The

IPO market has recently been pretty unwelcoming, with some of the popular firms

going dud right after their debut. Endeavor

Group Holdings and WeWork were sent scurrying back to review their IPO

plans, primarily driven by the shifting

investor tendency to ditch hype-driven firms.

However, this was not a deterrent to two clinical-stage biotech firms that made their market debuts yesterday. It will be interesting to see how the market responds, especially given their small size and lack of product revenues.

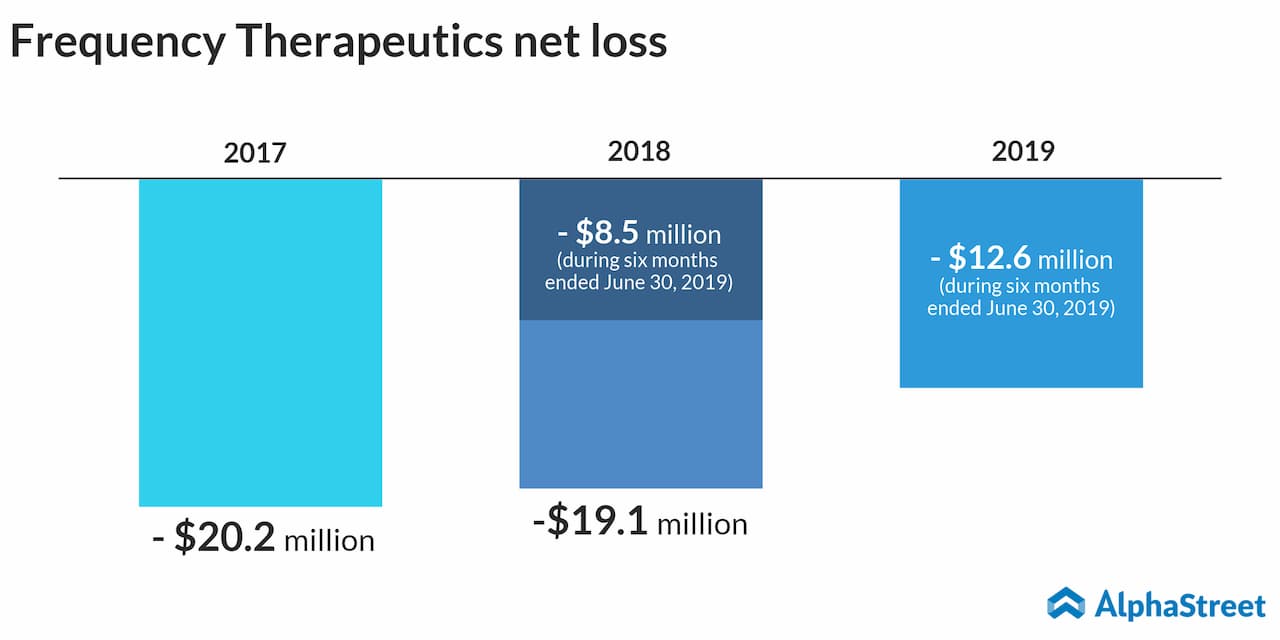

Frequency Therapeutics

The Woburn, Massachusetts-based firm aims at developing a treatment for sensorineural hearing loss (SNHL), which is the most common type of hearing loss. The disorder reportedly affects over 59 million people in the US alone.

The drug candidate – FX-322 – will begin Phase 2a clinical trial by the end of this year, results of which are expected by mid next 2020. Currently, SNHL does not have any FDA-approved drug therapies in the market. In the future, Frequency hopes to expand its proprietary approach, which it calls Progenitor Cell Activation, to other degenerative conditions such as multiple sclerosis.

On Thursday, the company floated 6 million shares for $14 apiece under the ticker FREQ, but the stock ended its first trading day down 2%.

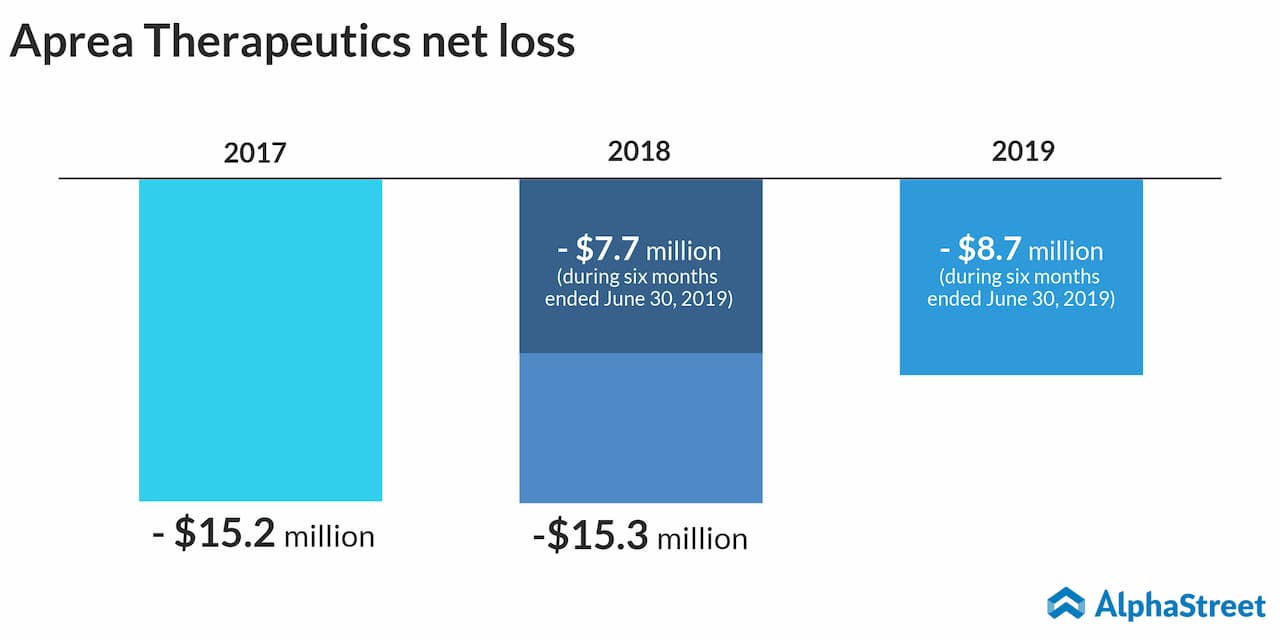

Aprea Therapeutics

Aprea Therapeutics is

a more promising stock. It is an oncology-focused biopharmaceutical firm and

its lead product candidate, APR-246 is currently undergoing Phase 3 trial.

Notably, it has received orphan drug status from both the FDA and the European

Medicines Agency for the treatment of myelodysplastic syndromes (MDS), a type

of cancer.

APR-246 also has a Fast Track designation from the FDA.

The company aims to

treat cancer by reactivating mutant p53 tumor suppressor protein, which in its

normal state functions to sense DNA damage and induce cell cycle arrest.

The company issued 5.7 million shares for $15 a share, and the stock ended its first trading day up at $20.50. The company, headquartered in Boston, is trading under the ticker APRE.

Get access to timely and accurate

verbatim transcripts that are published within hours of the event.