Net revenue jumped 16.5% to $2.38 billion. Revenues from digital channels were $1.79 billion. The company posted net bookings of $2.84 billion for the quarter, higher by 7.6% compared to last year.

Looking ahead into the first quarter of fiscal 2019, the company expects adjusted earnings of $0.63 per share and revenues of $1.715 billion. For the full year 2019, the adjusted earnings and revenue forecast is set at $1.85 per share and $6.025 billion, respectively. Net bookings are expected to be $6.30 billion for 2019 and $1.18 billion for the first quarter.

The number of developers working on Call of Duty, Candy Crush, Overwatch, Warcraft, Hearthstone and Diablo in aggregate will increase by about 20% over the course of 2019. The company is also integrating its global and regional sales and go-to-market, partnerships, and sponsorships capabilities. As part of these restructuring actions, the company expects to incur a GAAP-only pre-tax charge of about $150 million, the majority of which is expected to be incurred this year.

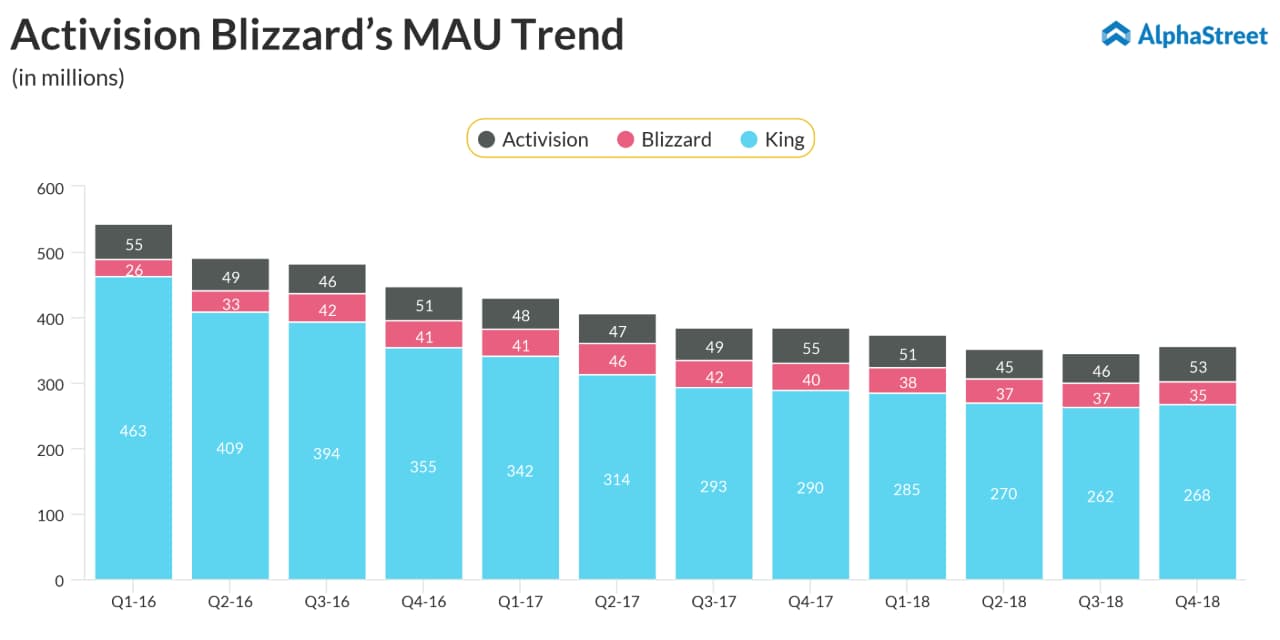

For the fourth quarter, Activision had 53 million monthly active users (MAU), growing double-digits quarter-over-quarter. Segment revenues rose 6% to $1.41 billion. Call of Duty was again the number-one selling console franchise worldwide for the year, a franchise feat accomplished for nine of the last 10 years. Call of Duty: Black Ops 4 sold-through more units than Call of Duty: Black Ops III, with PC units more than tripling.

Also read: Activision Blizzard Q4 2018 earnings call transcript

Blizzard had 35 million MAUs in the quarter, as Overwatch and Hearthstone saw sequential stability and World of Warcraft saw expected declines post-expansion-launch. Fourth quarter segment revenues grew 15% year-over-year to $686 million. Building on an 11-year partnership, Blizzard extended its joint venture with NetEase to publish its games in China through January 2023.

King had 268 million MAUs in the quarter, growing sequentially, driven by the successful launch of Candy Crush Friends Saga. Segment revenues grew 5% year-over-year to $543 million. Candy Crush Friends Saga saw strong monetization and retention trends, contributing incremental growth for the Candy Crush franchise, which grew net bookings and MAUs.

The board of directors declared a cash dividend of $0.37 per common share, payable on May 9, 2019, to shareholders of record on March 28, 2019, which represents a 9% increase from 2018. Additionally, the board authorized a new two-year stock repurchase program under which the company is authorized to repurchase up to $1.5 billion of its outstanding common stock during the period.

Shares of Activision ended Tuesday’s regular session up 3.89% at $41.67 on the Nasdaq. The stock has fallen over 39% in the past year and over 22% in the past three months.