After registering record e-commerce sales last year, grocery store chain Kroger (NYSE: KR) has been on a mission to transform itself into a full-fledged omnichannel retailer, amid rising competition. The initiative, called Restock Kroger, got a fresh boost after the company recorded strong same-store sales in the second quarter.

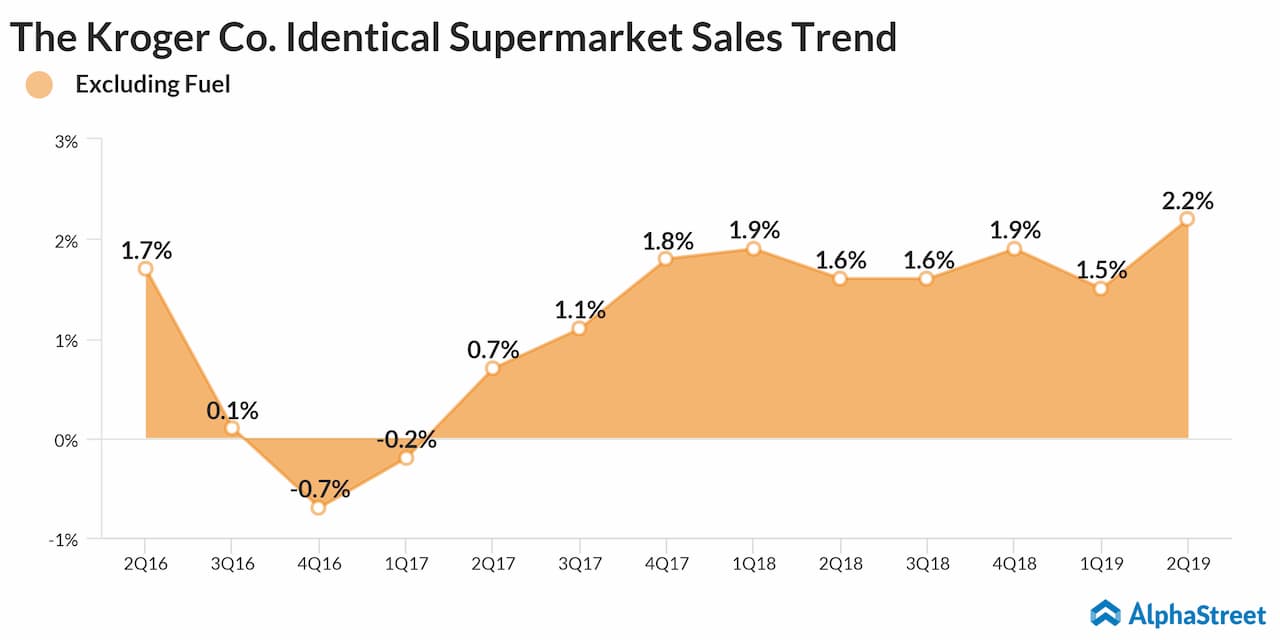

The company surprised the market this week by announcing an extensive workforce reduction to streamline operations, casting a shadow over its ambitious growth program. Though earnings topped expectations in the most recent quarter, the underlying weakness was evident from the muted sales growth, which also missed the forecast. Despite the positive momentum, same-store sales lagged behind the company’s peers.

Tough Task Ahead

Considering the changed scenario, Kroger is unlikely to achieve the goals set by the management in the recent quarterly report. In the post-earnings interaction with analysts, CEO Officer Rodney McMullen had hinted that operating profit might not benefit meaningfully from the ongoing restructuring program this year. The bleak outlook, at a time when there are clear indications of a slowdown, is a cause for worry as far as shareholders are concerned.

Given the company’s not-so-impressive fundamentals, the market will now be approaching the stock with caution. Though Kroger’s current debt is at sustainable levels, the relatively weak cash flow could be a risk to its stability if the situation worsens.

Value Addition

It needs to be seen to what extent innovations would help lure customers to the stores, such as the opening of large food halls in select locations to facilitate on-site dining. Considering the uniqueness of the offering – an eating area for customers visiting the supermarket – it might contribute to the turnaround plan in the long run.

The majority of the analysts have recommended either buy or hold for Kroger’s stock, which has underperformed the market so far this year losing about 12% during that period. Currently priced at around $25, it has the potential to bounce back in the coming months, bringing value to the new investors.

Rightsizing

The focus of this week’s layoff is on reducing the size of the middle management team across the country, which complements the ongoing e-commerce push that allows customers to access merchandise directly. Following the report, the stock slipped a few points, reversing the recent gains. Though the stock is likely to recover from the current levels as the company approaches the next quarterly report, it will remain volatile.

Going forward, the market will be looking for concrete steps from the management to tackle competition from the likes of Walmart (WMT) and privately-owned grocery chain Albertsons.