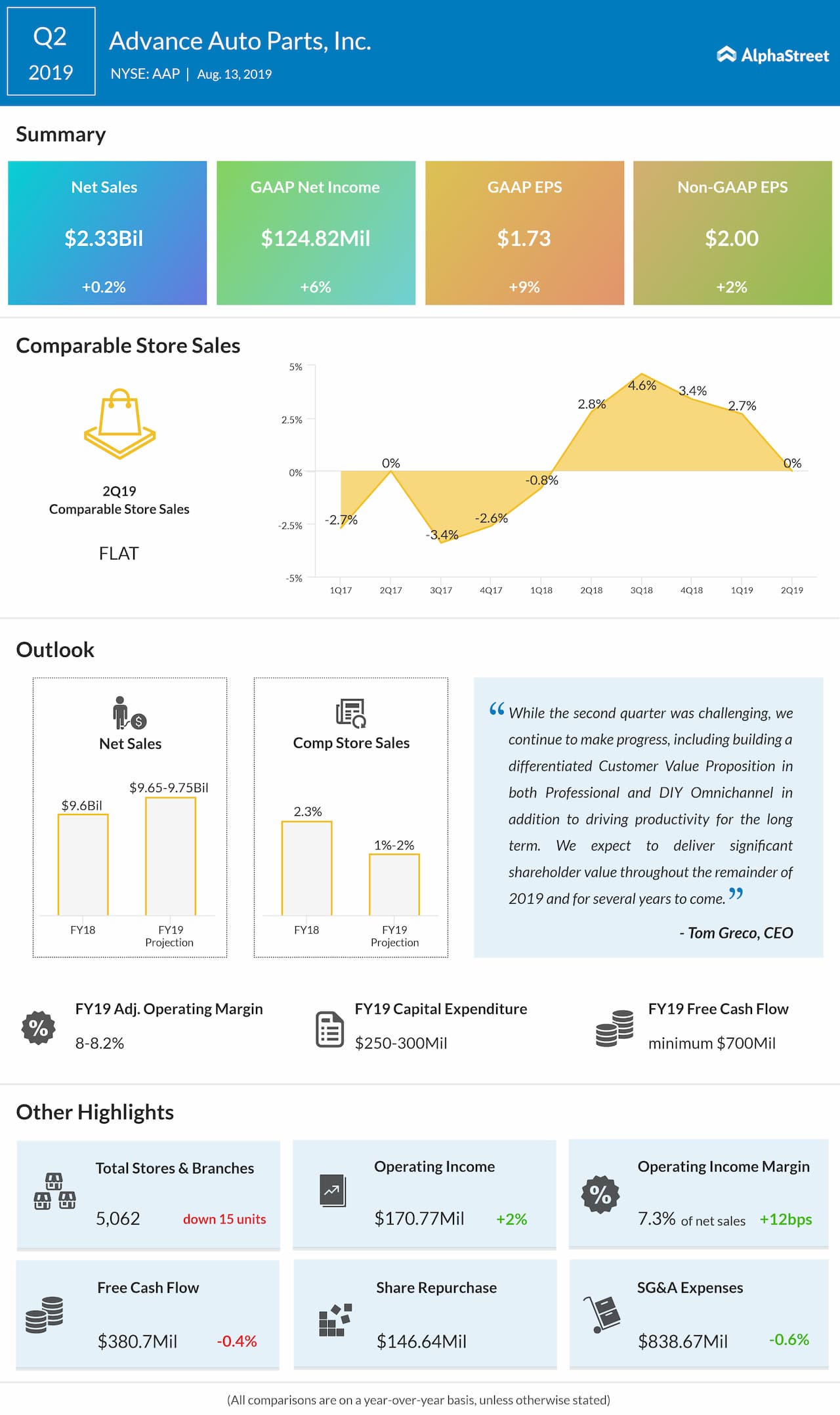

Looking ahead into the full year 2019, the company narrowed its net sales outlook to the range of $9.65 billion to $9.75 billion from the prior range of $9.65 billion to $9.80 billion, and its comparable-store sales estimates to the range of 1% to 2% from the previous range of 1% to 2.5%. Adjusted operating income margin guidance is narrowed to the range of 8% to 8.2% from the prior range of 8% to 8.4%.

Capital expenditures are still anticipated to be in the range of $250 million to $300 million. Free cash flow is now expected to be at the minimum of $700 million compared to the previous estimates of a minimum of $650 million.

The company is expected to deliver meaningful progress against its transformation plan in 2019. In addition, Advance Auto Parts expects to deliver sales growth and margin expansion in the back half of the year, resulting in second consecutive year of top and bottom line growth.

Also read: Lyft Q2 earnings review

For the second quarter, adjusted gross margin declined by 42 basis points to 43.3% due to channel and product mix, in addition to planned supply chain wage investments. These headwinds were partially offset by continued improvements in utilization and management of inventory. Increased material costs due to both inflation and tariff related costs were fully offset by pricing actions in the quarter.

On August 7, the board of directors authorized a $400 million share repurchase program, which replaced the balance portion of its $600 million share repurchase program that was authorized in August 2018. The company’s board declared a regular quarterly cash dividend of $0.06 per share, payable on October 4, 2019 to all common shareholders of record as of September 20, 2019.