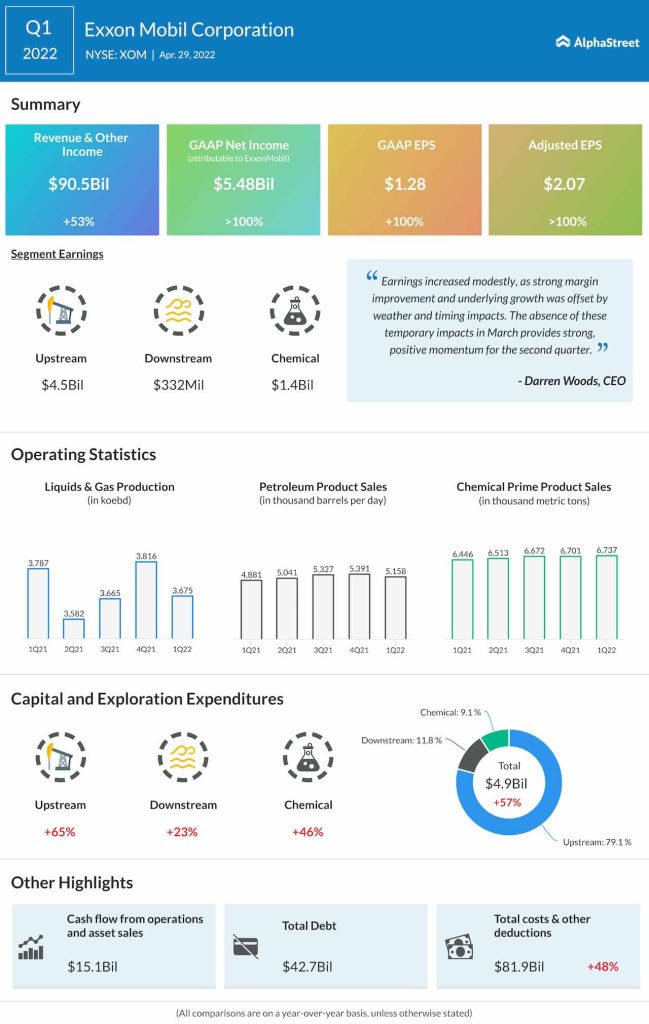

Net profit, adjusted for special items, climbed to $2.07 per share during the three-month period from $0.65 per share a year earlier. Analysts were looking for a bigger number for the latest quarter. On a reported basis, the company posted a net income of $5.48 billion or $1.28 per share, compared to $2.73 billion or $0.64 per share in the first quarter of 2021.

Driving the bottom-line growth, total revenues and other income surged to $90.5 billion in the March quarter from $59.1 billion in the same period of last year. However, the latest number fell short of expectations.

Check this space to read management/analysts’ comments on ExxonMobil’s Q1 2022 results

“Earnings increased modestly, as strong margin improvement and underlying growth were offset by weather and timing impacts. The absence of these temporary impacts in March provides strong, positive momentum for the second quarter,” said Darren Woods, chief executive officer of ExxonMobil.