Q1 performance

Collectibles, C2C, tariffs

As mentioned on the earnings call, eBay’s Q1 performance was mainly driven by momentum in its focus categories, which saw GMV growth of over 6% in the quarter. Collectibles was the largest contributor to this increase, helped by continued traction in trading cards. Grading services by PSA, which help buyers evaluate the value of their cards, have generated positive responses from hobbyists and proved beneficial in driving growth in this category.

Fashion, which generates over $10 billion in GMV annually, is another growth category. The company is improving the customer experience for luxury fashion and pre-loved apparel by expanding inventory and harnessing new sources of supply in international markets. In Q1, eBay launched pre-loved apparel as a new focus category on its platform.

A key geo-specific initiative aimed at driving growth is the consumer-to-consumer initiative in the UK. eBay is working on making the C2C experience seamless through various means like introducing buyer protection fees, and simplifying shipping by reducing costs and offering flexibility in selecting carrier preferences. In the second quarter of 2025, the company plans to add pick-up and drop-off capabilities along with support for large, bulky items. This initiative is expected to create a new source of revenue for eBay.

With regards to tariffs and their impact on the business, eBay’s SpeedPAK shipping program helps in managing most of the complexity related to international shipping. The company believes its dynamic global supply and demand provides it with an advantage and its vast selection of pre-loved and non-new, in-season goods across a range of categories will provide customers some respite when costs increase.

Outlook

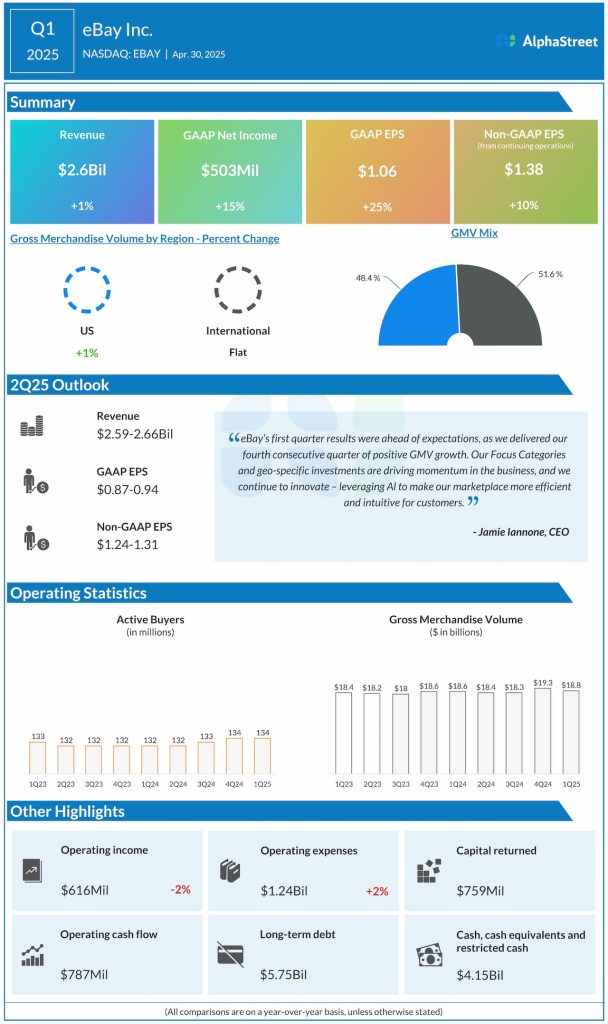

For the second quarter of 2025, revenue is expected to range between $2.59-2.66 billion, representing FX-neutral YoY growth of down 1% to up 2%. GMV is expected to be $18.6-19.1 billion. GAAP EPS is expected to range between $0.87-0.94 while adjusted EPS is projected to be $1.24-1.31.