Shares of 360 Finance, Inc. (NASDAQ: QFIN) have witnessed significant volatility ever since their Wall Street debut nearly a year ago. The China-based fintech company made strong gains this week after it reported better-than-expected revenues for the third quarter, though earnings missed the estimates.

Referring to the sharp increase in loan originations under the capital-light model during the quarter, CEO Haisheng Wu said the company has effectively implemented its transition from a traditional loan facilitator to a technology enabler.

Stock Rallies

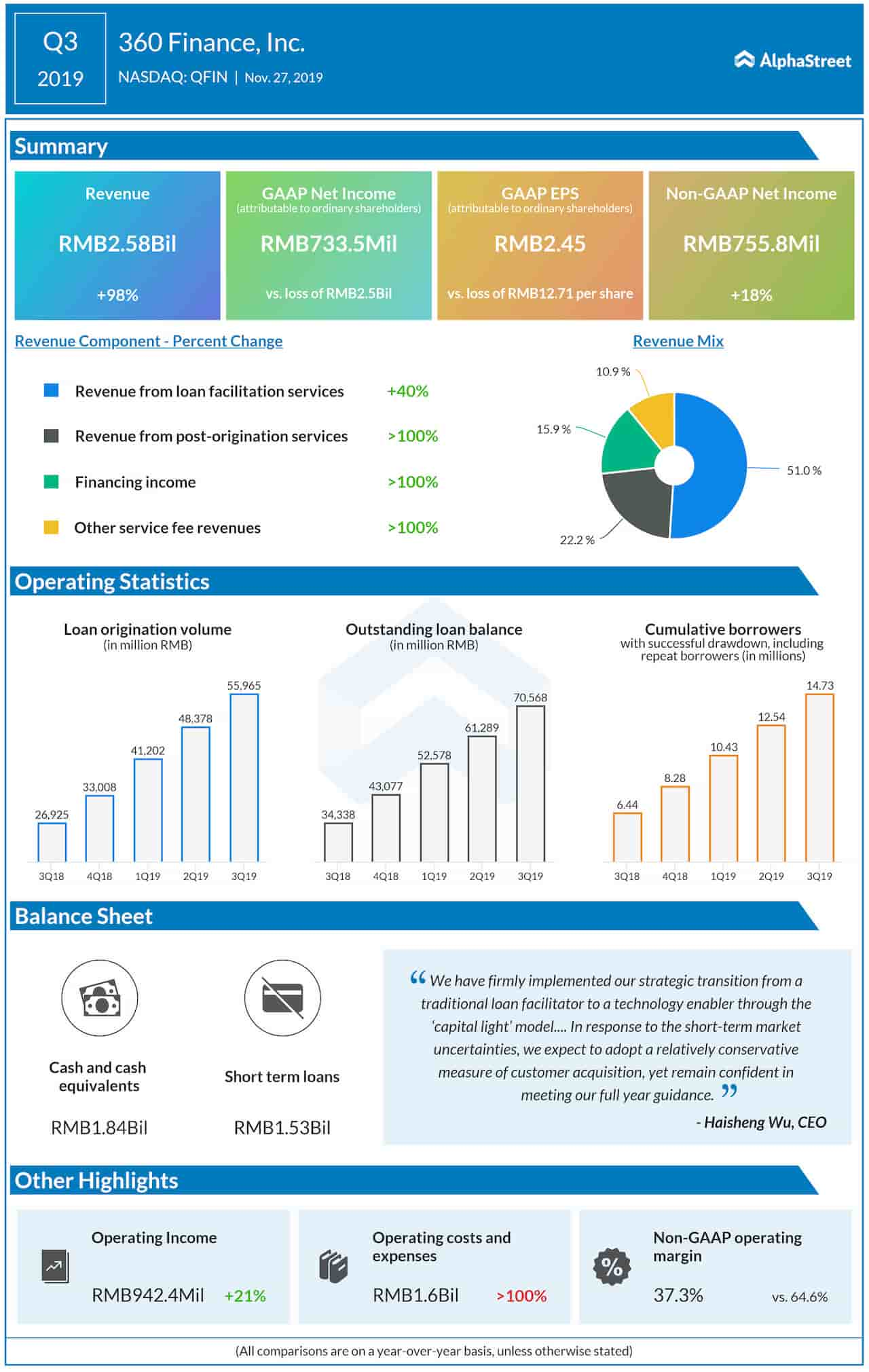

The company, which provides consumer finance products online, said September-quarter revenues nearly doubled to $361.38 million, sending the stock soaring on the day the markets closed for Thanksgiving holiday. Revenues topped the Street view. Investors were also encouraged by the company securing a major investment from Ruby Finance Investment.

Ruby, the investment arm of FountainVest Partners, acquired about 11.5 million American depository shares of the company from multiple holders. As part of the deal, Eric Xiaohuan Chen, FountainVest’s finance chief and a former executive of Citigroup (C), joined the board of directors of 360 Finance, effective immediately.

Profit up 27%

Backed by the impressive top-line growth, net income climbed 27% from last year to $102.6 million or $0.34 per share. Net income attributable to shareholders was RMB 733.56 million or RMB 2.45 per share, compared to a loss of RMB 2.5 billion or RMB 12.71 per share a year earlier. Adjusted profit rose 18% annually to $105.7 million. Overall, the results benefitted from strong loan origination volumes, which more than doubled year-over-year, and a 90% surge in the number of registered users to 126 million. The number of users with approved credit lines climbed to 22.83 million from 9.64 million last year.

“In response to the short-term market uncertainties, we expect to adopt a relatively conservative measure of customer acquisition, yet remain confident in meeting our full-year guidance. In the long-run, we will continue to focus on the quality of growth and safety of operations, while maintaining a reasonable growth rate. We are committed to delivering greater value to all of our stakeholders,” said Wu.

Outlook

The company expects revenues to be between RMB8.0 billion and RMB8.5 billion in fiscal 2019. Going ahead, the growth strategy will continue to be ‘investing in technology development and research’, as the management remains focused on achieving sustainable profit growth in the long term.

360 Finance facilitates the delivery of unsecured, online loans to borrowers, mainly for consumption-spending and as a supplement to credit cards. Most of the funding comes from financial institution partners who serve the borrowers through the company’s digital platform.

Related: Bank of America beats Q3 earnings expectations

ADVERTISEMENT

360 Finance had a relatively unimpressive Nasdaq debut, with the stock falling steadily after opening at $16.50 in December last year, mainly owing to regulatory curbs in the Chinese financial services sector and unfavorable market conditions. Last week, the stock had slipped to an all-time low, after losing about 45% since the IPO.