Zoom Video Communications (Nasdaq: ZM), which provides video and audio conferencing services, topped Wall Street’s views for its first quarter of fiscal 2020. Zoom reported adjusted earnings of 3 cents per share on revenue of $122 million. Analysts had predicted the company to post breakeven earnings on revenue of about $111 million. Zoom stock surged more than 10% during the extended hours of trading.

The San Jose, California-based tech firm reported GAAP net income attributable to common stockholders of $0.2 million, or $0.00 per share, compared to GAAP net loss attributable to common stockholders of $1.3 million, or a loss of $0.02 per share in the first quarter of fiscal 2019.

For the second quarter of fiscal 2020, revenue is expected to be between $129 million and $130 million and non-GAAP income from operations is expected to be between $2 million and $3 million. Q2 non-GAAP EPS is expected to be approximately $0.01 to $0.02.

For the fiscal year 2020, Zoom expects revenue to be between $535 million and $540 million and non-GAAP income (loss) from operations is expected to be between $0.0 million and $3.0 million. Full year non-GAAP EPS is expected to be approximately $0.02 to $0.03.

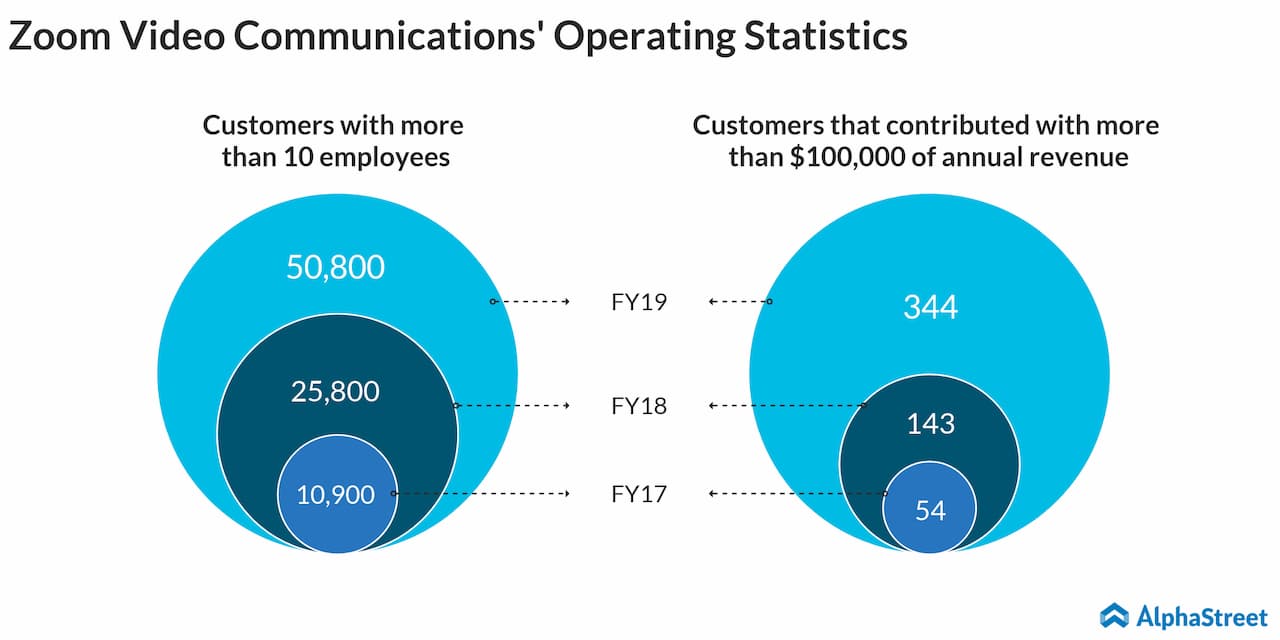

For the fiscal year ended January 31, 2019, customers that contributed more than $100,000 of the company’s annual revenue more than doubled to 344 from 143 customers a year ago.

At the end of Q1, Zoom had approximately 58,500 customers with more than 10 employees, up approximately 86% from the same quarter last year. 405 customers contributed more than $100,000 in trailing 12 months revenue, up approximately 120% from the same quarter last year.

“In our first quarter as a public company, strong execution and expanding adoption of Zoom’s video-first unified communications platform drove total revenue growth of 103% year-over-year. While we remain focused on strong growth, we are also pleased that our highly efficient business model and disciplined investment approach contributed to positive non-GAAP profitability and free cash flow,” said CEO Eric Yuan.

Two other IPO stocks, Beyond Meat (BYND) and PagerDuty (PD), are also reporting their first quarterly results today after the market closes.

Zoom Video stock, which reached its peak price ($91.46) on May 20, had appreciated more than 100% from its IPO price of $36. Shares of Zoom ended up 1.78% at $79.43 today.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions