a slowdown during the tenure of Iger’s predecessor Bob Chapek.

Iger said at the earnings call, “The thorough restructuring of our company has enabled tremendous efficiencies, and we’re on track to achieve roughly $7.5 billion in cost reductions, which is approximately $2 billion more than we targeted earlier this year. Our new structure also enabled us to greatly enhance their effectiveness, particularly in streaming, where we’ve created a more unified, cohesive, and highly coordinated approach to marketing, pricing, and programming.”

Opportunities

According to the company’s leadership, the main building opportunities for its success are ‘achieving significant and sustained profitability in the streaming business; building ESPN into the preeminent digital sports platform; improving the output and economics of film studios; and turbocharging growth in the parks and experiences business.‘

The management bets on the strength of Disney+ streaming content and continued subscriber growth, despite the recent price hike, to drive growth. The streaming business looks poised to get a boost and turn profitable once the company completes the purchase of the remaining stake in Hulu. Also, plans are afoot to release a combined app for all three streaming channels in the coming weeks.

Earnings Beat

Fourth-quarter earnings, on an adjusted basis, more than doubled to $0.82 per share from $0.30 per share a year earlier. On a reported basis, earnings from continuing operations were $0.14 per share, compared to $0.09 per share in the prior year period. Revenues increased 5% annually to $21.24 billion in the September quarter. Profit beat analysts’ estimates of $0.71 per share on revenues of $21.37 billion. The bottom line had topped expectations in Q3 also, after missing in the previous period.

Under the Entertainment segment, which accounts for more than 40% of total revenues, direct-to-consumer revenues increased in double-digits, offsetting weakness in the other divisions. The company added 7 million new Disney+ subscribers sequentially, raising the total number of users to 150.2 million.

After the post-earnings gains, DIS moved closer to the 52-week average but lost some momentum in the following sessions. The stock traded slightly higher in the early hours of Monday.