Senior executives of Walt Disney Company (NYSE: DIS) held a conference call Tuesday after the entertainment giant reported mixed results for the third quarter. The event was attended by chairman and CEO Robert Iger and CFO Christine McCarthy, among others.

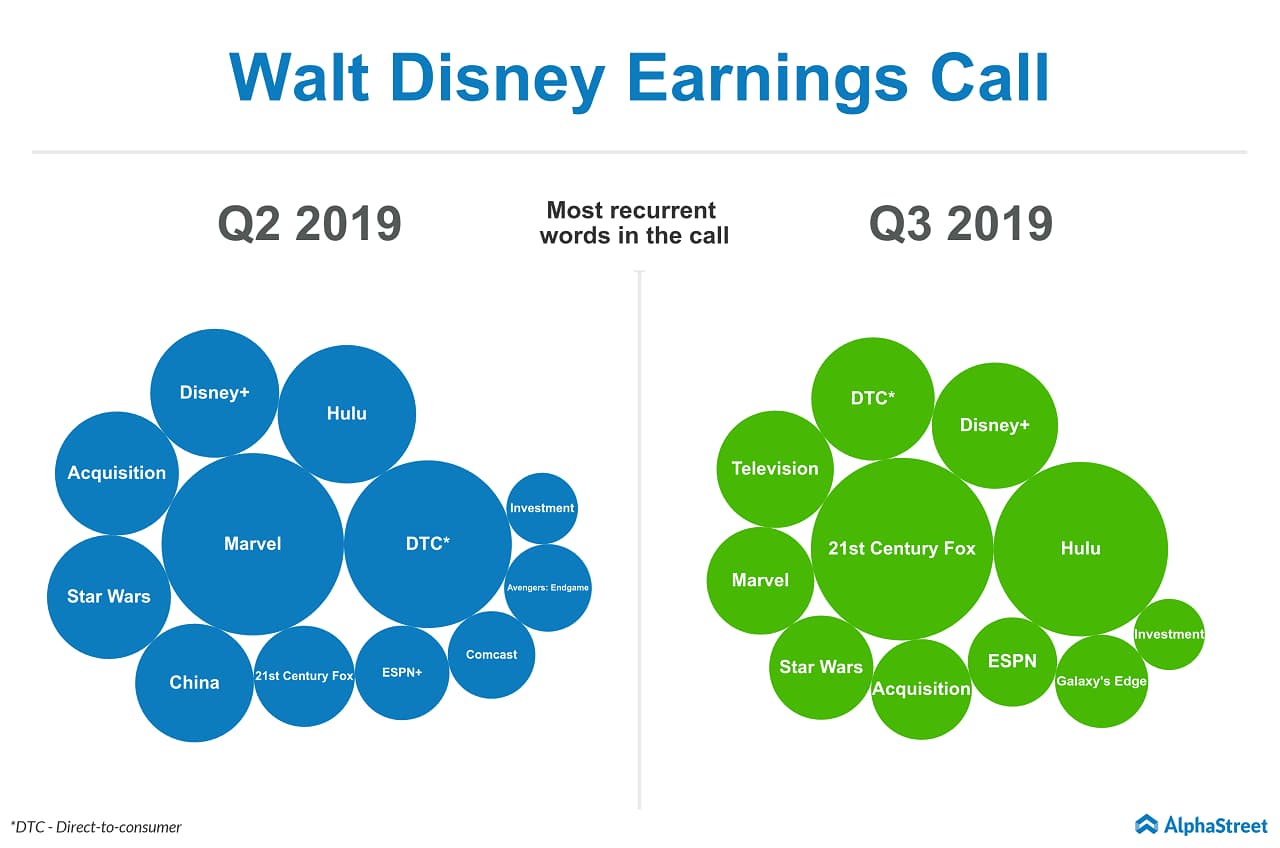

This was the first full-quarter conference call after the acquisition of 21st Century Fox, which was completed in the second quarter. In the last call, the management’s references to Fox centered on the impact of the mega deal on the company’s finances. This time the focus shifted to the integration of the newly acquired assets, which is currently progressing.

Fox Integration

The Fox deal, which had a more dilutive effect on earnings in the latest quarter than estimated, is expected to have a negative impact on the fourth-quarter results also. With more capital being pumped into the direct-to-consumer business, the ongoing expansion initiatives could weigh on bottom-line performance beyond the current fiscal year.

Though the heavy investments in new streaming service Disney Plus can put pressure on cash flow in the near term, they will start yielding results from next year. The platform also requires heavy marketing to succeed in a highly competitive industry.

Chief Financial Officer Christine McCarthy in her statement hinted at providing updates at the next call on the key growth drivers for the next fiscal year, for which the planning process is currently underway.

Box Office Rally

It needs to be seen how the Studio Entertainment segment performs in the coming quarters, after doing extremely well in the last two quarters backed by the phenomenal success of Avengers: Endgame, Aladdin and Toy Story-4. Disney is set to continue to cash in on the success of these movies and more, by airing them exclusively on Disney+ starting December.

Altogether, the latest developments point to significant growth opportunities in the future, as viewed by Disney executives in their recent interactions with analysts.

Disney’s entry into the streaming realm can be viewed as a precaution in view of the challenges facing the traditional television business, such as pricing issues and growing competition. Iger’s response to an analyst’s query on this matter suggests that the relevance of linear television might diminish, making the business unsustainable.

Hulu Holds the Key

Though the services of Hulu, in which Disney holds a majority stake, overlaps the traditional and non-traditional spaces, its comprehensive offerings make the platform unique.

Interestingly, Iger sounded confident about the China market as he sees little impact from the trade war, though the recent political unrest in Hong Kong was a bit of a concern.