Workday (NASDAQ: WDAY) reported fourth quarter earnings of 50 cents per share, 10 cents higher than last year, despite incurring costs associated with the acquisition of Scout RFP. Wall Street analysts were expecting just $0.40 per share.

The acquisition of Scout RFP, which is a cloud-based supplier engagement platform, was completed in December and was expected to have squeezed Workday’s Q4 margins.

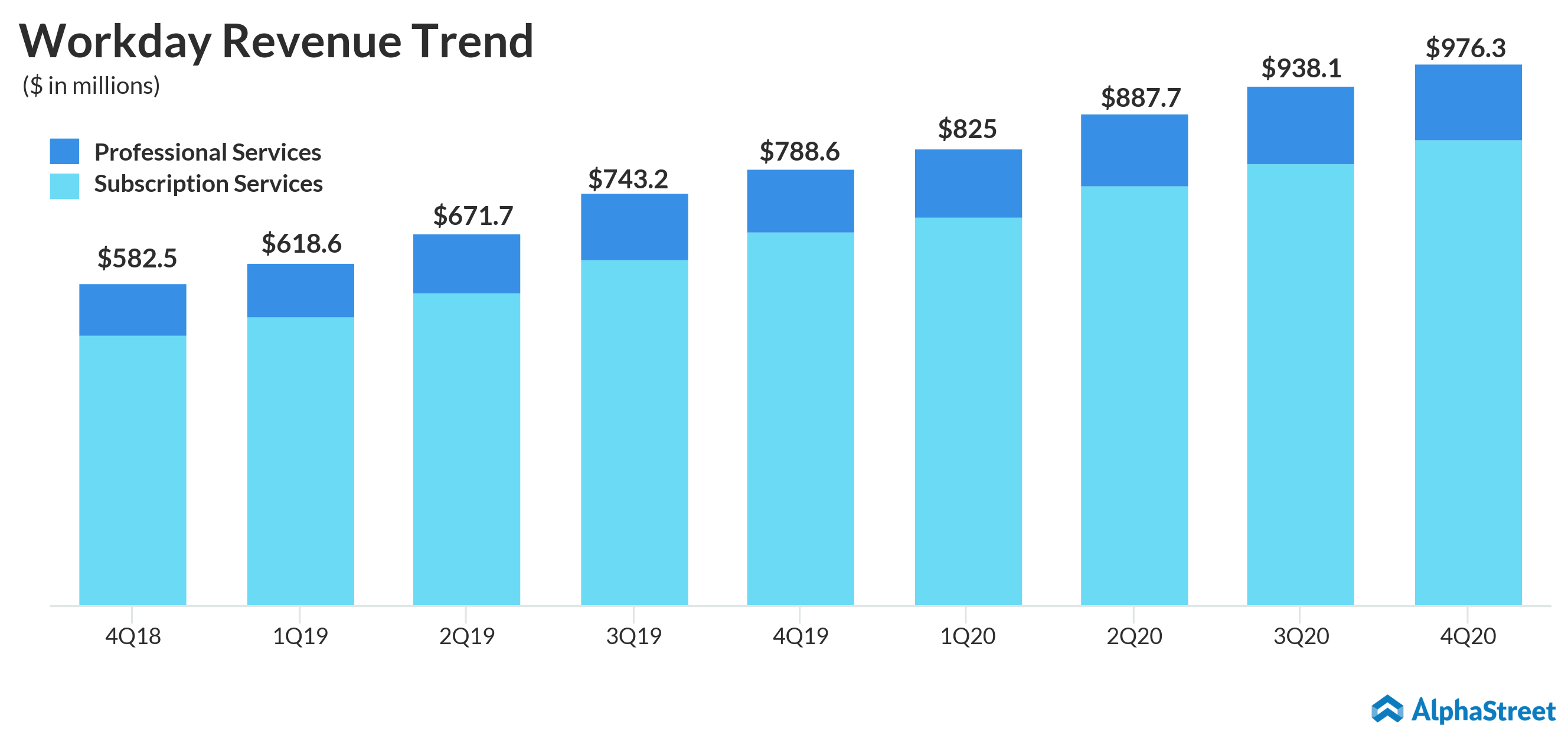

Meanwhile, the company continued to display strong growth in the topline in Q4, driven by strong demand for its cloud-based enterprise applications, especially in Asia and Europe. Revenue for the quarter grew 24% to $976.3 million, which surpassed street projection of $964.5 million, driven by a 25% jump in subscription revenues.

“Our industry leading HCM solutions also continue to see strong adoption with 45 percent of the Fortune 500 and 60 percent of the Fortune 50 having selected Workday,” said CEO Aneel Bhusri.

READ: Here’s why Limelight Networks is a great stock during cord-cutting times

ADVERTISEMENT

WDAY stock gained 2.8% immediately following the results. In the trailing 12 months, the stock is down 12%.

Pointing to this laggard, Goldman Sachs analyst Heather Bellini had recently expressed optimism in the stock. Hinting at an initiation opportunity, the analyst also reiterated Buy rating on the stock.

Earlier today, The Street reported that Workday would cancel its annual sales meeting due to the coronavirus outbreak. The event was to be held at Orlando from March 2-4, in the attendance of over 3000 people.

Competitor Oracle (NYSE: ORCL) is slated to report financial results on March 12.