This momentum was driven by live services as well as strong performances from the Empires & Puzzles and Merge Dragons! games. The company also saw strength in the new titles Merge Magic! and Game of Thrones Slots Casino which were launched last year.

Zynga saw a growth in user engagement for its mobile games

particularly from March as more people stayed at home due to the pandemic.

Although the company saw decreases in average mobile daily active users and

monthly active users on a year-over-year basis of 7% and 5% respectively, both

metrics improved sequentially.

Not only did Zynga see higher engagement levels from new and

existing players during this period, it also saw the return of lapsed players,

meaning players who had stopped playing the game and exited the platform over

time.

Although the company saw user declines in older mobile

titles and chat games, the newly launched titles continue to attract players. It

is likely that many of these players could stay on after the pandemic subsides

if they find the new games interesting enough.

Several market experts have predicted that there could be

changes in customer behavior amid the health crisis as people find new ways to

conduct their business, do their shopping or discover new options for

entertainment. It is likely some of them could stick to these new patterns

after the crisis passes. If such a trend works out in favor of Zynga, that

could drive further growth for the company.

Despite the uncertainty posed by COVID-19, the company

expects live services, led by forever franchises, and user pay to drive growth

both in the second quarter and for the full year of 2020. The second quarter is

expected to be impacted by declines in older mobile and web titles but the full

year is projected to benefit from new titles that are set to be launched in the

second half of the year.

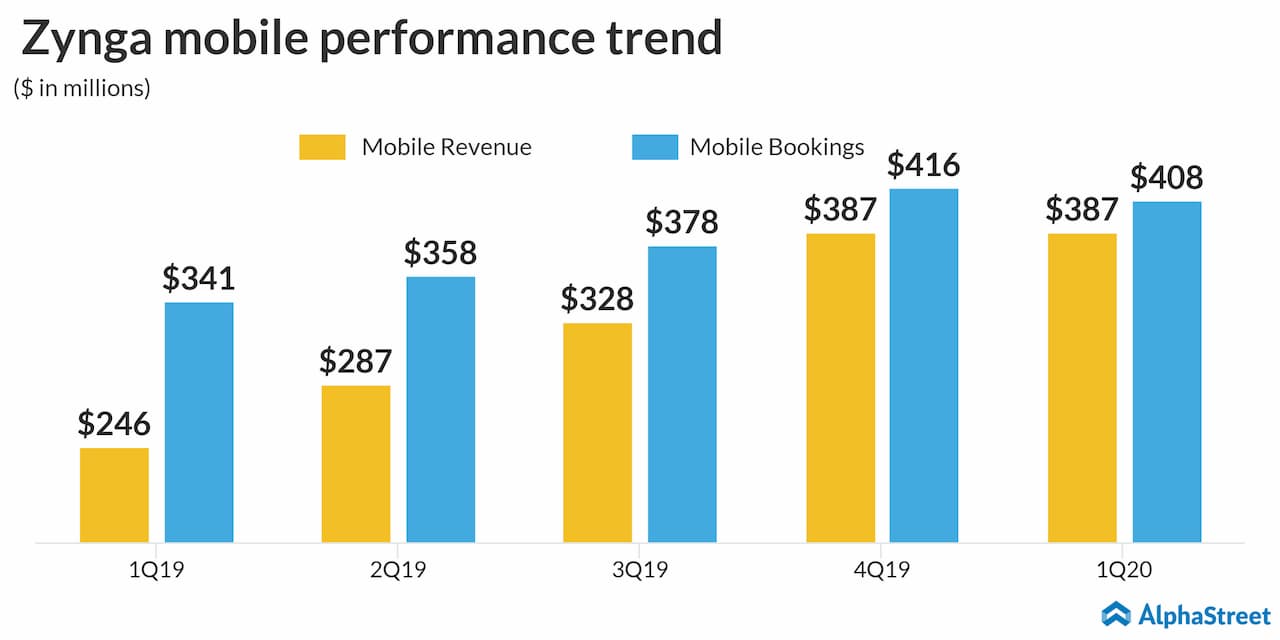

Zynga expects revenues to increase 31% year-over-over to

$400 million and bookings to rise 22% to $460 million in the second quarter.

For the full year, revenues are expected to increase 25% to $1.65 billion and bookings

are expected to grow 15% to $1.8 billion.

Zynga also said on its quarterly conference call that even

if there was a recession following the coronavirus pandemic, the company might

not be severely hurt as free-to-play mobile games will continue to have takers

and they could prove to be a less-expensive and more attractive option in the

midst of a recession.

Despite the positives, Zynga’s bottom line in the first

quarter was hurt by a contingent consideration expense of $120 million. The Empires & Puzzles and Merge Dragons! titles, which were picked

up through the Small Giant Games and Gram Games acquisitions, continue to

perform really well and this means Zynga must hand out perks to these units. As

these divisions continue to perform well, the company will continue to see an

increase in the contingent consideration expense.

Zynga also paid the first of three annual instalments in order to acquire the remaining 20% stake in Small Giant Games, which amounted to $122 million for a 6.7% interest. This resulted in a net operating cash outflow of $35 million during the first quarter. Zynga expects to acquire the remaining shares in Q1 2021 and Q1 2022 which will see the company put more cash into its acquired assets.

Looking ahead, Zynga is expected to see good growth as well as higher expenses from its acquired titles which is both a positive and negative for the company.