Accenture (NYSE: ACN) reported revenue and earnings that surpassed market expectations for the second quarter of 2020. The stock was up by 3.2% in premarket hours on Thursday.

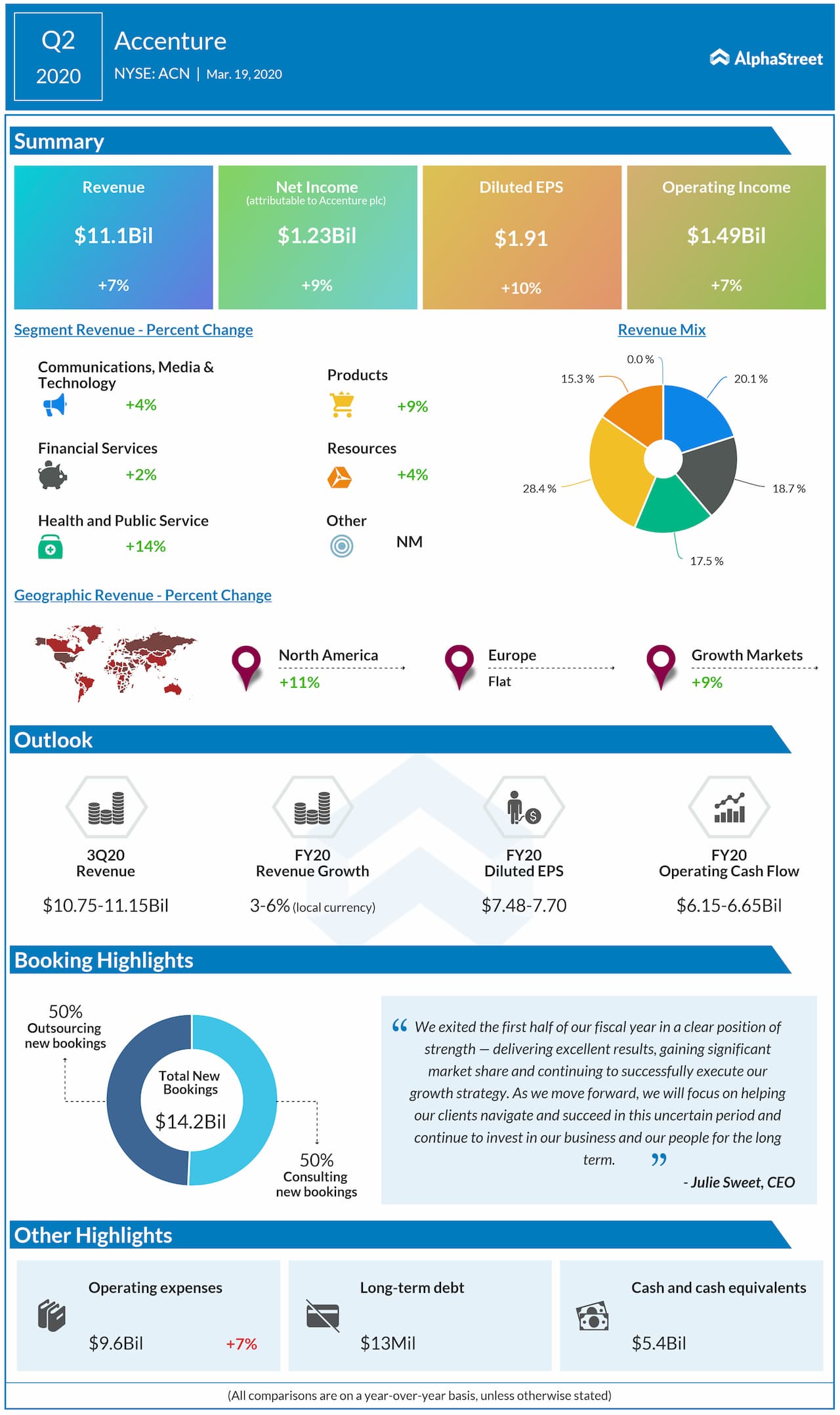

Revenues increased 7% to $11.14 billion versus the prior-year period. Revenues grew 8% in local currency. The topline results were ahead of forecasts of $11.11 billion.

Net income attributable to Accenture was $1.23 billion, or

$1.91 per share, compared to $1.12 billion, or $1.73 per share, in the

prior-year period. Analysts had forecast EPS of $1.72.

New bookings were $14.2 billion, with consulting bookings of

$7.2 billion and outsourcing bookings of $7 billion. Consulting revenues

increased 7% while outsourcing revenues grew 6% in the quarter.

Days services outstanding, or DSOs, were 39 days at Feb. 29,

2020, compared with 40 days in the same period a year ago.

The company saw revenue increases across all its operating

groups and geographic regions during the quarter, with the exception of Europe

which remained flat compared to the year-ago period.

Accenture declared a quarterly cash dividend of $0.80 per

share, payable on May 15, 2020, to shareholders of record on April 16, 2020.

For the third quarter of 2020, Accenture expects revenues to be $10.75 billion to $11.15 billion, reflecting a growth of negative 2% to positive 2% in local currency.

The company has lowered its guidance for fiscal year 2020 to reflect the impact of the coronavirus epidemic. Revenue growth is now expected to be in the range of 3-6% in local currency, compared to the previous range of 6-8%. Diluted EPS is now estimated to be $7.48 to $7.70, versus the prior guidance of $7.66 to $7.84.