AbbVie Inc. (NYSE: ABBV) surpassed market estimates on revenue and earnings for the first quarter of 2019, giving shares a lift of 2.3% in premarket hours on Thursday.

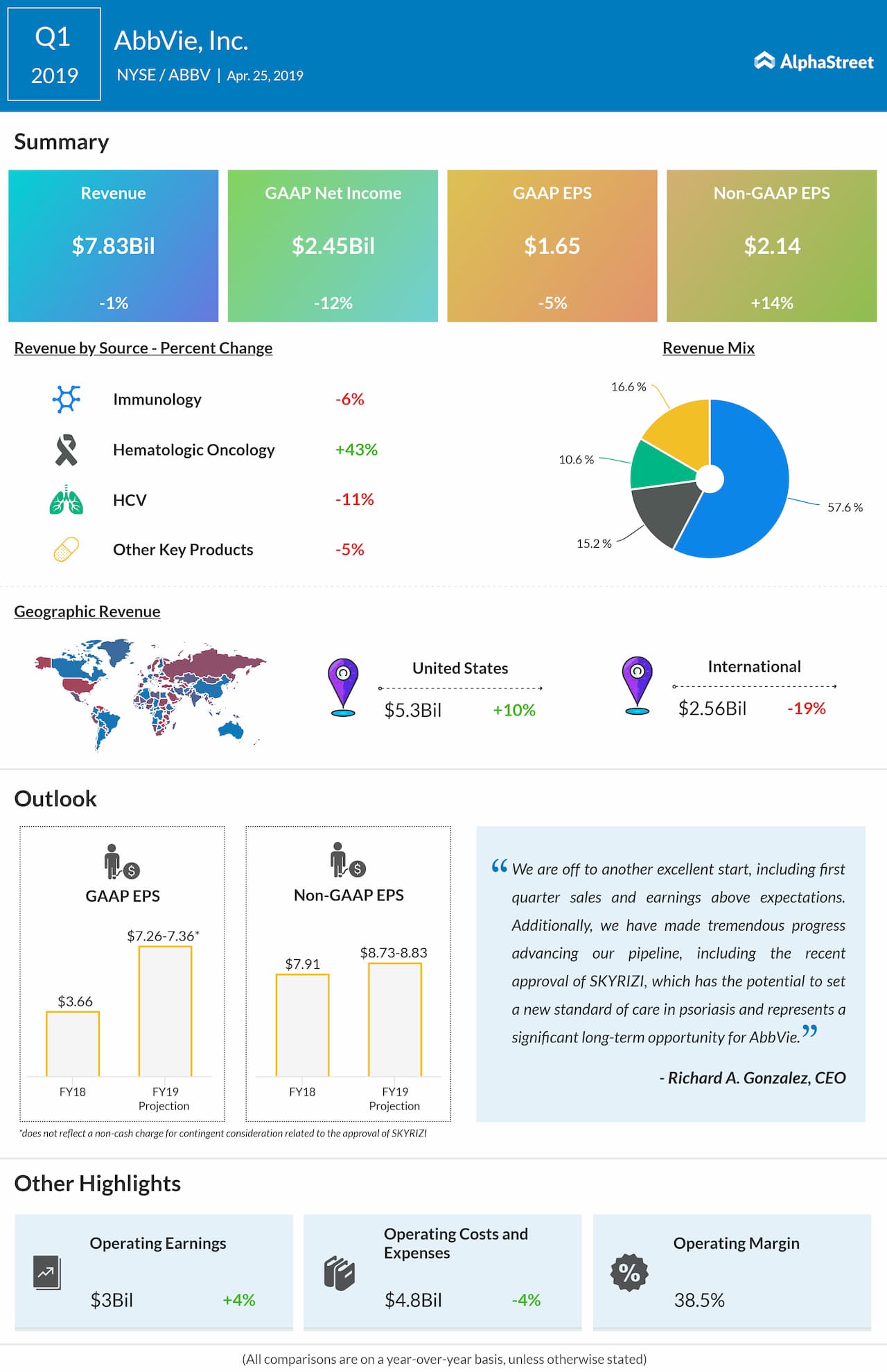

Worldwide net revenues were $7.82 billion, down 1.3% on a reported basis and up 0.4% operationally. The consensus estimate was for revenues of $7.7 billion.

On a GAAP basis, net income was $2.4 billion, or $1.65 per share, compared to $2.7 billion, or $1.74 per share, in the year-ago period. Adjusted EPS grew 14.4% to $2.14, beating estimates of $2.06.

Global HUMIRA net revenues fell 5.6% to $4.4 billion. HUMIRA revenues grew 7.1% in the US but decreased nearly 28% internationally due to biosimilar competition. In the hematologic oncology portfolio, global revenues grew nearly 43% to $1.17 billion.

Global net revenues amounted to $1.02 billion for IMBRUVICA and $151 million for VENCLEXTA. Global HCV revenues dropped 11.3% to $815 million while in the US, HCV revenues grew 17.3%.

Also see: AbbVie Q1 2019 Earnings Conference Call Transcript

For the full year of 2019, AbbVie is raising its GAAP diluted EPS guidance to $7.26-7.36. The company is also raising its adjusted EPS guidance range from $8.65-8.75 to $8.73-8.83, representing growth of 11% at the mid-point.

AbbVie announced regulatory approvals for SKYRIZI for the treatment of adult patients with plaque psoriasis. The approvals from the US FDA and the Japanese Ministry of Health, Labour and Welfare are based on results from four pivotal Phase 3 studies, which evaluated over 2,000 patients affected by the condition. SKYRIZI is part of a collaboration between Boehringer Ingelheim and AbbVie, with AbbVie leading development and commercialization globally.