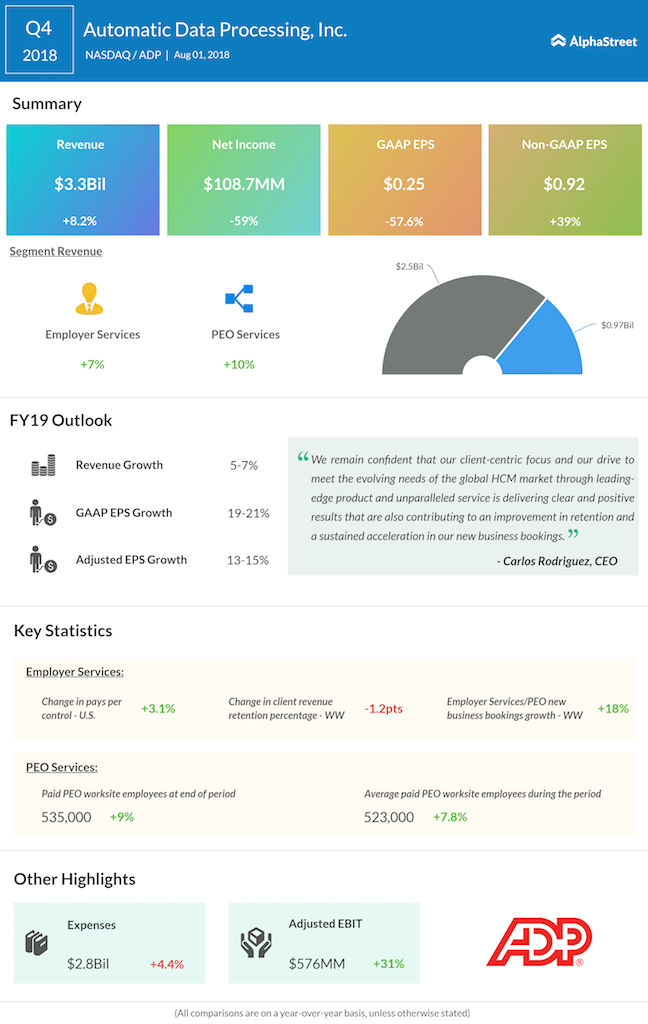

Employer Services division, which used to provide HR management solutions, witnessed a 7% increase in revenues. However, the client revenue retention was down 120 basis points. Co-employment division PEO Services revenue climbed 10% compared to last year, driven primarily by an 8% increase in average worksite employees for the quarter.

RELATED: New business bookings lift ADP’s results

On July 31, the company acquired Celergo, a provider of global payroll management services. This deal is said to enhance ADP’s international payroll offerings. Financial details of the deal remain unknown.

Looking ahead into fiscal 2019, the company expects revenue growth to be about 5% to 7% and adjusted EPS to grow between 13% and 15%.

Related Infographics