Chinese social media company Weibo Corporation (NASDAQ: WB) on Thursday reported better-than-expected first-quarter earnings, even as the top line narrowly missed the street estimate.

Revenues grew 14% to $399.2 million, below the Wall Street consensus of $401.51 million. However, adjusted net income for the quarter was 56 cents per share, topping 51 cents per share projected by analysts.

Advertising and marketing revenues grew 13% from the prior-year period. Value-added service revenues saw a growth of 24%, primarily due to revenues derived from the live streaming business acquired in the fourth quarter of 2018.

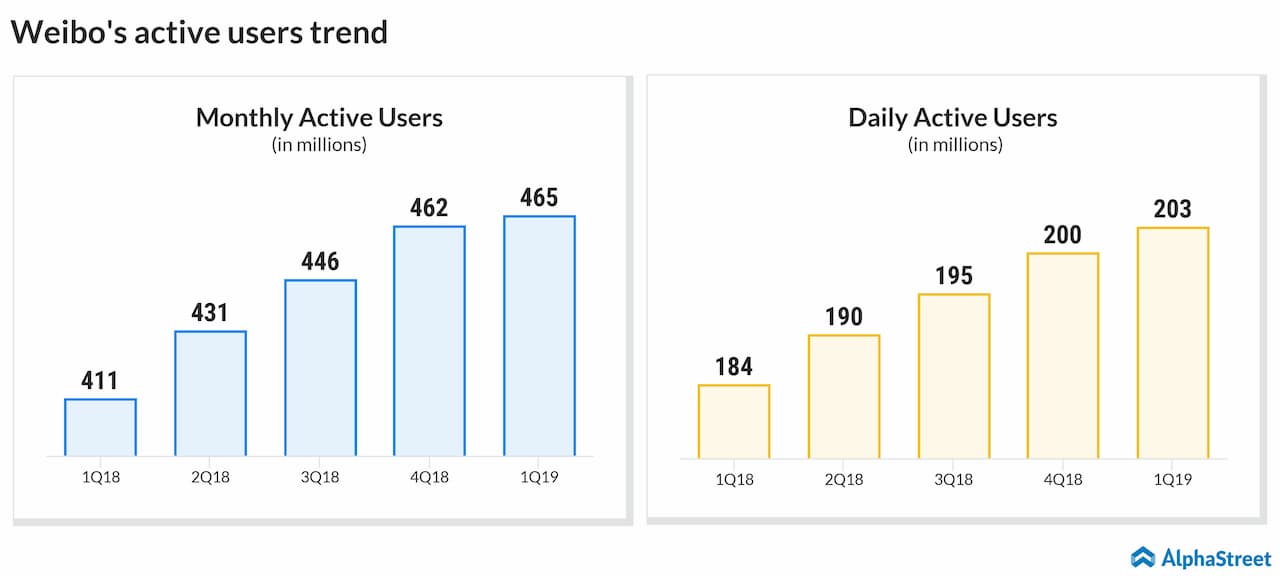

Monthly

active users (MAUs) stood at 465 million in March 2019, representing a net

addition of approx. 54 million users on a year-over-year basis. Mobile MAUs

comprised 94% of MAUs.

Average daily active users (DAUs) were 2013 million during this period, representing a net addition of around 19 million users on a year-over-year basis.

Costs increased 15% during the quarter, primarily due to the higher expenses related to its live streaming business.

READ: IQIYI BEATS ON BOTTOM-LINE IN Q1, KEEPS ADDING USERS

CEO Gaofei

Wang said, “Weibo has delivered solid traffic growth through effective product

upgrade and channel investment. We have also achieved strong advertising

revenue growth for KA business, as we demonstrated unique value proposition for

brand customers with the breadth of our social ad offerings and enhanced ad

performance.”

Weibo stock has lost nearly 50% since June 2018, as it has been facing multiple headwinds like US-China trade wars, slowing Chinese economy and increased censorship regulations in China. The stock hit a new 52-week low in January 2019 touching $51.15.

Outlook

For the second quarter, Weibo estimates net revenues to be between $427 million and $437 million, representing an increase of 7-10% year over year on a constant currency basis.