Among the US tech firms, ON Semiconductor Corp. (NASDAQ: ON) is one of the worst hit by the market turmoil set off by the Covid-19 epidemic, with the stock losing two-thirds of its value in the last two months alone. The company, which makes semiconductor components for electronic devices, is a leading exporter to markets across the globe.

ON Semiconductor’s competitive advantage in the areas of cloud-power and automotive solutions has given it an edge over rivals. Currently, the management is focused on revamping the manufacturing footprint and cutting costs to enhance margins.

Outlook

The growth initiatives, such as expansion of the 300mm fab product line, should help the company overcome the impact of fluctuations in the global economy and geopolitical issues like the trade war.

Nevertheless, like others in the industry, it would not be smooth ride for ON Semiconductor hereafter, given the deepening uncertainty across markets due to the coronavirus crisis. The turmoil can be detrimental to the semiconductor industry, which has already been hit by the trade war. Considering its exposure to China, ON Semiconductor might need to tackle major supply-chain disruptions in the coming months.

Buy ON?

While the present market conditions make the company a risky investment, some investors would find the stock attractive for its low price. The prospects of future value creation cannot be ignored, and analysts have rightly given the stock buy rating. Investors with long-term plans will definitely keep a close watch on the developments, because the stock price is going to follow earnings per share once the markets stabilize.

In the past five years, ON Semiconductor has given returns broadly in line with the industry, with an average earnings-per-share growth of around 4% annually. However, the stock price increased at a faster pace during that period, reflecting investors’ confidence in the company.

Year-end slowdown

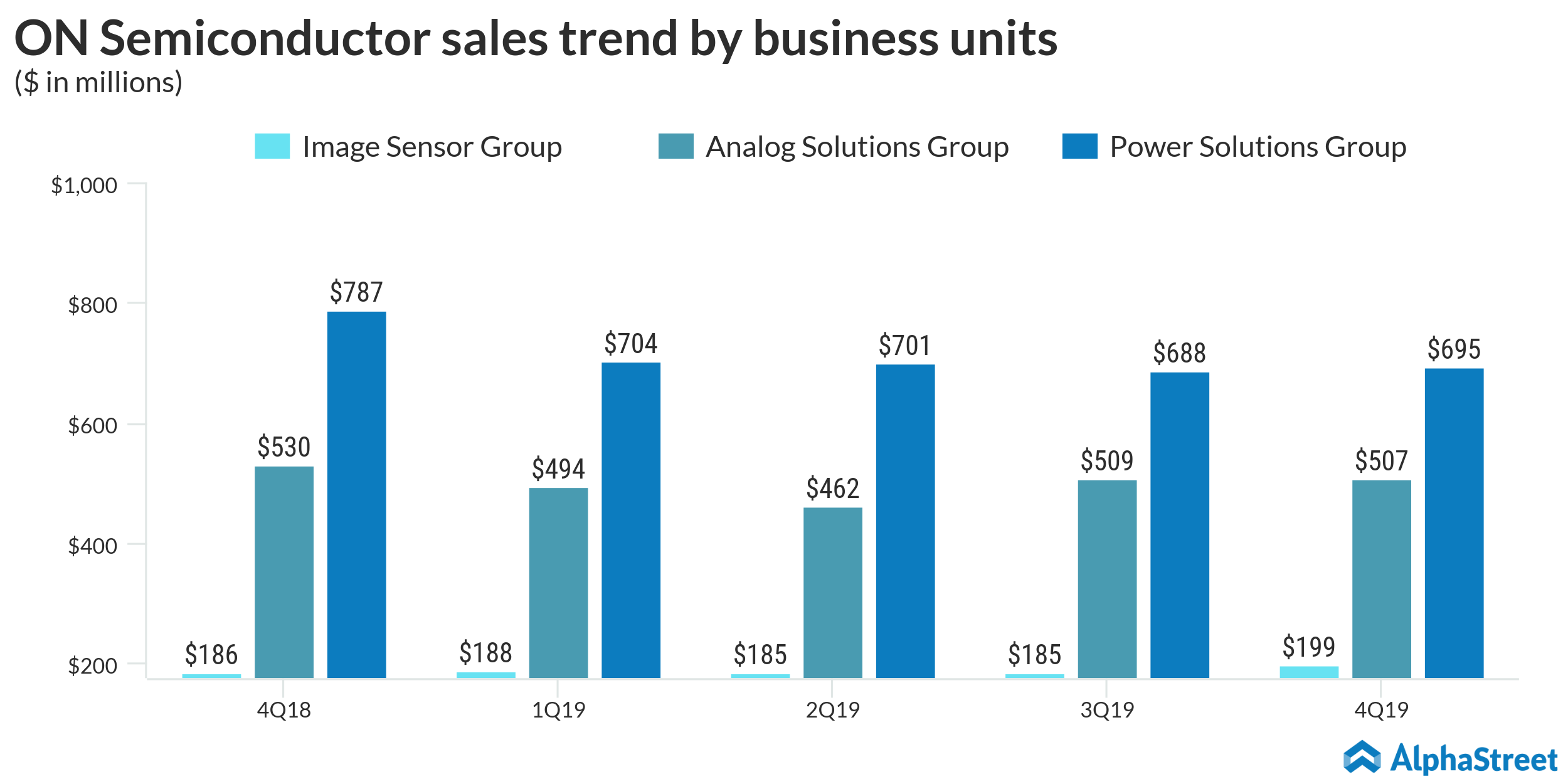

In the

fourth quarter, revenues dropped 7% hurt by weakness in the performance of

Analog Solutions and Power Solutions, the main operating segments, compared to

last year. Consequently, earnings fell sharply to $0.30 per share and missed

the estimates.

At $8:45, shares of ON Semiconductor closed the last trading session at the lowest level in about four years. For the company, 2019 was a fruitful year in terms of market value, as the stock made steady gains and peaked towards the end of the year.